Slide

13-1

Chapter

13

Statement of

Cash Flows

Financial Accounting, IFRS Edition

Weygandt Kimmel Kieso

Slide

13-2

Study Objectives

1. Indicate the usefulness of the statement of cash flows.

2. Distinguish among operating, investing, and financing

activities.

3. Prepare a statement of cash flows using the indirect

method.

4. Analyze the statement of cash flows.

Slide

13-3

Statement of Cash Flows

The Statement of

Cash Flows:

Usefulness and

Format

Preparing the

Statement of Cash

Flows—Indirect

Method

Usefulness

Classifications

Step 1: Operating

activities

Significant non-cash

activities

Step 2: Investing and

financing activities

Format

Step 3: Net change

in cash

Preparation

Indirect and direct

methods

Slide

13-4

Using Cash Flows to

Evaluate a Company

Free cash flow

Usefulness and Format

Usefulness of the Statement of Cash Flows

Provides information to help assess:

1. Entity’s ability to generate future cash flows.

2. Entity’s ability to pay dividends and obligations.

3. Reasons for difference between net income and net cash

provided (used) by operating activities.

4. Cash investing and financing transactions during the

period.

Slide

13-5

SO 1 Indicate the usefulness of the statement of cash flows.

Usefulness and Format

Classification of Cash Flows

Operating

Activities

Income

Statement

Items

Slide

13-6

Investing

Activities

Generally

Non-Current

Asset Items

Financing

Activities

Generally

Non-Current

Liability and

Equity Items

SO 2 Distinguish among operating, investing, and financing activities.

Classification of Cash Flows

Types of Cash Inflows and Outflows

Slide

13-7

Illustration 13-1

SO 2 Distinguish among operating, investing, and financing activities.

Classification of Cash Flows

Types of Cash Inflows and Outflows

Slide

13-8

Illustration 13-1

SO 2 Distinguish among operating, investing, and financing activities.

Classification of Cash Flows

Types of Cash Inflows and Outflows

IFRS requires that the following amounts be disclosed:

Cash paid for taxes.

Cash received and paid from interest and dividends.

Illustration 13-2

Daimler’s statement of

cash flows note

Slide

13-9

SO 2 Distinguish among operating, investing, and financing activities.

Usefulness and Format

Significant Non-Cash Activities

1. Direct issuance of ordinary shares to purchase assets.

2. Conversion of bonds into ordinary shares.

3. Direct issuance of debt to purchase assets.

4. Exchanges of plant assets.

Companies report these activities in either a separate note or

supplementary schedule to the financial statements.

Slide

13-10

SO 2 Distinguish among operating, investing, and financing activities.

Slide

13-11

Usefulness and Format

Format of the Statement of Cash Flows

Order of Presentation:

Direct Method

1. Operating activities.

2. Investing activities.

Indirect Method

3. Financing activities.

The cash flows from operating activities section always

appears first, followed by the investing and financing sections.

Slide

13-12

SO 2 Distinguish among operating, investing, and financing activities.

Format of the Statement of Cash Flows

Illustration 13-3

Slide

13-13

SO 2 Distinguish among operating, investing, and financing activities.

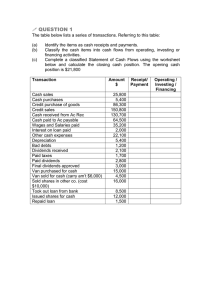

Format of the Statement of Cash Flows

During its first week, Hu Na Company had these

transactions.

Classification

Slide

13-14

1. Issued 100,000 HK$50 par value ordinary shares

for HK$8,000,000 cash.

Financing

2. Borrowed HK$2,000,000 from Castle Bank,

signing a 5-year note bearing 8% interest.

Financing

3. Purchased two semi-trailer trucks for

HK$1,700,000 cash.

Investing

4. Paid employees HK$120,000 for salaries and

wages.

Operating

5. Collected HK$200,000 cash for services provided.

Operating

SO 2 Distinguish among operating, investing, and financing activities.

Usefulness and Format

Preparing the Statement of Cash Flows

Three Sources of Information:

1. Comparative statement of financial position

2. Current income statement

3. Additional information

Slide

13-15

SO 2 Distinguish among operating, investing, and financing activities.

Usefulness and Format

Three Major Steps:

Slide

13-16

Illustration 13-4

SO 2 Distinguish among operating, investing, and financing activities.

Usefulness and Format

Three Major Steps:

Slide

13-17

Illustration 13-4

SO 2 Distinguish among operating, investing, and financing activities.

Usefulness and Format

Indirect and Direct Methods

Companies favor the indirect method for two reasons:

1. Easier and less costly to prepare, and

2. Focuses on the differences between net income and net

cash flow from operating activities.

Slide

13-18

SO 2 Distinguish among operating, investing, and financing activities.

Slide

13-19

Preparing the Statement of Cash Flows

Illustration

Illustration 13-5

Indirect

Method

Slide

13-20

SO 3 Prepare a statement of cash flows using the indirect method.

Preparing

the

Statement

of Cash

Flows

Indirect

Method

Illustration 13-5

Slide

13-21

SO 3 Prepare a statement of cash flows using the indirect method.

Preparing the Statement of Cash Flows

Additional information for 2011:

1. The company declared and paid a $29,000 cash dividend.

2. Issued $110,000 of long-term bonds in direct exchange for land.

3. A building costing $120,000 and equipment costing $25,000 were

purchased for cash.

4. The company sold equipment with a book value of $7,000 (cost

$8,000, less accumulated depreciation $1,000) for $4,000 cash.

5. Issued ordinary shares for $20,000 cash.

6. Depreciation expense was comprised of $6,000 for building and

$3,000 for equipment.

Slide

13-22

SO 3 Prepare a statement of cash flows using the indirect method.

Preparing the Statement of Cash Flows

Step 1: Operating Activities

Indirect

Method

Determine net cash provided/used by operating activities

by converting net income from an accrual basis to a cash

basis.

Common adjustments to Net Income (Loss):

Add back non-cash expenses (depreciation and

amortization expense).

Deduct gains and add losses that resulted from investing

and financing activities.

Slide

13-23

Analyze changes in non-cash current assets and current

liabilities.

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Question

Which is an example of a cash flow from an operating

activity?

a. Payment of cash to lenders for interest.

b. Receipt of cash from the sale of shares.

c. Payment of cash dividends to the company’s

shareholders.

d. None of the above.

Slide

13-24

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Depreciation Expense

Although depreciation expense reduces net income, it does not

reduce cash.

Illustration 13-7

Slide

13-25

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Loss on Sale of Equipment

Because companies report as a source of cash in the investing

activities section the actual amount of cash received from the

sale:

Any loss on sale is added to net income in the operating

section.

Any gain on sale is deducted from net income in the

operating section.

Slide

13-26

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Loss on Sale of Equipment

Computer Services’ income statement reports a $3,000 loss on

the sale of equipment (book value $7,000, less $4,000 cash

received from sale of equipment).

Illustration 13-8

Slide

13-27

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Changes to Non-Cash Current Asset Accounts

When the Accounts Receivable balance decreases, cash

receipts are higher than revenue earned under the accrual

basis.

Illustration 13-9

Accounts Receivable

1/1/011

Balance

Revenues

12/31/11 Balance

30,000

507,000

Receipts from customers 517,000

20,000

Therefore, the company adds to net income the amount of the

decrease in accounts receivable.

Slide

13-28

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Changes to Non-Cash Current Asset Accounts

Illustration 13-10

Cash flows from operating activities:

Net income

$

145,000

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation expense

9,000

Loss on sale of equipment

3,000

Decrease in accounts receivable

Net cash provided by operating activities

Slide

13-29

10,000

$

167,000

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Changes to Non-Cash Current Asset Accounts

When the Inventory balance increases, the cost of

merchandise purchased exceeds the cost of goods sold.

Merchandise Inventory

1/1/11

Balance

Purchases

12/31/11 Balance

10,000

155,000

Cost of goods sold

150,000

15,000

As a result, cost of goods sold does not reflect cash payments

made for merchandise. The company deducts from net income

this inventory increase.

Slide

13-30

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Changes to Non-Cash Current Asset Accounts

Illustration 13-10

Cash flows from operating activities:

Net income

$

145,000

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation expense

9,000

Loss on sale of equipment

3,000

Decrease in accounts receivable

10,000

Increase in inventory

(5,000)

Net cash provided by operating activities

Slide

13-31

$

162,000

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Changes to Non-Cash Current Asset Accounts

When the Prepaid Expense balance increases

Cash paid for expenses is higher than expenses reported on

an accrual basis.

Company deducts the increase from net income to arrive at

net cash provided by operating activities.

If prepaid expenses decrease, reported expenses are higher

than the expenses paid.

Slide

13-32

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Changes to Non-Cash Current Asset Accounts

Illustration 13-10

Cash flows from operating activities:

Net income

$

145,000

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation expense

9,000

Loss on sale of equipment

3,000

Decrease in accounts receivable

10,000

Increase in inventory

(5,000)

Increase in prepaid expenses

(4,000)

Net cash provided by operating activities

Slide

13-33

$

158,000

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Changes to Non-Cash Current Liability Accounts

When Accounts Payable increases

Company received more in goods than it actually paid for.

Increase is added to net income.

When Income Tax Payable decreases

Income tax expense was less than the amount of taxes paid

during the period.

Decrease is subtracted from net income.

Slide

13-34

SO 3 Prepare a statement of cash flows using the indirect method.

Operating Activities

Changes to Non-Cash Current Liability Accounts

Illustration 13-11

Cash flows from operating activities:

Net income

$

145,000

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation expense

9,000

Loss on sale of equipment

3,000

Decrease in accounts receivable

10,000

Increase in inventory

(5,000)

Increase in prepaid expenses

(4,000)

Increase in accounts payable

16,000

Decrease in income taxes payable

(2,000)

Net cash provided by operating activities

Slide

13-35

$

172,000

SO 3 Prepare a statement of cash flows using the indirect method.

Preparing the Statement of Cash Flows

Summary of Conversion to Net

Cash Provided by Operating

Activities—Indirect Method

Slide

13-36

Illustration 13-12

SO 3 Prepare a statement of cash flows using the indirect method.

Step 2: Investing and Financing Activities

From the additional information, the company purchased land of

$110,000 by issuing long-term bonds. This is a significant

noncash investing and financing activity that merits disclosure in

a separate schedule.

Land

1/1/11

Balance

Issued bonds

12/31/11 Balance

20,000

110,000

130,000

Bonds Payable

1/1/11

Slide

13-37

Balance

For land

20,000

110,000

12/31/11 Balance

130,000

SO 3 Prepare a statement of cash flows using the indirect method.

Investing and Financing Activities

Partial statement

Slide

13-38

Illustration 13-14

Net cash provided by operating activities

Cash flows from investing activities:

Purchase of building

Purchase of equipment

Sale of equipment

Net cash used by investing activities

Cash flows from financing activities:

Issuance of ordinary shares

Payment of cash dividends

Net cash used by financing activities

Net increase in cash

Cash at beginning of period

Cash at end of period

172,000

$

20,000

(29,000)

(9,000)

22,000

33,000

55,000

Disclosure: Issuance of bonds to purchase land

$

110,000

(120,000)

(25,000)

4,000

(141,000)

SO 3 Prepare a statement of cash flows using the indirect method.

Investing and Financing Activities

From the additional information, the company acquired an office

building for $120,000 cash. This is a cash outflow reported in

the investing section.

Building

1/1/11

Balance

40,000

Office building 120,000

12/31/11 Balance

Slide

13-39

160,000

SO 3 Prepare a statement of cash flows using the indirect method.

Investing and Financing Activities

Partial statement

Slide

13-40

Illustration 13-14

Net cash provided by operating activities

Cash flows from investing activities:

Purchase of building

Purchase of equipment

Sale of equipment

Net cash used by investing activities

Cash flows from financing activities:

Issuance of ordinary shares

Payment of cash dividends

Net cash used by financing activities

Net increase in cash

Cash at beginning of period

Cash at end of period

172,000

$

20,000

(29,000)

(9,000)

22,000

33,000

55,000

Disclosure: Issuance of bonds to purchase land

$

110,000

(120,000)

(25,000)

4,000

(141,000)

SO 3 Prepare a statement of cash flows using the indirect method.

Investing and Financing Activities

The additional information explains that the equipment increase

resulted from two transactions: (1) a purchase of equipment of

$25,000, and (2) the sale for $4,000 of equipment costing $8,000.

Equipment

1/1/11

Balance

Purchase

12/31/11 Balance

Journal

Entry

Slide

13-41

10,000

25,000

Equipment sold

8,000

27,000

Cash

Accumulated depreciation

Loss on sale of equipment

Equipment

4,000

1,000

3,000

8,000

SO 3 Prepare a statement of cash flows using the indirect method.

Statement

of Cash

Flows

Indirect

Method

Illustration 13-14

Slide

13-42

Cash flows from operating activities:

Net income

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation expense

Loss on sale of equipment

Decrease in accounts receivable

Increase in inventory

Increase in prepaid expenses

Increase in accounts payable

Decrease in income taxes payable

Net cash provided by operating activities

Cash flows from investing activities:

Purchase of building

Purchase of equipment

Sale of equipment

Net cash used by investing activities

Cash flows from financing activities:

Issuance of ordinary shares

Payment of cash dividends

Net cash used by financing activities

Net increase in cash

Cash at beginning of period

Cash at end of period

$

145,000

9,000

3,000

10,000

(5,000)

(4,000)

16,000

(2,000)

172,000

(120,000)

(25,000)

4,000

(141,000)

$

20,000

(29,000)

(9,000)

22,000

33,000

55,000

SO 3 Prepare a statement of cash flows using the indirect method.

Investing and Financing Activities

The additional information notes that the increase in share

capital - ordinary resulted from the issuance of new shares.

Ordinary Shares

1/1/11

Balance

Shares sold

12/31/11 Balance

Slide

13-43

50,000

20,000

70,000

SO 3 Prepare a statement of cash flows using the indirect method.

Investing and Financing Activities

Illustration 13-14

Partial statement

Slide

13-44

Net cash provided by operating activities

Cash flows from investing activities:

Purchase of building

Purchase of equipment

Sale of equipment

Net cash used by investing activities

Cash flows from financing activities:

Issuance of ordinary shares

Payment of cash dividends

Net cash used by financing activities

Net increase in cash

Cash at beginning of period

Cash at end of period

172,000

$

20,000

(29,000)

(9,000)

22,000

33,000

55,000

Disclosure: Issuance of bonds to purchase land

$

110,000

(120,000)

(25,000)

4,000

(141,000)

SO 3 Prepare a statement of cash flows using the indirect method.

Investing and Financing Activities

Retained earnings increased $116,000 during the year. This

increase can be explained by two factors: (1) Net income of

$145,000 increased retained earnings. (2) Dividends of $29,000

decreased retained earnings

Retained Earnings

1/1/11

Dividends

29,000

Balance

Net income

12/31/11 Balance

Slide

13-45

48,000

145,000

164,000

SO 3 Prepare a statement of cash flows using the indirect method.

Statement

of Cash

Flows

Indirect

Method

Step 3: Net

Change in

Cash

Slide

13-46

Cash flows from operating activities:

Net income

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation expense

Loss on sale of equipment

Decrease in accounts receivable

Increase in inventory

Increase in prepaid expenses

Increase in accounts payable

Decrease in income taxes payable

Net cash provided by operating activities

Cash flows from investing activities:

Purchase of building

Purchase of equipment

Sale of equipment

Net cash used by investing activities

Cash flows from financing activities:

Issuance of ordinary shares

Payment of cash dividends

Net cash used by financing activities

Net increase in cash

Cash at beginning of period

Cash at end of period

Illustration 13-14

$

145,000

9,000

3,000

10,000

(5,000)

(4,000)

16,000

(2,000)

172,000

(120,000)

(25,000)

4,000

(141,000)

$

20,000

(29,000)

(9,000)

22,000

33,000

55,000

SO 3 Prepare a statement of cash flows using the indirect method.

Investing and Financing Activities

Question

Which is an example of a cash flow from an investing

activity?

a. Receipt of cash from the issuance of bonds

payable.

b. Payment of cash to repurchase outstanding

shares.

c. Receipt of cash from the sale of equipment.

d. Payment of cash to suppliers for inventory.

Slide

13-47

SO 3 Prepare a statement of cash flows using the indirect method.

Using Cash Flows to Evaluate a Company

Free Cash Flow

Free cash flow describes the cash remaining from

operations after adjustment for capital expenditures and

dividends.

Slide

13-48

SO 4 Analyze the statement of cash flows.

Using Cash Flows to Evaluate a Company

Illustration 13-16

Slide

13-49

SO 4 Analyze the statement of cash flows.

Understanding U.S. GAAP

Key Differences

Statement of Cash Flows

Companies preparing financial statements under both IFRS and

GAAP must prepare a statement of cash flows as an integral

part of the financial statements.

Both IFRS and GAAP require that the statement of cash flows

should have three major sections—operating, investing, and

financing—along with changes in cash and cash equivalents.

Similar to IFRS, the cash flow statement can be prepared using

either the indirect or direct method under GAAP. In both U.S.

and international settings, most companies choose the indirect

method for reporting net cash flows from operating activities.

Slide

13-50

Understanding U.S. GAAP

Key Differences

Statement of Cash Flows

The definition of cash equivalents used in GAAP is similar to

that used in IFRS. A major difference is that in certain

situations, bank overdrafts are considered part of cash and

cash equivalents under IFRS, which is not the case in GAAP.

Under GAAP, bank overdrafts are classified as financing

activities.

IFRS requires that non-cash investing and financing activities

be excluded from the statement of cash flows. Non-cash

investing and financing activities should be disclosed in the

notes instead of in the financial statements. Under GAAP,

companies may present this information at the bottom of the

Slide

13-51

cash flow statement.

Understanding U.S. GAAP

Looking to the Future

Statement of Cash Flows

Presently, the FASB and the IASB are involved in a joint project on

the presentation and organization of information in the financial

statements. One interesting approach, revealed in a published

proposal from that project, is that in the future the income

statement and statement of financial position would adopt headings

similar to those of the statement of cash flows. That is, the income

statement and statement of financial position would be broken into

operating, investing, and financing sections. With respect to the

cash flow statement specifically, the notion of cash equivalents will

probably not be retained. That is, cash equivalents will not be

combined with cash but instead will be reported as a form of highly

continued

Slide

13-52

Understanding U.S. GAAP

Looking to the Future

Statement of Cash Flows

liquid, low-risk investments. The definition of cash in the existing

literature would be retained, and the statement of cash flows would

present information on changes in cash only. In addition, the FASB

favors presentation of operating cash flows using the direct method

only. However, the majority of IASB members express a preference

for not requiring use of the direct method of reporting operating

cash flows. So, the two Boards will have to resolve their differences

in this area in order to issue a converged standard for the statement

of cash flows.

Slide

13-53

Using a Worksheet to Prepare the Statement of Cash

Flows-Indirect Method

Appendix A

Illustration 13A-1

Slide

13-54

SO 5 Explain how to use a worksheet to prepare the statement of cash flows

using the indirect method.

Using a Worksheet to Prepare the Statement of Cash

Flows-Indirect Method

Preparing a Worksheet

1. Enter in the statement of financial position accounts section the

statement of financial position accounts and their beginning and

ending balances.

2. Enter in the reconciling columns of the worksheet the data that

explain the changes in the statement of financial position accounts

other than cash and their effects on the statement of cash flows.

3. Enter the cash line and at the bottom of the worksheet the increase

or decrease in cash. This entry should enable the totals of the

reconciling columns to be in agreement.

Slide

13-55

SO 5 Explain how to use a worksheet to prepare the statement of cash flows

using the indirect method.

Using a Worksheet

to Prepare the

Statement of Cash

Flows-Indirect

Method

Slide

13-56

Illustration 13A-3

Completed worksheet—

indirect method

Statement of Cash Flows-Direct Method

Appendix B

1. Under the direct method, companies compute net cash

provided by operating activities by adjusting each item in the

income statement from the accrual basis to the cash basis.

2. To simplify and condense the operating activities section,

companies report only major classes of operating cash

receipts and cash payments.

3. For these major classes, the difference between cash receipts

and cash payments is the net cash provided by operating

activities.

Slide

13-57

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Step 1: Operating Activities

Illustration 13B-2

Slide

13-58

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Illustration 13B-1

Slide

13-59

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Illustration 13B-1

Additional information:

1. In 2011, the company declared and paid a $32,000 cash dividend.

2. Bonds were issued at face value for $130,000 in cash.

3. Equipment costing $180,000 was purchased for cash.

4. Equipment costing $20,000 was sold for $17,000 cash when the book value of the

equipment was $18,000.

5. Ordinary shares of $60,000 were issued to acquire land.

Slide

13-60

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Cash Receipts from Customers

For Juarez Company, accounts receivable decreased $3,000.

Illustration 13B-3

Illustration 13B-5

Slide

13-61

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Cash Payments to Suppliers

In 2011, Juarez Company’s inventory increased $10,000

and cash payments to suppliers were $678,000.

Illustration 13B-6

Illustration 13B-7

Illustration 13B-9

Slide

13-62

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Cash Payments for Operating Expenses

Cash payments for operating expenses were $179,000,

Illustration 13B-10

Illustration 13B-11

Slide

13-63

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Cash Payments for Income Taxes

Cash payments for income taxes were $24,000,

Illustration 13B-12

Illustration 13B-13

Slide

13-64

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Step 2: Investing and Financing Activities

Increase in Equipment. (1) Juarez purchased for cash equipment

costing $180,000. And (2) it sold for $17,000 cash equipment

costing $20,000, whose book value was $18,000.

Illustration 13B-15

Slide

13-65

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Step 2: Investing and Financing Activities

Slide

13-66

Increase in Land. Juarez’s land

increased $60,000. The additional

information section indicates that the

company issued ordinary shares to

purchase the land.

Significant non-cash

investing and financing

transaction.

Increase in Bonds Payable. Bonds

Payable increased $130,000. The

additional information indicated that

Juarez issued, for $130,000 cash,

bonds with a face value of $130,000.

Financing activity.

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Step 2: Investing and Financing Activities

Increase in Share Capital - Ordinary.

The Share Capital - Ordinary account

increased $60,000. The additional

information indicated that Juarez

acquired land from the issuance of

ordinary shares.

Increase in Retained Earnings. The

$52,000 net increase in Retained

Earnings resulted from net income of

$84,000 and the declaration and

payment of a cash dividend

of $32,000.

Slide

13-67

Significant non-cash

investing and financing

transaction.

Financing activity (cash

dividend).

SO 6 Prepare a statement of cash flows using the direct method.

Statement of Cash Flows-Direct Method

Step 2:

Investing

and

Financing

Activities

Step 3: Net

Change in

Cash

Illustration 13B-16

Slide

13-68

SO 6 Prepare a statement of cash flows using the direct method.

Copyright

“Copyright © 2011 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility for

errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.”

Slide

13-69