BA 654 Finance Midterm, Fall 2009 Name Label all answers, and

advertisement

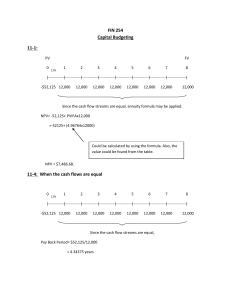

BA 654 Finance Midterm, Fall 2009 Name ____________________________ Label all answers, and show your calculations in problems 3 and 4. 1. (12 points) You have estimated the following cash flows for Project X: Year 0 1 2 3 CFX (125,000) 80,000 40,000 20,000 The cost of capital for the project is 12%. a. Calculate the internal rate of return for the project. b. Calculate the NPV for the project. IRR = 7.57% NPV = -$7,448 2. (12 points) Shown below are the cash flows for two mutually exclusive projects, A and B, as well as an excel worksheet showing analysis of those cash flows. Year 0 1 2 3 CFA ($1,200) $800 $500 $200 CFB ($200) $120 $100 $80 CF ($1,000) $680 $400 $120 IRR 15.3% 25.3% 12.9% r 0 10 14 20 25 NPVA $300.00 $90.76 $21.48 ($70.37) ($137.60) NPVB $100.00 $51.84 $36.21 $15.74 $0.96 $350.00 $300.00 $250.00 $200.00 $150.00 $100.00 NPVA $50.00 NPVB $0.00 ($50.00) 0 5 10 15 20 25 30 ($100.00) ($150.00) ($200.00) Use the information above to answer the questions on the next page. Problem 2, continued. As stated above, the two projects are mutually exclusive. a. If the cost of capital is 10%, which project(s) should be selected? State what your decision is based on. b. What is the third column of cash flows (CF) and what is the significance of its IRR? a. If the cost of capital (r) is 10 percent, choose A. It has a higher NPV than B. b. CFis the difference in cash flows, that is CF CFA – CFB. The IRR of CF represents the cost of capital (r) at which the decision is reversed. If r < 12.9%, choose A. If r > 12.9%, choose B. 3. (28 points) A firm’s target weights for its capital structure are that 40 percent of financing will come from long-term debt and 60 percent of financing will come from common equity. It can sell 20 year bonds with $1,000 par and a coupon rate of 8% paid annually for $950. a. (8 points) Calculate the before-tax interest rate on new debt financing and the after-tax interest rate on new debt financing if the firm’s tax rate is .40. To solve rd: -950 = PV, 1000 = FV, pmt = 80, n = 20, I/Y = rd = 8.53% ATrd = rd ( 1-T) = 8.53 (.6) = 5.12% b. (4 points) The risk-free rate is 4% and the expected return on the market is 10%. The common stock has a beta of 1.25. Calculate the required return on the firm’s stock. Rs = rf + B (ERM – rf) = 4 + 1.25 (6) = 11.5% c. (4 points) Calculate the firm’s weighted average cost of capital (WACC), assuming that new common equity is from retained earnings. (If you are unable to do part (a) or (b), assume values you believe are reasonable for the cost of debt and/or the required return on equity and clearly state them.) WACC = Wd (ATrd) + Wce (rs) = .4 (5.1) + .6 ( 11.5) = 2.04 + 6.9 = 8.94% Problem 3, continued. d. (12 points) Suppose all financing in the first quarter for the firm in this problem will come from internally generated cash flows (i.e., retained earnings) and all financing in the second quarter will come from debt. Should the firm use the weighted average cost of capital as the required return on a project of average risk in both periods, or should it use the required return on equity (rs) in the first quarter and the after-tax cost of debt (AT rd) in the second quarter as the required return on projects of average risk? Explain your answer. The firm should use the WACC as the hurdle rate (required return) in both periods. The WACC is based on the firm’s target weights. In this case, the firm plans, on average, to get 40% of its financing from debt and 60% from equity. As pointed out in your text on p. 359, all investors have a claim on future cash flows of every project, and it is management’s responsibility to insure that the cash flows are sufficient to satisfy those investors. In addition, it only makes sense that there should be some consistency from period to period. If the firm uses r s (11.5%) as the hurdle rate in the first quarter and the after-tax interest rate (5.1%) in the hurdle rate in the second quarter, it will reject projects with an IRR of 10% in the first quarter and invest in projects with an IRR of 6% in the second quarter. 4. (30 points) Pasta and Pizza, Inc. owns a chain of restaurants. It is considering ting its own brand of pasta in grocery stores. It will require purchasing equipment with a cost of $2.4 million. Delivery and installation of the equipment will cost an additional $300,000. The project will require an increase in net working capital of $200,000 at the beginning of the project. The project is expected to generate sales revenue of $3 million per year, based on the expected sales price in year 1. Cash expenses are 45 percent of sales revenue. The sale price and cash expenses are expected to increase at 4 percent annually due to inflation. Depreciation for tax purposes will be straight line to zero over the three year life of the equipment. The firm’s tax rate is 40 percent. At the end of 3 years the equipment will be sold for an estimated $800,000 and funds invested in net working capital will be recovered. a. (6 points) Calculate the initial investment for the project. Price Delivery & installation Change in net WC Initial investment 2,400 300 200 2,900 b. (4 points) Calculate annual depreciation expense for the project. Depr Exp = 2,700 / 3 = 900 c. (4 points) Calculate the after-tax salvage value of the equipment, assuming the expected salvage value of the equipment is not affected by inflation. Salvage value -Book Vale Recap Depr xT Tax 800 0 800 .4 320 Salvage value -Tax AT Salvage value 800 320 480 Problem 4, continued. d. (4 points) Calculate the terminal cash flows associated with the project. AT salvage value Change in Net WC Terminal CF 480 200 680 e. (12 points) Calculate the annual operating cash flows for each year of the project, taking into consideration the effects of inflation on sales revenue and cash expenses. Op CF1 = (Sales Rev – Cash Exp) (1 – T) + Depr Exp) (T) (3,000 – 1350) (.6) + (900) (.4) = 990 + 360 = 1,350 Op CF2 = (3,120 – 1,404) (.6) + 360 = 1,389.6 Op CF3 = (3,244.8 – 1,460.16) (.6) + 360 = 1,430.78 5. (18 points) Flagstaff Mfg. has a corporate WACC of 12 percent. You are evaluating two mutually exclusive projects, X and Y, each of which has a lifetime of 6 years. Use the information provided to answer the questions below. Project X: Initial investment Expected NPV @ 12% Standard deviation of NPV $126,700 17,321 15,112 Project Y: Initial investment Expected NPV @ 12% Standard deviation of NPV $126,700 17,321 15,112 The cash flows from project X are positively correlated with the firm’s existing cash flows, however, the cash flows of Y are negatively correlated with the firm’s existing cash flows. a. What type of risk does the standard deviation measure(circle one)? stand-alone risk within-firm risk market risk Answer: stand-alone risk b. What type of risk do the correlations affect (circle one)? stand-alone risk within-firm risk market risk Answer: within-firm risk c. Briefly explain your answer to (b). Within firm refers to the effect of the project on the variability of the firm’s cash flows. It views the firm’s assets as a portfolio and considers the diversification effects of adding another asset to that portfolio. Diversification (and the resulting risk reduction) is greater if the correlation is negative. d. Based on the information provided, which project should be selected and why? Choose Y; it has lower within firm risk than X and based on the information, it is identical in all other respects.