SOLUTIONS TO EXERCISES

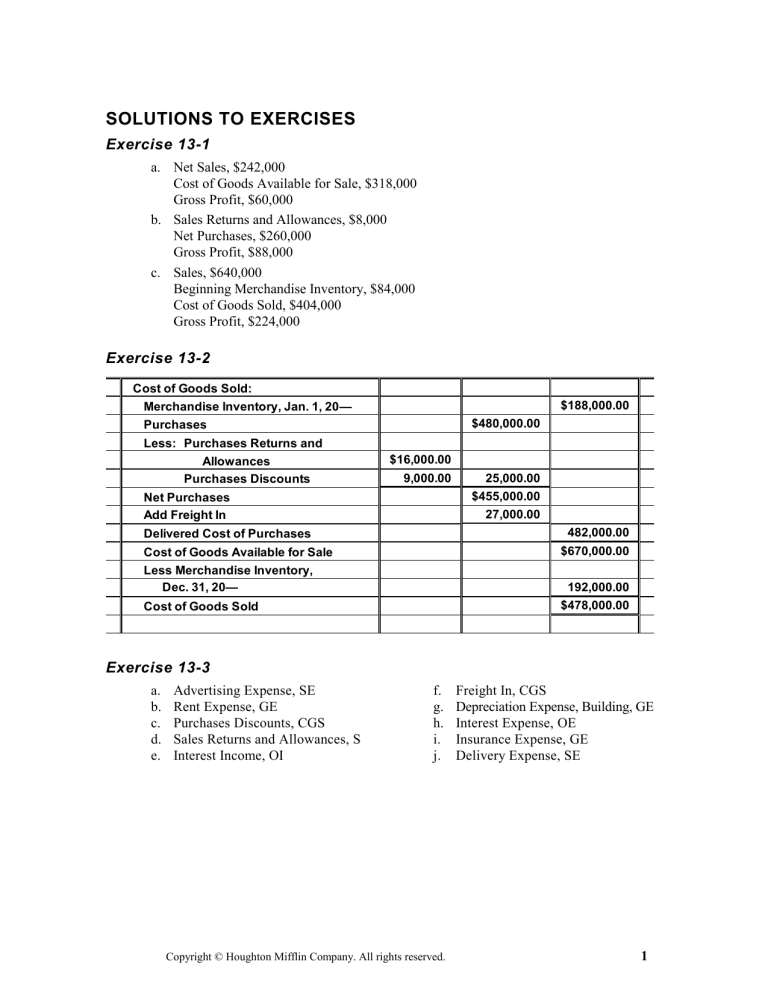

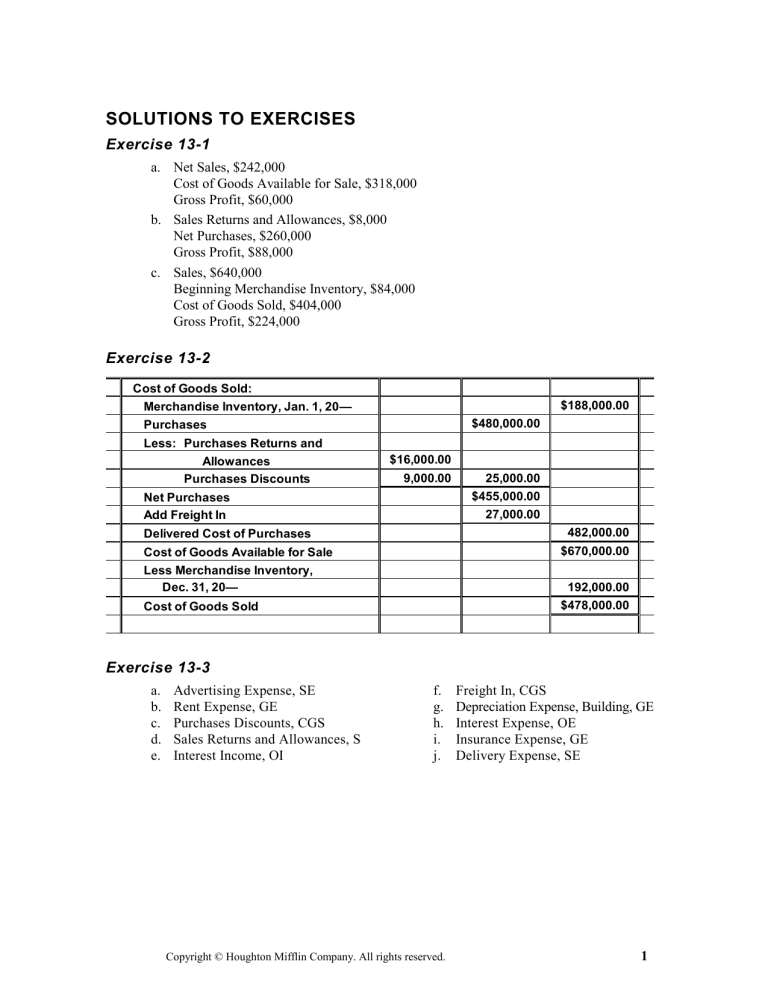

Exercise 13-1

a. Net Sales, $242,000

Cost of Goods Available for Sale, $318,000

Gross Profit, $60,000

b. Sales Returns and Allowances, $8,000

Net Purchases, $260,000

Gross Profit, $88,000

c. Sales, $640,000

Beginning Merchandise Inventory, $84,000

Cost of Goods Sold, $404,000

Gross Profit, $224,000

Exercise 13-2

Cost of Goods Sold:

$188,000.00

Merchandise Inventory, Jan. 1, 20—

$480,000.00

Purchases

Less: Purchases Returns and

Allowances

Purchases Discounts

$16,000.00

9,000.00

25,000.00

$455,000.00

Net Purchases

Add Freight In

27,000.00

482,000.00

Delivered Cost of Purchases

$670,000.00

Cost of Goods Available for Sale

Less Merchandise Inventory,

Dec. 31, 20—

192,000.00

$478,000.00

Cost of Goods Sold

Exercise 13-3

a.

b.

c.

d.

e.

Advertising Expense, SE

Rent Expense, GE

Purchases Discounts, CGS

Sales Returns and Allowances, S

Interest Income, OI

f.

g.

h.

i.

j.

Copyright © Houghton Mifflin Company. All rights reserved.

Freight In, CGS

Depreciation Expense, Building, GE

Interest Expense, OE

Insurance Expense, GE

Delivery Expense, SE

1

Exercise 13-4

Baki Company

Income Statement

For Year Ended June 30, 20—

Revenue from Sales:

Sales

Less: Sales Returns

and Allowances

Sales Discounts

Net Sales

Cost of Goods Sold:

Merchandise Inventory,

July 1, 20—

Purchases

Less: Purchases Returns

and Allowances

Purchases Discounts

Net Purchases

Add Freight In

Delivered Cost of

Purchases

Cost of Goods Available

for Sale

Less Merchandise

Inventory, June 30, 20—

Cost of Goods Sold

Gross Profit

Operating Expenses:

Selling Expenses

General Expenses

Total Operating Expenses

Net Income

$291,000.00

$ 11,100.00

4,100.00

15,200.00

$275,800.00

27,000.00

$116,000.00

$1,200.00

1,000.00

2,200.00

$113,800.00

7,500.00

121,300.00

$148,300.00

23,000.00

125,300.00

$150,500.00

$ 56,000.00

49,000.00

105,000.00

$ 45,500.00

Exercise 13-5

a.

b.

c.

d.

e.

Accounts Receivable, CA

Building, PE

Wages Payable, CL

Prepaid Taxes, CA

Mortgage Payable (current), CL

f.

g.

h.

i.

j.

Supplies, CA

Mortgage Payable (due in 3 years), LTL

Unearned Fees, CL

D. Mann, Capital, OE

Notes Payable (due in 3 months), CL

Copyright © Houghton Mifflin Company. All rights reserved.

2

Exercise 13-6

Current Assets:

Prepaid Insurance

Merchandise Inventory

Store Supplies

Cash

Notes Receivable

Total

$

600

72,000

1,000

9,000

4,000

$86,600

Current Liabilities:

Unearned Fees

$ 700

Notes Payable

7,000

Accounts Payable

22,000

Mortgage Payable (current portion)

4,400

Salaries Payable

2,000

$36,100

Working capital = $86,600 – $36,100 = $50,500

Current ratio =

$86,600

$36,100

= 2.40

Exercise 13-7

GENERAL JOURNAL

DATE

1

2

3

4

5

DESCRIPTION

POST.

REF.

20—

Adjusting Entries

Dec. 31 Sales

Purchases Returns and Allowances

Purchases Discounts

Income Summary

PAGE

DEBIT

CREDIT

1

504,000.00

7,600.00

5,600.00

2

3

4

517,200.00

6

7

8

9

10

11

12

13

6

31 Income Summary

Sales Returns and Allowances

Purchases

Freight In

Salary Expense

Rent Expense

Miscellaneous Expense

365,200.00

31 Income Summary

H. Beal, Capital

( $104,000

– ( $88,000

168,000.00

7

8,000.00

236,800.00

15,200.00

68,000.00

24,000.00

13,200.00

14

15

16

17

18

21

8

9

10

11

12

13

14

15

168,000.00

+ $517,200 )

+ $365,200 )

16

17

18

19

20

5

19

31 H. Beal, Capital

H. Beal, Drawing

22

54,000.00

20

54,000.00

21

22

Copyright © Houghton Mifflin Company. All rights reserved.

3

Exercise 13-8

GENERAL JOURNAL

DATE

1

2

3

DESCRIPTION

PAGE

POST.

REF.

DEBIT

20—

Closing Entries

Dec. 31 Income Summary

T. H. Reece, Capital

CREDIT

1

92,000.00

2

92,000.00

4

5

6

3

4

31 T. H. Reece, Capital

T. H. Reece, Drawing

69,000.00

5

69,000.00

7

6

7

Reece Company

Statement of Owner's Equity

For Year Ended December 31, 20—

T. H. Reece, Capital, January 1, 20—

Additional Investment, April 7, 20—

Total Investment

Net Income for the Year

Less Withdrawals for the Year

Increase in Capital

T. H. Reece, Capital, December 31, 20—

Copyright © Houghton Mifflin Company. All rights reserved.

$440,000.00

16,000.00

$456,000.00

$92,000.00

69,000.00

23,000.00

$479,000.00

4