Slides

advertisement

Business

Understanding the Big Picture

A Step Back

• What does it mean to have a job

– An organization is willing to pay you to help them

– They have to make money

– By hiring you, they are betting that you will

generate more revenue than your salary

A Step Back

• What does it mean to be an entrepreneur

– Start your own organization and generate your own

revenue

– You [and investors] are betting on yourself to generate

profit

– If you’re in it for the money

• You have to generate more profit/year than the salary you

turned down

– If you’re in it for the fun

• Go for it!

• Do it now

Every Organization Has to Make

Money

• Even non-profits and charities have to keep

the lights on

• As much as we’d rather just write code

– Someone has to make sure all the bills and

salaries are paid on time

How Organizations Make Money

• Hire a combination of employees with specific

skills and organize them towards a profitable

goal

• How expensive are employees?

The Employee

Employer Expenses

•

•

•

•

•

•

•

Salary

Social security 6.2%

Medicare 1.45%

Federal Unemployment $56

State Unemployment: Varies 2-10%

Workers Comp: Varies

Benefits: Varies

– Health Insurance

– Retirement

– Vacation

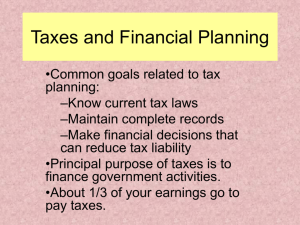

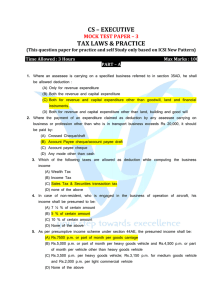

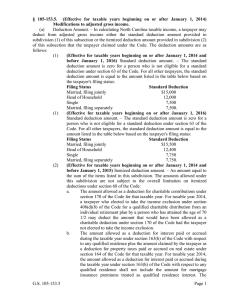

Employee Taxes

•

•

•

•

Social security 6.2%

Medicare 1.45%

Federal Income Tax

State Income Tax

– Varies by state

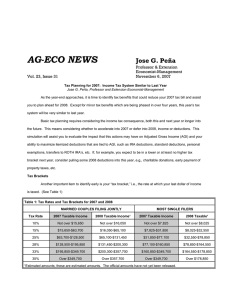

Federal Income Tax

• Tax brackets are widely misunderstood!

• No such thing as making a little more money

and paying a lot more in taxes

2014 Federal Income Tax - Single

• {Income : $89,300 , Federal Income Tax : $16,631}

• {Income : $89,400 , Federal Income Tax : $16,656}

Deductions

• The previous example was misleading

• After deductions, the taxable income of both

salaries were in the same bracket

• Itemized deductions

– Claim everything that is a tax deductible

– Complicates filing for taxes

– For most people, it will not save money

• Standard deduction

– The default deduction if you don’t itemize

– Filing single: $6200

• Taxable income is income minus deductions

Example Revised – Filing Single

• Income : $95,500

– Taxable Income after standard deduction: $89300

– Federal Tax: $18181

– Effective tax rate: 19%

• Income : $95,600

– Taxable Income after standard deduction: $89400

– Federal Tax: $18208

– Effective tax rate: 19%

Benefits

• Your salary is only the beginning

• Insurance (Health, Dental, Vision)

– Very expensive to purchase independently

• Vacation

• Profit-sharing and bonuses

– Take them if you can get them

• Stock Options

Benefits – 401K

• Most common employer sponsored retirement plan

• Set income aside and invest to earn interest

– Varying level of flexibility for investments

• Common for employer to match a % of contributions

• Pre-tax contributions

– Effectively an additional deduction on your taxable income

– Contributions + interest are taxed when withdrawn

– Similar to Tradition IRA

• Sometimes an option to use post-tax income

– No tax during retirement

– Similar to Roth IRA

• Penalties for withdrawing before retirement

Accounting

Accounting – The Big Three

• Income Statement

– Did the company make money?

• Balance Sheet

– What does the company own?

• Statement of Cash Flow

– How liquid is the company?

• The business world works in quarters

– Public corporations report to shareholders every 3

months

Accounting – Income Statement

• Revenue

– How much capital was generated

– Mostly through sales

• Expenses

– How capital much was used

• Income

– Income = Revenue – Expenses;

– The bottom line on the income statement

– What all investors are watching

– Usually translated into Earnings Per Share (EPS)

Microsoft Income Statement

(Abridged)

Accounting – Balance Sheet

• Assets

– Everything a company owns

– Includes cash, accounts receivable, properties,

equipment, investments, goodwill

• Liabilities

– Everything a company owes

– Includes debt, accounts payable, deferred tax, and

other financial obligations

• Equity

– Equity = Assets – Liabilities;

– The sheet must balance this equation

Apple Balance Sheet (Abridged)

Cash Flow

• A measure of liquidity (Flexibility)

– Cash is the most liquid asset

• Everyone wants it

– Non-cash assets make a company rigid

• Slower to adapt

• Susceptible to market changes

• Bottom line is the change in cash on hand

Facebook Cash Flow

Cash Flow Scenario

• A small startup has $100,000 cash

• Sells $1M in product that will cost $100,000 to produce

– $900,000 profit!

•

•

•

•

Revenue increases by $1M on the income statement

Accounts receivable increases by $1M on the balance sheet

Equity and Income look great: $900,000

Common to wait 90 days after delivery for a payment

– Cash flow looks bad in the short term: ($100,000)

• Startup must go an entire quarter with no cash

– Can’t fill any orders while waiting

– Taking orders during this time can cause a successful business to

fail

– Desperately look for new loans and investments