Uses of Accounting Information I (ACC 230)

advertisement

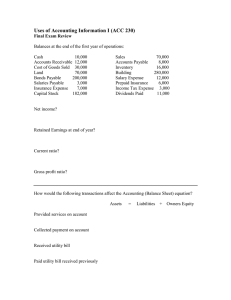

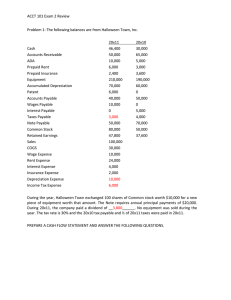

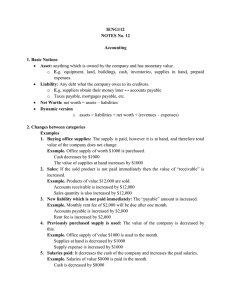

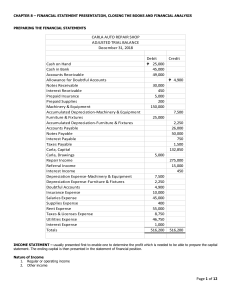

Uses of Accounting Information I (ACC 230) Final Exam Review Balances at the end of the first year of operations: Cash 10,000 Accounts Receivable 12,000 Cost of Goods Sold 30,000 Land 70,000 Bonds Payable 200,000 Salaries Payable 3,000 Insurance Expense 7,000 Capital Stock 182,000 Sales 70,000 Accounts Payable 8,000 Inventory 16,000 Building 280,000 Salary Expense 12,000 Prepaid Insurance 6,000 Income Tax Expense 3,000 Dividends Paid 11,000 Net income? 18,000 Retained Earnings at end of year? 7,000 Current ratio? 4 to 1 Gross profit ratio? 57.1% How would the following transactions affect the Accounting (Balance Sheet) equation? Assets Provided services on account + Collected payment on account + - Liabilities - + Owners Equity + + Received utility bill Paid utility bill received previously = - - Cash balance per bank 12,000 Deposits in transit Interest earned Service charges Customer’s NSF check Outstanding checks 3,000 50 150 100 1,100 Adjusted balance per bank? 13,900 Cash balance per books 8,000 Service charges Deposits in transit Outstanding checks Interest earned Customer’s NSF check 70 2,500 900 20 130 Adjusted balance per books? 7,820 Buyer Company purchases 1,000 geegaws at $100 each. Supplier Company offers a 5% quantity discount for purchases of 500 or more and terms 2/10, n/30. If Buyer Company remits payment on the ninth day after the invoice date, how much should they pay? 93,100 Sales 100 Inventory: Beg 6 End 3 Operating Expenses 21 Purchases 50 Purchases returns 4 Purchases discounts 2 Transportation-in 5 Dividends 8 Calculate the following: Cost of goods purchased Cost of goods sold Gross margin Date Aug 1 14 28 Units 30 50 20 Unit Cost $2 3 4 49 52 48 Total Cost $ 60 150 80 Aug 31 Ending Inventory – 32 units Ending Inventory Cost of Goods Sold First-in First-out (FIFO) 116 174 Last-in First-out (LIFO) 66 224 Weighted Average 92.80 197.20 An automobile was purchased on January 1, 2006 at a cost of $18,000. Estimated useful life was 5 years with a residual value of $3,000. 1) Straight-line method a) Annual depreciation? 2) Double declining balance method 3,000 Depreciation for 2006? b) Book value on December 31, 2006? 7,200 15,000 Which payroll taxes are imposed on the following? Employee Employer FICA – Social Security FICA – Both Taxes (Matching) FICA - Medicare FUTA – Federal Unemp Federal Income Tax SUTA – State Unemp State Income Tax Which taxes are subject to a maximum amount? FICA – Social Security, FUTA, SUTA An investment of $10,000 is made at an annual rate of 8% for 6 years. How would the time value of money tables be used if the compounding of interest was: Semi-annually Quarterly 12 periods, 4% 24 periods, 2% Bonds were issued on a date when the face rate of interest was 6% and the market rate was 5%. These bonds will be issued at a Premium to face value. Leases Lessor – owns property Lessee – pays to use property Operating Capital (meets one of four criteria) Accounting treatment? Accounting treatment? Record: Rent or Lease Expense Record: Asset and Lease Liability Amounts received: Amounts paid: Salary Tips Interest – bank Maricopa county bonds Inheritance Game show winning Partnership income Gift from aunt Illegal income 20,000 15,000 500 1,200 30,000 3,000 6,000 12,000 18,000 Interest – home mortgage car loan credit card Property taxes – home car Charitable Income taxes – federal state Tuition paid to GCC 7,200 1,400 600 1,500 300 2,000 5,000 1,000 800 Amount to be included in taxable income? Total of itemized deductions? 62,500 12,000 Common stock, $10 par $200,000 Additional paid in capital 90,000 Retained Earnings 150,000 Less: Treasury stock, 2,000 shares (36,000) Number of: shares issued? 20,000 shares outstanding? 18,000 What would change if the company split its stock 2 for 1? Market price per share decreases, par value decreases, number of shares increases with no change to Stockholders’ Equity dollar amounts. Sales Accounts receivable, January 1 Accounts receivable, December 31 $400,000 40,000 70,000 Cash collected from customers? 370,000 Salaries expense Salaries payable, January 1 Salaries payable, December 31 $100,000 30,000 50,000 Cash paid for salaries? 80,000 Cost of goods sold Inventory, January 1 Inventory, December 31 Accounts payable, January 1 Accounts payable, December 31 $200,000 20,000 40,000 10,000 50,000 Cash paid for merchandise? 180,000 Accounts receivable Inventories Accounts payable Net income Depreciation expense 2007 $14 16 12 2008 $10 22 10 80 5 Using the indirect method, this company’s cash flow from operating activities would be? 81