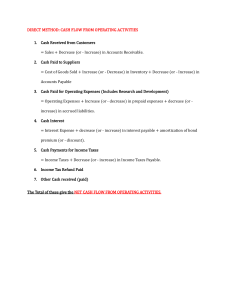

Use the following financial statements and additional information. PORTER INCORPORATED Comparative Balance Sheets June 30, 2019 and 2018 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation—Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity 2019 2018 $ 71,100 70,000 63,000 6,300 210,400 205,000 (51,000) $ 364,400 $ 6,100 55,000 88,000 7,900 157,000 190,000 (17,000) $ 330,000 $ 26,000 8,000 3,600 37,600 33,000 70,600 $ 32,000 20,000 4,000 56,000 65,000 121,000 240,000 53,800 $ 364,400 170,000 39,000 $ 330,000 PORTER INCORPORATED Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Other expenses Total operating expenses Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income $ 1,102,000 674,000 428,000 $ 93,000 109,000 $ 202,000 226,000 8,200 234,200 71,690 $ 162,510 Additional Information a. b. c. d. e. f. A $32,000 note payable is retired at its $32,000 carrying (book) value in exchange for cash. The only changes affecting retained earnings are net income and cash dividends paid. New equipment is acquired for $91,000 cash. Received cash for the sale of equipment that had cost $76,000, yielding a $8,200 gain. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. All purchases and sales of inventory are on credit. Use the Income Statement, Comparative Balance Sheet, and the additional information given above to reconstruct the entries for the summarized activity of the current fiscal year. We start by recreating the journal entries for the Income Statement: Step 1: We are going to reconstruct a journal entry to record Sales based on the income statement and the net effect in the balance sheet accounts that relate to sales. According to the Income Statement, period sales were $1,102K. Sales, if you recall from ACG2021, are either cash sales or credit sales. Additional information (f) in the problem states that "all purchases and sales of inventory are on credit". This means there were no cash sales. All sales were credit sales. To record these credit sales the journal entry must have been: Dr. A/R $1,102K Cr. Sales $1,102K However, when we look at the balance sheet, the balance in accounts receivable, net is $70K for the period. The prior period balance was $55K. That means the change in accounts receivable for the period is an increase of $15K (70-55). The account did not increase by the full amount of credit sales in the period ($1,102). To understand what occurred in A/R you must recall from financial accounting that: A/R increases due to sales on credit and A/R decreases due to collections on credit sales Therefore, the A/R account must look like this: We knew the beginning A/R balance, the ending A/R balance, and the sales on credit. To calculate the collections on credit sales we do the following: (Beg. Bal. + Sales on Account - End. Bal. = Collections on A/R). With figures: 55+1,102-$70 = 1,087. The change in A/R for the period (an increase of $15K) is due to credit sales being greater than collections of credit sales by $15K. So, 1,102K (credit sales) - 1,087K (collections) = $15K. Stated differently, if we know credit sales for the period were $1,102K and the change in A/R for the period was only an increase of $15K, we must have collected $1,087 of credit sales (1,102 - 15 = 1,087). Also, we need to understand that collections on credit sales impact cash. The journal entry to record the collections on A/R (credit sales) would be: Dr. Cash 1,087K Cr. A/R. 1,087K Therefore, if we summarize the impact of recording the credit sales as one journal entry it would be: Dr. Cash $1,087K (collections on A/R) Dr. A/R, net $15K (credit sales – collections, in other words the change in the account which was an increase) Cr. Sales. $1,102K (credit sales) Step 2: We need to reconstruct the journal entry to record cost of goods sold (COGS). According to the Income Statement, COGS for the period was $674K. If you recall from ACG2021, COGS is the cost of the inventory that is sold. So, COGS (an expense in the income statement) is directly related to the current asset - Inventory. Once again to recreate this JE, you must understand the following: Inventory increases by net purchases and Inventory decreases by COGS Therefore, the inventory account must look like this: We know the beginning balance in inventory is $88K, the ending balance is $63K, and the COGS is $674K. Since the change in COGS for the period is a decrease of $25K (63-88 = -25) and we decreased Inventory by 674K worth of COGS for the period, this means there must have been net purchases for the period of $649K. We can calculate this by doing the following: (End. Bal. + COGS - Beg. Bal = Net Purchases). Using figures: 63 + 674 - 88 = 649. The change in inventory for the period (a decrease of $25K) is due to COGS being greater than Net Purchases by $25K. In other words, if COGS were $25K greater than Purchases and COGS was $674, then COGS of $674K $25K = $649K Net Purchases. Stated differently, Net Purchases of $649K - COGS of $674K = a net decrease of $25K. As noted before, additional information in the problem (letter f), states that inventory purchases were on credit. Therefore, no inventory was purchased for cash. If the inventory was purchased for credit, then the journal entry must have been: Dr. Inventory $649K Cr. A/P. $649K To recreate the journal entry, you must understand how the Accounts Payable account works, that is: A/P increases due to purchases on account (credit purchases) and A/P decreases due to payments made on those accounts Therefore, the A/P account must look like this: We know the beginning balance in A/P is $32K, the ending balance is $26K, and that purchases on account for the period were $649K (from the inventory account analysis above). However, the change in A/P for the period is not equal to the $649K purchases on account. The change is a decrease of $6K (26-32 = -6), as opposed to $649K. Therefore, payments on account must have been $6K higher than purchases on account. $649K purchases on account + $6K = $655K payments on account. We can also calculate the payments by doing the following: Beg. Bal + Purchases on Account - End. Bal = Payments on Account. Using figures: ($32 + 649 - 26 = 655). Payments on account impact cash. The journal entry to record the payments would have been: Dr. A/P $655K Cr. Cash. $655K Therefore, if we summarize the impact of recording COGS as one journal entry, the journal entry would be: Dr. COGS. $674K (cost of inventory sold) Dr. A/P. $6K. (purchases on account - payments on account, in other words the change in the acct. – a decrease) Cr. Inventory. $25K. (net purchases – COGS, in other words the change in the acct. – a decrease) Cr. Cash. $655K. (payments on accounts payable) Step 3: Reconstruct the journal entry to record depreciation expense. The Income Statement states that depreciation expense for the period is $93K. Recall from ACG 2021 that depreciation expense is related to accumulated depreciation. The Journal entry must have been: Dr. Depreciation Expense $93K Cr. Accumulated Depreciation $93K This entry takes care of recreating the depreciation expense entry. However, when we look at the change in Accumulated Depreciation in the balance sheet: Beg. Accum. Depr. = $17K, End. Accum. Depr. = $51K. The change is an increase in Accumulated Depreciation of $34K. Note the increase in the period is not equal to the $93K recorded for depreciation expense. To understand what is happening in the accumulated depreciation account we must recall the following: Accumulated Depreciation increases from recording depreciation expense (an estimate representing the use of a plant asset). Accumulated Depreciation decreases from the sale or disposal of a plant asset. Note (d) in the problem states “Received cash for the sale of equipment that had a cost of $76K, yielding an $8.2K gain”. As such, we did in fact sell a plant asset. The sale of a plant asset is an investing activity, and we need to recreate this journal entry. Step 4: Reconstruct the journal entry to record the sale/disposal of equipment. To recreate the journal entry, we need to determine the amount of cash received and the amount of accumulated depreciation for the equipment sold. We know the acquisition cost of the equipment is $76K and we know we have a gain on the sale of the plant asset in the amount of $8.2K(from note (d ) of the additional information). Recall from ACG2021 the following about gains and losses on the disposal of plant assets: If the cash received is > the book value of the asset = gain If the cash received is < the book value of the asset = loss If the cash received is = the book value of the asset = neither a gain nor a loss Also recall, to calculate book value: Acquisition Cost of Plant Asset – Accumulated Depreciation = Book Value We know the acquisition cost of the equipment is $76K and we can calculate the accumulated depreciation of the asset that was disposed by analyzing the Accumulated Depreciation Account as follows: in '000's Accumulated Depreciation - Equipment Dr. (Decreases) Cr. (Increases) $ 17 Beg. Bal. $ 93 Depreciation Expense Disposal of PPE: $ 59 $ 51 End. Bal. Beg. Accum. Depr. + Depreciation Expense – End. Accum. Depreciation = Disposal of PPE. Using figures: (17 + 93 – 51 = 59). $59K is the amount of accumulated depreciation associated with the equipment that was sold. Now we know that the Cost of the Equipment = $76K (from note d) The Accumulated Depreciation of the Equipment = (59K) from our analysis of the Accum. Depreciation Acct. And we can calculate the book value = $17K (76-59) As mentioned before, to have a gain on the sale the book value must be less than the cash received. We can now calculate the cash received for the equipment sale as follows: Cash – BV = Gain Cash – 17 = $8.2 Cash = 8.2 + 17 Cash = $25.2 Now we have all the figures to reconstruct the journal entry for the sale of the equipment: Dr. Cash. Dr. Accumulated Depreciation Equipment Cr. Equipment Cr. Gain on Sale of Equipment $25.2K $59K $76K $8.2K Note that the $76K reduction in Equipment for the period does not account for the change in the Equipment account. The Beg. Bal in Equipment is $190K, the End. Bal is $205K. The change in Equipment is an increase of $15K. To understand what is driving the change in the equipment account we must recall the following: Equipment increases from the purchase of equipment Equipment decreases from the sale of equipment Therefore, the Equipment account must look as follows: in '000's Equipment Dr. (Increases) Cr. (Decreases) Beg. Bal: $ 190 Purchases of Equipment $ 91 $ 76 Sale of Equipment End. Bal: $ 205 We calculate the purchase of equipment as follows: End Bal. + Equipment Sales – Beg. Bal. = Equipment Purchases. Using figures: 205 + 76 – 190 = $91. Additional note (c ) states that “ New equipment was acquired for $91K cash”. We confirmed this through the analysis of the equipment account above. The purchase of equipment is a financing activity and we must recreate the journal entry. Step 5: Reconstruct the JE to record the Equipment Purchase: Dr. Equipment $91K Cr. Cash $91K Step 6: Reconstruct the JE to record Other expenses. The income statement lists other expenses in the amount of $109K. Note (d) of the additional information states that “Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.” Therefore, we must understand what impacts Prepaid Expenses and Wages Payable. Prepaid Expenses: Prepaid Expenses increase due to cash payments(purchases) of deferred expenses such as rent and insurance: Dr. Prepaid Expense, Cr. Cash Prepaid Expenses decrease due to the expiration (expense/use) of the deferred expense such as rent expense and insurance expense. Prepaid expenses once expired become operating expenses: Dr. Expense, Cr. Prepaid Expense Wages Payable: Wages Payable increases from accrued wages (wages we have incurred but not yet paid): Dr. Wages Expense, Cr. Wages Payable Wages Payable decreases from payments of accrued wages: Dr. Wages Payable, Cr. Cash However, in this problem we are not told how much of the other operating expenses are wages expense and how much are expenses related to the expiration of prepaid expenses. Therefore, we cannot determine the cash payments for prepaid expenses and the cash payments for accrued wages. As demonstrated in the other examples thus far, we only need to record the change in these accounts. The remaining difference between those figures and other operating expenses must be the portion paid in cash for deferred expenses and accrued wages. in '000's Prepaid Expenses Dr. (Increases) Cr. (Decreases) Beg. Bal: $ 7.9 Payment of Deferred Expenses: ? ? (such as rent and insurance) $ End. Bal: $ Expiration of Deferred Expenses (Operating expenses other than depreciation such as expired insurance or expired rent) 1.6 net change is a decrease (credit) 6.3 We calculate the net change in prepaid expenses as follows: End. Balance $6.3K – Beg. Bal. $7.9K = decrease of -$1.6K Payment of Accrued Wages in '000's Wages Payable Dr. (Decreases) Cr. (Increases) $ 20 Beg. Bal. ? Accrued Wages ? net change is a decrease (debit) $ 12 $ 8 End. Bal. We calculate the net change in wages payable as follows: End. Bal. $8K – Beg. Bal. $20K = decrease of -$12K The journal entry to reconstruct Other expenses is as follows: Dr. Other Expenses Dr. Wages Payable Cr. Prepaid Expenses Cr. Cash $109K (from the income statement) $ 12K. (the amount of the net decrease in the account) $1.6K. (the amount of the net decrease in the account) $119.4K (remaining difference required: 109 + 12 – 1.6 = 119.4) Step 7: Reconstruct the JE to record Income Tax Expense. The income statement lists income taxes expense for the period as $71,690. Income taxes expense is related to Income taxes payable. The journal entry would have been: Dr. Income Taxes Expense $71.69K Cr. Income Taxes Payable. $71.69K However, the change in the income taxes payable account for the period is not an increase of $71.69K but rather a decrease of $400. End. Bal. $3.6K – Beg. Bal. $4K = decrease of - $0.4K. To understand the change in the income taxes payable you must know the following: Income taxes payable increases from accrued taxes expenses: Dr. Income Taxes Expense, Cr. Income Taxes Payable Income taxes payable decreases from payments of accrued taxes: Dr. Income Taxes Payable, Cr. Cash The Income Taxes Payable account must look like this: Payment of Accrued Taxes in '000's Income Taxes Payable Dr. (Decreases) Cr. (Increases) $ 4 Beg. Bal. $ 71.69 Accrued Income Taxes (Income taxes expense) $ 72.09 $ 3.6 End. Bal. We calculate the payment of accrued taxes as follows: Beg. Bal. + Income Taxes Expense – End. Bal. = Payment of Accrued Taxes. Using figures: 4 + 71.69 – 3.6 = $72.09 The net change in income taxes payable for the period is equal to the difference between the accrued income taxes (income taxes expense) – the payment of accrued taxes. ($71.69 – 72.09 = decrease of -0.4) The payment of accrued taxes would have been recorded as follows: Dr. Income Taxes Payable $72.09 Cr. Cash $72.09 We summarize the journal entry as follows: Dr. Income tax expense Dr. Income taxes payable. Cr. Cash $71.69K (from the income statement) $ 0.40 K (the net decrease in the taxes payable account) $72.09K (the payment of income taxes accrued) Thus far, we have recreated the journal entries for all the income statement items and in doing so, we have analyzed all the non-cash current assets on the balance sheet, all the long-term assets, and all the current liabilities. We must still analyze the remaining sections of the balance sheet: long-term liabilities and equity. The only long-term liability on the balance sheet is Notes Payable. We must understand the transactions that affect this account. Thus: Notes Payable increases from issuing debt (specifically notes). Notes Payable decreases from retiring debt (debt is retired when it is no longer owed which typically involves paying the note in its entirety or paying some portion of the note and recording a gain or loss.) We analyze the change in the notes payable account as follows and review the income statement for gains or losses on retirement of notes: in '000's Notes Payable Dr. (Decreases) Cr. (Increases) $ 65 Beg. Bal. Retirement / satisfaction of note $ 32 $ 33 End. Bal. We don’t have any information (additional notes) indicating that we have issued any debt in exchange for cash or to purchase PP&E. So, we assume there are no increases (credits) to notes payable for the period. Therefore, the change in the account (Beg. Bal of $65K – End. Bal. of $33K = a decrease of -$32K) is due to the satisfaction/retirement of notes payable. Next, we look at the other gains (losses) section of the income statement: The only item listed is a gain related to the sale of equipment (which we already accounted for above). There is no gain or loss from the retirement of a note. Therefore, we can assume the note was retired at its carrying value for cash. We can confirm this with additional note (a) which states that a $32K note payable is retired at its book value ($32K) for cash. Step 8: Reconstruct the JE to record Notes Payable. Therefore, the journal entry to reconstruct the change in Notes Payable is: Dr. Notes Payable $32K Cr. Cash $32K We move on to analyze changes in the equity section of the balance sheet beginning with Common Stock. Step 9: Reconstruct the JE to record Common Stock. Common stock increases when stock is issued in exchange for capital usually in the form of cash. Common stock only decreases when a company is liquidated (closed). The Common Stock account looks as follows: in '000's Common Stock Dr. (Decreases) Cr. (Increases) $ 170 Beg. Bal. liquidation of business $ 70 stock issuances $ 240 End. Bal. The End. Bal of $240K for the period – the Beg. Bal of $170 = an increase of $70K The equity section does not have an “additional paid in capital in excess of par – common stock” account. Therefore, we can determine the stock was issued at par, as opposed to on a premium (for more than par $70K) or a discount (for less than par -$70K). Thus, the cash received for the $70K of stock issued was $70K. The JE to record the issuance of stock at par in exchange for cash would have been: Dr. Cash $70K Cr. Common Stock $70K Now we move on to reconstruct the entries impacting Retained Earnings. Recall from ACG2021 that we calculate retained earnings as follows: Beg. Retained Earnings + Net Income – Dividends = Ending Retained Earnings. Recall that to move “net income” to retained earning we prepare closing entries: Close the revenues and gains accounts to income summary: dr. revenues/gains, cr. income summary Close the expenses and losses accounts to income summary: dr. income summary, cr. expenses/losses Step 10: Reconstruct the closing entries recorded to Income summary: Dr. Sales. Dr. Gain on sale of equipment Cr. Income Summary $1,102K $ 8.2K Dr. Income Summary Cr. COGS Cr. Depreciation Expense Cr. Other Expenses Cr. Income Taxes Expense $947.69K Dr. Income Summary. Cr. Retained Earnings $162.51K $1,110.2K $ $ $ $ 674K 93K 109K 71.69K $162.51K Now we analyze the change in the retained earnings account as follows: in '000's Retained Earnings Dr. (Decreases) Cr. (Increases) $ 39 Beg. Bal. Dividends: $ 147.71 $ $ 162.51 Net Income (Revenues - Expenses) from income summary 53.8 End. Bal. The change in retained earnings for the period is an increase of $14.8K (End Bal. $53.8 – Beg. Bal. $39 = $14.8). as opposed to the $162.51K of net income reported for the period. This means the retained earnings must have been reduced by dividends. Note b states the only changes affecting retained earnings are net income and cash dividends paid (in other words there are no prior period corrections affecting retained earnings). The note clarifies the dividends are paid in cash. We calculate the amount of dividends paid as follows: Beg. Bal. $39K + Net Income $162.51 – End. Bal. $53.8K = Dividends $147.71. Stated differently, the dividends reducing retained earnings must be $14.8K less than the net income recorded in the account ($162.51-$14.8 = $147.71). Step 11: Reconstruct the entry to record cash dividends paid: Dr. Retained Earnings. $147.71K Cr. Cash $147.71K Now you can finish the assignment by using all of the entries that involve cash to prepare the statement of cash flows using the direct method and the changes in Current Asset and Current Liability accounts that are related to operating activities to prepare the operating activities section of the cash flows statement using the indirect method.