Write **condor spread strategy

advertisement

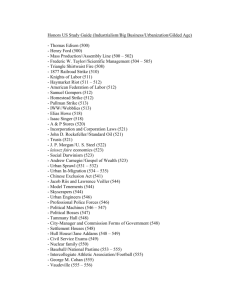

Adviser:張上財 Class:碩財一甲 Number:MA180104 Name:蔡佩蓉 Write condor spread strategy is composed of a total of four options composite strategy, use of time is that the underlying spot price is expected to greater fluctuations than consolidation rose dramatic use of the strategy of risk and profit are limited. Write condor is a neutral strategy similar to the short butterfly. It is a limited risk, limited profit trading strategy that is structured to earn a profit when the underlying stock is perceived to be making a sharp move in either direction. Using calls, the options trader can setup a short condor by combining a bear call spread and a bull call spread. The trader enters a short call condor by buying a lower strike in-the-money call, selling an even lower striking in-the-money call, buying a higher strike out-of-the-money call and selling another even higher striking out-of-the-money call. A total of 4 ways are involved in this trading strategy and a net credit is received on entering the trade. The maximum possible profit for a short condor is equal to the initial credit received upon entering the trade. It happens when the underlying stock price on expiration date is at or below the lowest strike price and also occurs when the stock price is at or above the highest strike price of all the options involved. Maximum loss is suffered when the underlying stock price falls between the 2 middle strikes at expiration. Max Loss Occurs When Price of Underlying is in between the Strike Prices of the 2 Long Calls Upper Breakeven Point = Strike Price of Highest Strike Short Call - Net Premium Paid Lower Breakeven Point = Strike Price of Lowest Strike Short Call + Net Premium Paid Strike price Premium Sell 7200 132 Short spread Buy 7400 64 Short spread Buy 7600 29 Bull spread Sell 7800 12.5 Bull spread 7200(+68) 68 7268 When 7200→7400,the loss 200 point, 132-200=(-68), -68+(-64)=(-132) When 7200 point earn 200-132=+68 132 7400 (-132) Sell one 7200 Call for 132 Buy one 7400 Call for 64 The maximum gain is 68 and the maximum loss is 132 The Break-even point is 7268 points 7800(+183.5) -29+12.5=(-16.5) When 7600→7800,the earn 200 point 200-16.5=183.5 183.5 16.5 7616.5 7600(-16.5) Buy one 7600 Call for 29 Sell one 7800 Call for 12.5 The maximum gain is 183.5 and the maximum loss is 16.5 The Break-even point is 7616.5 points 7200(+51.5) 7251.5 7400(-148.5) 7800(+51.5) 7748.5 7600(-148.5) The maximum loss is -132-16.5=-148.5 point The maximum gain is 200-148.5= 51.5 point Upper Breakeven Point =7600 + 148.5 = 7748.5 point Lower Breakeven Point =7400 -148.5 = 7251.5 point If the futures Index closed at under 7,251.5 points or on the 7,748.5 points, In a profitable state, the operation was successful. If the futures Index closed at under 7200 points or 7800 points, it can get the maximum profit. (51.5 point) If the index closed between the largest 7,400 to 7,600 .the loss will 148.5 points. http://www.optionstradingresearch.com/short-condor-spread/ http://seekingalpha.com/article/308897-using-the-shortcondor-option-spread-around-earnings-with-volatile-stocks http://www.theoptionsguide.com/short-condor.aspx http://www.optiontradingpedia.com/free_short_condor_spread_s implified.htm http://www.optiontradingpedia.com/free_short_condor_spread.h tm http://www.theoptionsguide.com/reverse-iron-condor.aspx http://tw.myblog.yahoo.com/james59572002/article?mid=53 Thanks for your listening !