CS – EXECUTIVE TAX LAWS & PRACTICE MOCK TEST PAPER – 3

advertisement

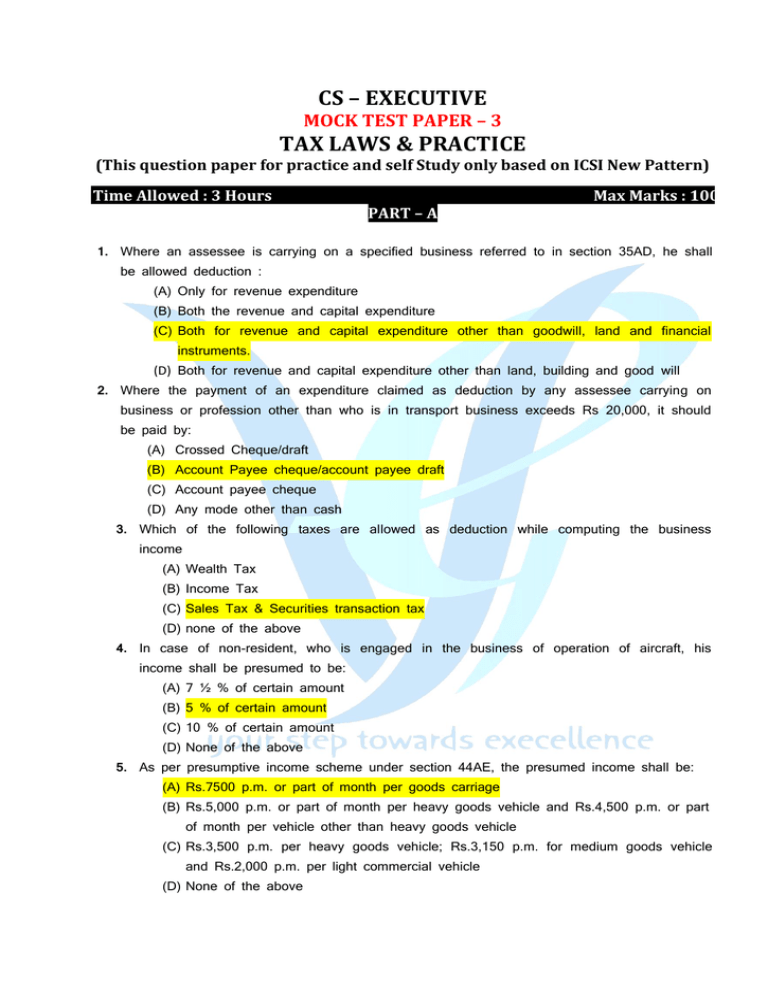

CS – EXECUTIVE MOCK TEST PAPER – 3 TAX LAWS & PRACTICE (This question paper for practice and self Study only based on ICSI New Pattern) Time Allowed : 3 Hours Max Marks : 100 PART – A 1. Where an assessee is carrying on a specified business referred to in section 35AD, he shall be allowed deduction : (A) Only for revenue expenditure (B) Both the revenue and capital expenditure (C) Both for revenue and capital expenditure other than goodwill, land and financial instruments. (D) Both for revenue and capital expenditure other than land, building and good will 2. Where the payment of an expenditure claimed as deduction by any assessee carrying on business or profession other than who is in transport business exceeds Rs 20,000, it should be paid by: (A) Crossed Cheque/draft (B) Account Payee cheque/account payee draft (C) Account payee cheque (D) Any mode other than cash 3. Which of the following taxes are allowed as deduction while computing the business income (A) Wealth Tax (B) Income Tax (C) Sales Tax & Securities transaction tax (D) none of the above 4. In case of non-resident, who is engaged in the business of operation of aircraft, his income shall be presumed to be: (A) 7 ½ % of certain amount (B) 5 % of certain amount (C) 10 % of certain amount (D) None of the above 5. As per presumptive income scheme under section 44AE, the presumed income shall be: (A) Rs.7500 p.m. or part of month per goods carriage (B) Rs.5,000 p.m. or part of month per heavy goods vehicle and Rs.4,500 p.m. or part of month per vehicle other than heavy goods vehicle (C) Rs.3,500 p.m. per heavy goods vehicle; Rs.3,150 p.m. for medium goods vehicle and Rs.2,000 p.m. per light commercial vehicle (D) None of the above 8. A person who sets up a non-specified profession or commences a business during the current PY is required to maintain books of account if his: (A) total income of the current year exceeds or is likely to exceed Rs.1,20,000 (B) his gross turnover or sales of any of 3 preceding PY exceeded Rs.10 lakh (C) if condition mentioned either in (a) or (b) is satisfied (D) none of the above 9. Remuneration paid to working partner shall be allowed as deduction to a firm: a. in full b. subject to limits specified in section 40(b) c. none of these two d. none of the above 10. The business income of a company assessee before claiming deduction of revenue and capital expenditure is Rs.6,00,000. The revenue and capital expenditure incurred during the year are Rs.7,00,000 and Rs.10,00,000 respectively. The unabsorbed expenditure on family planning in this case shall be: (A) Rs.3,00,000 (B) Rs.11,00,000 (C) Rs.2,00,000 and Rs.1,00,000 shall be business loss (D) None of the above 11. Expenditure incurred on prospecting, etc., of minerals shall be allowed as deduction in: a. 5 equal instalments b. 10 equal instalments c. Full d. None of the above 12. In the case of non-company assessee, the total preliminary expenses incurred are allowed deduction to the extent of: a. 2 % of the cost of the project b. 5 % of the cost of the project c. 10 % of the cost of the project d. None of the above 13. If the goodwill of a business, right to manufacture or produce, tenancy rights, route permit or loom hours is acquired before 1.4.1981, the cost of acquisition of such asset shall be: a. cost for which it was acquired by the assessee b. market value as on 1.4.1981 c. nil 14. Conversion of capital asset into stock-in-trade will result into capital gain of the PY: a. in which such conversion took place b. in which such converted asset is sole or otherwise transferred c. none of these two 15. Conversion of capital asset into stock-in-trade will result into capital gain of the PY: a. in which such conversion took place b. in which such converted asset is sole or otherwise transferred c. none of these two 16. For claiming exemption under section 54, the assessee should construct the residential property within: a. one year before or two years after the date of transfer b. one year before or three years after the date of transfer c. within three years after the date of transfer d. within two years after the date of transfer 17. The new house purchased or constructed for which exemption was claimed under section 54, should not be transferred within 3 years: a. from the date of transfer of original house b. from the date of its purchase/construction c. from the end of the PY 18. Exemption u/s 54F is available if the new asset acquired is: a. one residential house property in india b. any house property c. residential house property for self-occupation 19. Deduction u/s 80C to 80U is allowed from: a. income from long-term capital gain as well as short-term capital gain b. short-term capital gain other than short-term capital gain from shares transferred through a recognized stock exchange c. long-term capital gain d. neither from income from long-term or short-term capital gain 20. Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable: a. at the normal rate b. at the rate of 20 % c. at the rate of 10 % if transferred on or after 1.10.2004 d. at the rate of 15 % if transferred on or after 1.10.2004 through a recognised stock exchange and such transaction is chargeable to securities transaction tax 21. Transfer of capital asset in the scheme of demerger shall not be regarded as transfer for the purpose of capital gain if: a. the demerged company is an Indian company b. the resulting company is an Indian company c. both demerged and resulting company should be an Indian company d. none of the above 22. The amendment of an order u/s 154 can be made: (A) within 4 years from the date when the order sought to be amended was passed (B) within 4 years from the date of receipt of such order by the assessee (C) within 4 years from the end of the FY in which the order sought to be amended was passed (D) None of the above 23. The notice u/s 143(2) must be served within: a. 12 months from the date of filing the return b. 12 months from the due date of filing the return u/s 139(1) or from the date of filing of return of income c. 6 months from the end of the financial year in which the return was furnished 24. The Assessing Officer has issued a notice u/s 142(1)(ii) for production of books of account. Such notice relates to the assessment of PY 2015-16. In this case the assessing officer can ask for books of accounts of: a. any past previous year b. previous years 2015-16, 2014-15 and 2013-14 c. previous years 2015-16, 2014-15, 2013-14 and 2012-13 25. R, who submitted his return of income for the AY 2016-17 on 31.7.2016, finds some mistake in the return submitted by him. The assessment orders u/s 143(3) for such return was passed on 15.2.2017 and were served to R on 18.2.2017. He could, in this case, revise the return till: (A) 14.2.2017 (B) 17.2.2017 (C) 31.3.2018 (D) None of the above 26. Salary of ‘R’ becomes due on 1st of next month and it is paid on 7th of that month. For assessment year 2016-17, the salary of ‘R’ shall be taken from: a. April 2015 to March 2016 b. March 2015 to February 2016 c. Any of the above d. None of the above 27. Commuted pension received shall be fully exempt in case of: a. Government employee b. Government employee or an employee of local authority c. Government employee or an employee of local authority or an employee of statutory corporation d. None of the above 28. During the previous year, the employee was reimbursed Rs.24,000 as medical expenses incurred by him which includes Rs.7,000 spent in Government hospital. The taxable perquisite in this case shall be: a. Rs.9,000 b. Rs. NIL c. Rs.2,000 d. Rs.24,000 29. An employer has provided a motor car of 1.5 litre capacity to his employee which the employee is allowed to use for official purpose and for travelling from office to residence and back. The expenses of running and maintenance of Motor Car are met by the employer. The value of this perquisite shall be: a. Rs.1,800 p.m. b. Rs.600 p.m. c. Rs.NIL d. Rs.2,400 p.m. 30. R is an employee of Indian Oil Corporation Ltd. He is provided with free gas for his personal purposes by the employer. The value of this perquisite shall be: a. NIL b. 6 1/4 % of the salary c. Manufacturing cost per unit d. Market rate of gas 31. R is provided with interest free loan by the employer for purchase of a house. The value of this perquisite shall be determined as the sum equal to: (A) simple interest computed @ 10 % p.a. (B) simple interest computed @ 13 % p.a. (C) simple interest computed at the rate charged by SBI on the 1st of the relevant previous year on the maximum outstanding monthly balance (D) simple interest computed at the rate charged by SBI on the last day of the month 32. The employer has purchased a car for Rs.3,00,000 which was being used for official purposes. After 2 years and 6 months of its use, the car is sold to R, the employee, for Rs.1,20,000. The value of this perquisite shall be: (A) Rs.72,000 (B) Rs.60,000 (C) 1,80,000 (D) Rs.1,23,000 33. An employee is neither a Government employee nor covered under Payment of Gratuity Act, 1972. Salary for the purpose of calculating half month shall be taken as: (A) last drawn salary (B) average salary of 10 months preceding the month of retirement (C) average salary of each completed year 34. Employer’s contribution to recognized provident fund shall be: a. fully exempt b. fully taxable c. exempt up to 12 % of salary 35. A has two house properties. Both are self-occupied. The annual value of: a. both the houses shall be nil b. one house shall be nil c. no house shall be nil d. none of the above 36. If the annual value of the let house property is negative then tick the deduction which shall be allowed under section 24. a. All deductions b. No deduction c. Deduction on account of interest of money borrowed d. None of the above 37. An assessee was allowed deduction of unrealized rent to the extent of Rs.40,000 in the past although the total unrealized rent was Rs.60,000. He is able to recover from the tenant Rs.45,000 during the PY on account of such unrealized rent. He shall be liable to tax to the extent of: a. Rs.45,000 b. Rs. NIL c. Rs.25,000 d. None of the above 38. An assessee has borrowed money for purchase of a house and interest is payable outside India. Such interest shall: a. be allowed as deduction b. not be allowed as deduction c. be allowed as deduction if the tax is deducted at source d. none of the above 39. Tick from the under mentioned, the cases where annual value can be negative. a. let out property , deemed let-out property , partly let-out & partly self-occupied property b. one self-occupied property, deemed let-out property c. deemed let-out property d. one property which could not be occupied due to employment elsewhere 40. For the assessment year 2016-17, a firm is subject to income-tax at a flat rate of: a. 30 % + EC @ 2 %+SHEC @1% b. 30 % + 5 % SC + EC @ 2 %+SHEC@1% c. 30 % + 10 % SC + EC @ 2 % + SHEC @ 1 % d. 30 % + 12 % SC if its total income exceeds Rs. 1 crore + EC @ 2 % + SHEC @ 1 % 41. Mrs. A a non-resident in India is 56 years old. Her total income for the assessment year 2016-17 is Rs 6,35,440. Her tax liability shall be – (A) Rs 53,650 (B) Rs 52,090 (C) Rs 77,090 (D) None of the above 42. A’s total income for the assessment year 2016-17 is Rs 7,90,000. His tax liability shall be (A) Rs 85,490 (B) Rs 83,000 (C) Rs 1,08,000 (D) None of the above 43. Astha Ltd., a domestic company assuming the total income is 1,02,00,000 compute the tax liability of Astha Ltd – (A) 32,96,000 (B) 32,00,000 (C) 30,00,000 (D)None of the above 44. Income tax is levied on(A) Monthly basis (B) Quarterly basis (C) Half-yearly basis (D) Yearly basis 45. Income tax is payable on(A) Earned income (B) Salary (C) Taxable income (D) Every income 46. The authority on whose recommendation the amt. collected as income tax is distributed to state govt.(A) CBDT (B) Planning Commission (C) Finance Commission (D) Chief Minister 47. Income tax department works under(A) State govt. (C) Income tax commission (B) President (D) CBDT 48. Where an individual has substantial interest in a concern, there shall be included in his total income any remuneration paid by such concern to: (A) the wife of such individual (B) the husband of such individual (C) the spouse of such individual 49. If there is a transfer of asset which is not revocable during the life time of the transferee, income arising from such asset shall be included in the income of: (A) transferor (B) transferee (C) transferee till his death and thereafter in the hands of the transferor 50. When income of a minor child is clubbed in the income of the parent concerned, such parent will be allowed exemption of: (A) Rs.1,500 (B) Rs.1,500 per minor child (C) to the extent of actual income clubbed or Rs.1,500 per minor child whichever is less 51. On 5th February 2015, R gets a gift of motor car from his relative M. Fair market value of the car is ` 3,60,000.The amount taxable u/s 56(2)(vii) is a) ` 3,60,000 b) ` 3,10,000 c) Nil d) ` 50,000 52. Income from other sources is also known as ……………………………………. head of income. a) residuary head b) useless head c) complementary head d) none of the above 53. Guest Lecture salary is taxable under which head of income a) Other sources b) Salary c) House property d) Not taxable at all 54. A watch has been gifted to an individual whose fair market value is ` 1,00,000. The fair market value of watch is a) exempt since received from a relative b) not taxable since watch is not property within the definition of section 56(2)(vii) c) taxable under head other sources d) None of the above 55. On 5th February, 2014 Vivek gets a gift of motor car from a relative Sumit. Fair market value of car is 3,60,000. The amount of taxable in hands of Vivek under section 56(2)(vii) is? a) 3,60,000 56. On 30 th b) 3,10,000 c) 50,000 d) Nil December, 2013 Vivek gets by gift a commercial flat from the elder brother of his father-in-law (SDV is 25,00,000). The amount chargeable to tax in hands of Raju is? a) 25,00,000 b) 24,50,000 c) 20,00,000 d) Nil 57. Deduction u/s 80C can be claimed for fixed deposit made in any scheduled bank, if the minimum period of deposit a) 5 years b) 8 years c) 10 years d) 12 years 58. Deduction under section 80C is allowed to a) All assessee b) Individual and HUF c) Individual only d) Assessee, being company 59. If house property for which loan has been taken for construction or purchase and deduction is claimed under section 80Cis transferred before …………….. from end of the ………………. for such property was taken by him, no deduction shall be allowable in the previous year in which the house property has been transferred. a) 8 years, financial year when loan b) 5 years, financial year when loan c) 5 years, financial year when possession d) 7 years, financial year when possession Mr. 60. A, aged about 61 years, has earned a lottery income of ` 1,20,000 (gross) during the PY 2014-15. He also has a business income of ` 30,000. He invested an amount of ` 10,000 in Public Provident Fund account and ` 24,000 in National Saving Certificates. What is the total taxable income of Mr. A for the A.Y.2016-17 a) 1,16,000 b) 1,20,000 c) 14,0,000 d) 1,26,000 61. An individual resident assessee has gross total income of ` 9,00,000 and has made investment in listed shares in accordance with a notified scheme of ` 1,00,000. What amount of deduction is available under section 80CCG a) ` 50,000 b) ` 25,000 c) `30,000 d) Nil 62. Ganesh paid premium of ` 18,000 for health insurance and has incurred expenditure of `3,000 on preventive health checkup. Amount of deduction allowed u/s 80D shall be a) 16,000 b) 21,000 c) 15,500 d) 20,000 63. If amount incurred by assessee for the treatment of specified disease of spouse is ` 37,000. A claim of ` 10,000 have been received under mediclaim policy. What amount of deduction shall be allowed to him? a) ` 37,000 b) ` 40,000 64. Section 64(1)(iv) is applicable on all assets except c) ` 60,000 a) House property b) Share c) Gold d) None of the above d) ` 27,000 65. Securities worth ` 20,00,000 was transferred by Abhi, member of HUF to HUF. Interest income of ` 2,00,000 is earned on securities so transferred. Partition of HUF took place. ¼ of securities were transferred to Abhi, ¼ of securities were transferred to Abhi’s wife. How much amount shall be taxable in the hands of Abhi a) ` 2,00,000 b) ` 50,000 c) ` 1,00,000 66. Notice u/s 142(1)(i) can be issued even after ……………………… a) end of relevant previous year b) end of relevant assessment year c) either of a) or b) d) None of the above d) None 67. Notice u/s 142(1)(ii) can be issued a) when return of income is not filed b) When return of income is filed c) in both the case whether return is filed or not d) one of the above 68. Where no such installment is due i.e. income is earned after 15th March, the entire tax should be paid by …………... a) 15th March b) 31st March c) 31st July d) 15th September 69. What shall be payable by assessee for deferment of advance tax beyond due dates. a) Interest under section 234A b) Interest under section 234B c) Interest under section 234C d) None of the above 70. During the PY ending 31st March, 2015, a charitable trust earned an income of ` 4,00,000. Amount applied by trust is ` 2,00,000. How much amount shall be taxable? a) ` 3,40,000 b) ` 4,00,000 c) ` 1,40,000 d) Nil PART-B 71. The method under which tax is imposed at each stage of sales on the entire sale value and the tax paid at the earlier stage is allowed as set-off is called a) Invoice method b) Subtraction method c) Deductive method d) Value addition and deletion method 72. Product X is taxable @ 4% and Product Y is taxable @12.5%. Product X is sold for Rs. 100,000 &Product Y for Rs. 50.000. Total input tax credit is available for Rs. 5,000. What would be the net VAT payable? a) Rs.5,250 b) Rs. 5,000 c) Rs. 2,500 d) Rs. 10,250 73. Where Input is lost, credit on same ………………… a) may be allowed b) cannot be allowed c) shall be allowed d) None of the above 74. Credit of which of the following purchases cannot be claimed by the dealer? a) purchase from unregistered dealer b) purchase from registered dealer who opt for composition scheme c) any of the above d) none of the above 75. Tax invoice is admissible as supporting documents for taking credit. Is the statement true? a) Valid c) Partly valid b) Invalid d) None of the above 76. In which of situation is registration compulsory? a) when the taxable annual turnover of a dealer does exceeds the threshold of Rs. 5 Lakh b) when dealer is an importer c) any of the above d) none of the above 77. A manufacturer purchased raw material for Rs. 1,12,500 (inclusive of 12.5% VAT) and capital equipment/ goods for Rs. 6,24,000 (inclusive of 4% VAT). Capital goods are depreciated over 3 years straight line. How much credit is available to manufacturer if Gross product Variant method followed. a) 12,500 b) 20,500 c) 36,500 d) Nil 78. How is value addition computed as per Addition Method? a) Profit + Trade and Manufacturing Expenses b) Sale price – purchase price c) Sale price + purchase price d) Not computed 79. Which method is widely used and accepted? a) Addition Method b) Subtraction Method c) Input Tax Credit Method d) Any of the above 80. Which invoice can be used to avail tax credit? a) Retail invoice b) Tax invoice c) any of the above d) None of the above 81. Penalty for failure to pay service tax electronically when assessee is required to pay tax electronically a) 5,000 b) 10,000 c) 1,000 82. A person is to file its return by 25 th d) 7,000 April, due date of filing return but it is public holiday, then return shall be filed on ………… a. immediately succeeding working day b. within two days from public holiday c. next day whether it is working day or not d. None of the above 83. Service tax liability arises only when the taxable turnover of the previous year exceeds a) ` 10,00,000 b) ` 9,00,000 c) ` 8,00,000, d) ` 7,00.000 84. The aggregate value of taxable turnover of an ABC Ltd. during the financial year 2013-14 is `49 lakh. company during the current financial year shall pay service tax on a. on receipt basis on all the taxable services provided b. on receipt basis on taxable services upto` 50 lakh c. on accrual basis on all the taxable services provided d. none of the above 85. Which approach to service tax is used in India? a) Comprehensive b) Selective c) Partly a) and b) d) None of the above 86. In case of Nil service tax during a specified period, penalty for delayed filing if service tax return a) Cannot be waived b) Can be waived by CEO c) waiver is not applicable d) None of the above 87. Determine the interest payable under section 75 of Finance Act, 1994 on delayed payment of service tax from the following particulars: Service tax payable ` 60,500 Due date of payment 06.11.2014 Date of payment 06.01.2016 Note: Turnover of services in the preceding financial year was` 80 lakh. a) 15,730 b) 12,740 c) 13,664 d) Nil 88. When is small service provider required to obtain registration? a) when value of total services exceeds ` 10 lakh b) when value of taxable services exceeds ` 10 lakh c) when value of total services exceeds ` 9 lakh d) when value of taxable services exceeds ` 9 lakh 89. A real estate agent who has his office in Chandigarh provided a service in relation to a property located in Mumbai. Which place is place of provision of service for purpose of levy of service tax? a) Mumbai b) Chandigarh c) Both a) and b) partly d) None of the above 90. What shall be the place of provision of service in case of GTA? a) location of person liable to pay service tax b) location of service provider c) location of destination of goods d) location of the event 91. If a corporate assessee has paid 15000 as excess service tax during the previous half year ending period, this excess amount can be adjusted against its subsequent liability a) Equally per quarter b) Equally every month c) In lump sum d) Equally on half yearly basis 92. Service tax is rounded off to nearest multiple of a) 10 b) 100 c) 1 d) None of the above 93. Service tax in India made a humble beginning from ....... with only 3 services a) June 1, 1994 b) July 1, 1994 c) July 1, 1995 d) July 1, 2014 94. The rate of service tax is …… (inclusive of education cess, SHEC, Swachh Bharat cess, if applicable) a) 12% b) 14% c) 14.5% d) 14.92% 95. Where service is rendered from outside India, such service shall be taxable in the hand of a) Provider of service b) Recipient of service c) Partly in hands of both a) and b) d) None of the above 96. What is the due date for filing return for the period April – September a) 25 September b) 25 October c) 31 December d) None of the above 97. Service Tax is to be paid to the credit of Central Government by the 5th of the month immediately following the calendar month in which the payment received. Is the statement valid a) Valid b) not valid c) partly valid d) maybe valid 98. If Raj has collected any amount of service tax from Brijesh which is not required to be collected, Raj shall pay the amount so collected to a) Brijesh b) The central government c) Keep with himself d) None of the above 99. What is the last date for payment Service Tax for the month of March? a) 31 March b) 30 April c) 7 April d) 5 April 100. The amount of service tax shall be increased by a. education cess b) secondary and higher education cess c) both of the above d) not increased by EC & SHEC