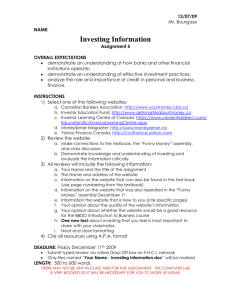

What is Investing?

advertisement

Introduction to Investing Take Charge of Your Finances Family Economics and Financial Education Saving vs. Investing 1.12.1.G1 Savings is for short-term goals and emergencies Remember: The purpose of savings is to develop financial security. You should have 3 – 6 months of salary in savings BEFORE you start investing. Investing is for long-term goals, such as college or retirement. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 2 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 What is Investing? • The purchase of assets with the goal of increasing future income • Focuses on wealth accumulation • Appropriate for long-term goals What are examples of long-term goals that can be accomplished by investing? © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 3 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Rate of Return • Return is money that you earn from your investment. • The Rate of Return is the total return on an investment expressed as a percentage of the amount of money invested. Investments usually earn higher rates of return than savings tools. Total Return Amount of Money Invested Rate of Return © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 4 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona What is Mandy’s Rate of Return? 1.12.1.G1 Mandy saved $2,200 in a money market deposit account. After one year, she has a return of $110. What is Mandy’s rate of return? $110 $2,200 .05 = 5% Mandy’s rate of return on investment is 5% © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 5 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona What is Derek’s Rate of Return? 1.12.1.G1 Derek invested $900. When he withdrew his money from the investment, he had a total of $1,050. What is Derek’s rate of return? $150 $900 .167 = 16.7% Derek’s rate of return on investment is 16.7% © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 6 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Risk POTENTIAL RETURN RISK Risk • The uncertainty regarding the outcome of a situation or event Investment Risk • The possibility that an investment will fail to pay the expected return or fail to pay a return at all © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 7 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona Financial Risk Pyramid Increasing potential for higher returns Increasing risk Speculation Wealth AccumulationInvestments Financial SecuritySavings Tools © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 8 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 1.12.1.G1 Inflation Inflation The rise in the general level of prices The rate of return on an investment should be higher than the rate of inflation. Inflation Risk The danger that money won’t be worth as much in the future as it is today Inflation risk should not be a concern with savings since the goal of savings is to provide current financial security © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 9 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona Investment Philosophy 1.12.1.G1 Each individual has a tolerance level for the amount of risk they are willing to take on The greater the risk a person is willing to make on an investment, the greater the potential return will be. Investment Philosophy An individual’s general approach to investment risk Generally divided into three categories: conservative, moderate, and aggressive © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 10 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona Types of Investment Tools Stocks Bonds Mutual Funds Index Funds Real Estate Speculative Investments © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 11 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 1.12.1.G1 Stocks • Stock – A share of ownership in a company • Stockholder or shareholder – Owner of the stock Usually a stockholder owns a very small part of a company. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 12 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Return on Stocks There are two ways people can make money on stocks: 1. Dividends – Dividends are the share of profits distributed in cash to stockholders 2. Market Price – The current price that a buyer is willing to pay for stock © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 13 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Return on Stocks • If stock is sold for a market price higher than what was paid, stockholder will receive a return (make money). • If stock is sold for a market price lower than what was paid, stockholder will lose money © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 14 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Stock Markets • Stocks are bought and sold on stock markets by people called brokers. • The main stock markets in the U.S. are: – New York Stock Exchange (NYSE) – NASDAQ © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 15 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Stock Activity • We are going to learn about stocks using McDonald’s as an example. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 16 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Bonds Bonds are less risky than stocks but do not have the potential to earn as much as a stock. • Bonds are loans. • A company or government will borrow money from investors by issuing bonds. • Example: The Crazy Hat Co. wants to build a new distribution center in Louisville, KY which will cost $7,000,000. They can issue 7,000 bonds at $1,000 each. 7,000 x $1,000 = $7,000,000 © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 17 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Bonds • The company or government pays annual interest to the investor until the maturity date is reached – The maturity date is the specified time in the future when the principal is repaid to the bondholder. • Bonds issued by a company are called corporate bonds. • Bonds issued by a government are called: – Treasury bonds (federal government) – Municipal bonds (local governments) © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 18 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Example • The Crazy Hat Co. issues $1,000 bonds that pay 4.5% interest with a maturity date of 11/22/2012 (2 years from today). • You buy the bond for $1,000. • Each year you will receive a payment of $1,000 x .045 = $45 • On 11/22/2012, you will also get your $1,000 back. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 19 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Stocks vs. Bonds • Stocks are equity. • The stockholder actually owns a piece of the company. • Equity is the value of the company. • For example, if a company has 10 million shares of stock, and each share is worth $5, then the company’s equity is: 10,000,000 x $5 = $50,000,000 © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 20 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Stocks vs. Bonds • Bonds are debt. • Debt means the bondholder has lent money to the company that the company will repay with interest. • Companies must repay debt before they pay anything to stockholders. • Therefore, bonds are less risky than stocks. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 21 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona Portfolio Diversification Portfolio Diversification- reduces risk by spreading investment money among different investment tools Referred to as “Building a Portfolio.” Creates a collection of investments that will increase return while reducing risk The main goal of diversification is to reduce risk. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 22 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 1.12.1.G1 Mutual Funds • Mutual fund- invests money in a diversified portfolio of stocks and bonds Always research the fees charged by a mutual fund. Reduces investment risk by helping people diversify their portfolio Saves investors time Fees can be high © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 23 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona How Do Mutual Funds Work? 1.12.1.G1 • Individuals buy shares • The money is used to purchase stocks, bonds, and other investments. • Profits returned to shareholders monthly, quarterly, or semi-annually in the form of dividends. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 24 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 How Do Mutual Funds Work? © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 25 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 What is the Advantage of Investing in a Mutual Fund? • Allows small investors to get professional account management and diversification normally only available to large investors. • This allows investors with a little bit of money to be able to invest in a variety of stocks, bonds, & other investments. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 26 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 There are lots of different types of mutual funds! © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 27 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Market Indexes • A market index is the value of a group of stocks or other investments. • Market indexes are intended to represent an entire stock market and thus track the market's changes over time. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 28 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Market Indexes • Dow Jones Industrial Average (DJIA or “The Dow”) – 30 large companies traded on NYSE or NASDAQ • Standard & Poors 500 Index (S&P 500) – An index of 500 large companies selected by a committee • Others – Russell 2000, Wilshire 5000 © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 29 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Index Fund • A mutual fund that was designed to reduce fees by investing in the stocks and bonds that make up an index. • Offers high diversification with low fees. © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 30 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Real Estate Examples of real estate investments include rental units and commercial property. • Includes any residential or commercial property or land as well as the rights accompanying that land • A family home is not considered an investment asset • Can be risky and more time consuming but has potential for large returns © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 31 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona Speculative Investments 1.12.1.G1 • Have the potential for significant fluctuations in return over a short period of time – Examples- future, options, commercial paper, collectibles • Recommended for people with an aggressive investment philosophy and a high level of financial security © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 32 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Buying and Selling Investments Investors must utilize a brokerage firm that acts as a buying and selling agent for the investor (except for when buying real estate and certain speculative investments). FULL SERVICE GENERAL BROKERAGE FIRM Complete investment transactions Offer investment advice and one-onone attention from a broker DISCOUNT BROKER Only complete investment transactions Offer no advice to investors but charge 40-60% less © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 33 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Taxation Profits earned on investments are considered to be income Income taxes MUST be paid on this money Includes all forms of returns: interest, dividends, and price appreciation Taxes are due on most investment returns in the year the income is received © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 34 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Employee-Sponsored Investment Accounts It is recommended that a person utilize these investment tools as much as possible if they are offered. • Allow employees to reduce their tax liability and make investing automatic • Money is automatically taken out of an employee’s paycheck • Employers often contribute a portion of money to the investment with no additional cost from the employee © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 35 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Rule of 72 Rule of 72 Allows a person to easily calculate when the future value of an investment will double the principal amount 72 Interest Rate Number of years needed to double the principal investment © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 36 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Albert Einstein Credited for discovering the mathematical equation for compounding interest, thus the “Rule of 72.” At 10% interest rate, money doubles every 7.2 years, “It is the greatest mathematical discovery of all time.” T=P(I+I/N)YN © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 37 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona What Can the “Rule of 72” Determine? How many years it will take an investment to double at a given interest rate using compounding interest How long it will take debt to double if no payments are made The interest rate an investment must earn to double within a specific time period How many times money (or debt) will double in a specific time period © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 38 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 1.12.1.G1 “Rule of 72” FYI • The rule is only an approximation • The interest rate must remain constant • The equation does not allow for additional payments to be made to the original amount • Interest earned is reinvested • Tax deductions are not included within the equation © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 39 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Doug’s Certificate of Deposit Doug invested $2,500 into a Certificate of Deposit earning a 6.5% interest rate. How long will it take Doug’s investment to double? • Invested $2,500 • Interest Rate is 6.5% 72 6.5% = .065 11 years to double © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 40 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona Jessica’s Credit Card Debt 1.12.1.G1 Jessica has a $2,200 balance on her credit card with an 18% interest rate. If Jessica chooses to not make any payments and does not receive late charges, how long will it take for her balance to double? • $2,200 balance on credit card • 18% interest rate 72 18% = .18 4 years to double © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 41 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona 1.12.1.G1 Jacob’s Car Jacob currently has $5,000 to invest in a car after graduation in 4 years. What interest rate is required for him to double his investment? • $5,000 to invest • Wants investment to double in 4 years 72 4 years 18% interest rate © Family Economics & Financial Education – June 2010 – Investing Unit – Introduction to Investing – Slide 42 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona ANY QUESTIONS?