C: 3-3 Discussion Question – Case Scenario on

advertisement

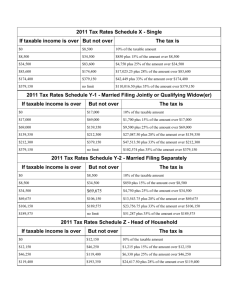

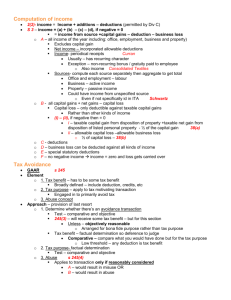

WEEK THREE PROBLEM SET ACC/455 Corporate Taxation I C:3-3 Discussion Question – Case Scenario on Tax Elections C:3-3 The two calendar year taxpayers, named Susan and Stan, are going to start a new business of digital circuits where they will manufacture and sell these goods. They are planning to do so with the help of their own capital of $600,000 and another equity capital of $2 million that other people invested. The company’s target is to gain $100,000 as organizational and start-up expenditure. A material income-producing factor is the inventories. The company is also thinking that a loss of $500,000 may have to be brought in the first two years of operation and first three year’s expenditures for development purpose. They expect that by three years they will break even and will make a profit by the end of fourth year although it is important to run research activities and make development frequently in this kind of business. Question is what type of accounting schemes and tax elections Susan and Stan should keep in mind in the first year of their operation? Explain the probable alternatives for each and every scheme and election and what advantages and disadvantages these have. C: 3-3 Discussion Question – Case Scenario on Tax Elections Elections Tax Year Accounting Methods • Calendar Year •Accrual Method benefit–The calendar year is currently being used by Susan and Stan Advantage –typical financial reporting is coordinated •Fiscal Year Advantage – to avoid short time filing, it can agree with the starting date of business •Cash Method Advantage– Stan and Susan are eligible because of inventories although it is less burdensome •Hybrid Method Advantage–less burdensome for other revenue and expenses and also meets financial reporting customary C:5-8 Discussion Question – Identify Items as AMT Adjustment or Preference C:5-8 The following items should be identified as (A) an AMT adjustment to taxable income, (B) a tax preference item or (N) none of them. a. At the end of the tax year, percentage reduction in excess of a property’s adjusted basis. b. The Sec. 179 expense along with first-year MACRS decrease claimed on a machine, with placing in service in the present year, which cost $200,000. c. Discrepancy between the gain, mentioned in Part b, on the sale of the asset and the other minimum taxable income purposes. d. The tax-exempt interest which was earned on State of Michigan private activity bond. e. The tax-exempt interest that was earned on State of Michigan general revenue bond. f. 75% of the surplus of adjusted current earnings (ACE) over preadjustment AMTI. C:5-8 Discussion Question –Items to identify as AMT Adjustment or Preference A. – P – Tax inclination item B. – A – AMT Alteration to taxable income (decrease) C. – A – AMT Alteration to taxable income D. – P – Tax inclination item E. – A – AMT Alteration to taxable income F. – A – AMT Alteration to taxable income C:3-37 Problem – Charitable Contributions of Property C:3-37 Charitable contributions of property. Blue Corporation confers some properties specified below to Johnson Elementary School: 1. 2 years ago XYZ corporation stock purchased for $25,000. There is a $19,000 FMV to the stock on the contribution date. 2. It cost $16,000 a year ago when computer equipment was built. The equipment has a $50,000 FMV on the donation date. The business of manufacturing computer equipment doesn’t include Blue. 3. six months ago XYZ corporation stock was purchased at $12,000. The hoard has a $19,000 FMV on the date of the bequest. By selling the stock, the school will remodel a classroom for the use of a computer laboratory. The taxable income for Blue is $400,000 regarding all charitable contribution deduction, dividends-received deduction and NOL or capital loss carry back. a. What is Blue’s recent charitable contribution deduction? b. If there is any charitable contribution carryover for this company then what is that? What years it can be used in? c. Considering the XYZ stock donation, what could be a better tax plan? C:3-37 Problem – Charitable Contributions of Property A. - $40,000 B. - $47,000 C. Sell XYZ stock and contribute proceeds. Claim loss on sale against taxable earnings and donation of income as charitable contribution Taxable Income Contributions XYZ Stock Equipment Blue Corporation $ Cost $ 25,000 $ 16,000 400,000 FMV $ 19,000 $ 50,000 PQR Stock $ 12,000 $ 18,000 Total donation $ 53,000 $ 87,000 highest Allowable Deduction $ 40,000 Contribution Carryover $ 47,000 C:3-64 Tax Form /Return Preparation Problem – Knoxville Musical Sales Inc. Tax Return Preparation See attached Form 1120, Form 1120 Schedule D, and Form 4562 in Assignment Section