Learning Objectives

• Understand the Business

– LO1 Describe the trade-offs of extending credit.

• Study the accounting methods

– LO2 Estimate and report the effects of uncollectable

accounts.

– LO3 Compute and report interest on notes receivable.

• Evaluate the results

– LO4 Compute and interpret the receivables turnover

ratio.

• Review the chapter

© McGraw-Hill Ryerson. All rights reserved.

1

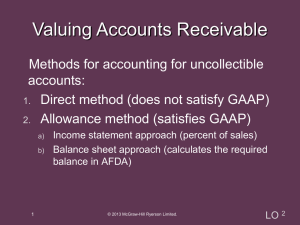

Accounts Receivable and Bad Debts

• Accounts Receivable

– The amounts owed to a business by its customers.

• Uncollectible Accounts

– The amount of credit that will not be collected.

– This amount is never known in advance.

• Bad Debt Expense

– Reports the estimated amount of this period’s

credit sales that customers will not pay.

LO2

© McGraw-Hill Ryerson. All rights reserved.

2

Allowance Method

• The Allowance Method reduces accounts receivable for an

estimate of uncollectable accounts.

• The Allowance Method follows a two-step process:

1.

Make an end-of-period adjustment to record the estimated

bad debts in the period credit sales occur.

2.

Remove (“write-off”) specific customer balances when

they are known to be uncollectible.

The allowance method reports accounts receivable at the

net realizable value, and records bad debt expense in the

accounting period the related credit sale was made.

LO2

© McGraw-Hill Ryerson. All rights reserved.

3

(1) Adjust for Estimated Bad Debts

Bad Debts are estimated to be $900

at the end of the accounting period.

1 Analyze

2

Record

Allowance for Doubtful Accounts is a contra-asset account that reduces Accounts

Receivable.

LO2

© McGraw-Hill Ryerson. All rights reserved.

4

Accounts Receivable and Allowance for Doubtful Accounts are

both permanent accounts. They are Balance Sheet accounts.

Sales Revenue and Bad Debt Expense are both temporary

accounts. They are Income Statement accounts.

LO2

© McGraw-Hill Ryerson. All rights reserved.

5

(2) Remove (Write-Off)Specific Customer

Balances

After trying to collect, it is determined that one customer

will never pay $800 owed.

1 Analyze

2

Record

A write-off does not affect income statement accounts.

LO2

© McGraw-Hill Ryerson. All rights reserved.

6

Methods for Estimating Bad Debts

• Percentage of Credit Sales Method

– Also called the income statement approach.

– Estimates bad debts based on percentage.

2

Record

The Percentage of Credit Sales Method is easy to apply.

LO2

© McGraw-Hill Ryerson. All rights reserved.

7

• Aging of Accounts Receivable Method

– Also called the balance sheet approach.

– Estimates uncollectable accounts based on the

age of each account receivable.

1.

2.

3.

Prepare an aged listing of accounts receivable.

Estimate bad debt loss percentages for each category.

Compute the total estimate.

The Aging of Accounts Receivable Method is generally more accurate.

LO2

© McGraw-Hill Ryerson. All rights reserved.

8

The amount calculated is the required ending balance in the

Allowance for Doubtful Accounts.

The amount of the entry must be determined:

1 Analyze

LO2

2

Record

3

Summarize

© McGraw-Hill Ryerson. All rights reserved.

9

Revising Estimates

• Bad Debts are estimates. If there is a material difference,

companies must revise their bad debt estimates for the

current period.

Account Recoveries

• Collection of a previously written-off account is called a

recovery and it is accounted for in two parts:

1. Reverse the write-off

2. Record the collection

LO2

© McGraw-Hill Ryerson. All rights reserved.

10