Lesson 3: Bank Crises, Failure, Regulation and Regulators

advertisement

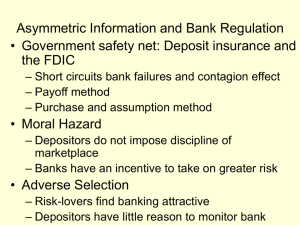

Lesson 3: Bank Crises, Failure, Regulation and Regulators A. Bank Failures and Crises • Bank failure: when a bank cannot fulfill its obligations. • Failure arises when the bank becomes insolvent or illiquid, and cannot raise cash needed to fulfill its obligations. • Most theories of bank failures recognize that bank balance sheets are mismatched in terms of maturities. • When depositors prefer liquidity while banks invest longterm, banks face the risk of a run, in which depositors demand more cash than banks are able to produce. • Runs can cause a bank to fail. • Other causes of bank failure include bad loans (credit risk) and high risk activities such as proprietary trading. Bank Crises • • • • • • • • • Bank crisis: when distress from one bank spills over to other banks. Bank crises are characterized first by depositor runs in fractional reserve systems. Runs can trigger additional runs, leading to a banking panic or crisis. Systemic banking crisis: when all or most banking capital is destroyed by bank runs. Such destabilization reduces real economic activity More than other types of financial crises, banking crises inflict large social costs. For example, stock market price collapses unaccompanied by banking crises (e.g., U.S. in 1987 and 2000) did not cause severe macroeconomic consequences. Empirical studies conducted on the U.S. banking system suggests that the Fed's 20th century active use of the discount window reduced risk of banking contagion. Larger contagion risk during the 19th century pre-Fed era when there was no discount window lending. Early Bank Crises • • • • • • • Pre-20th century bank failures were costly and frequent. Goldsmiths extending credit experienced failures due to poor crop harvests. Many early European failures, including those of the Medici of Florence and the Riccardi of Lucca were due to monarchies failing to meet obligations. Such failures were often war-related, particularly to losing combatants. Early bank failures in Europe tended not to involve significant contagion. One exception was the 1763 failure of the Dutch banker Leendert Pieter de Neufville, who innovated the use of acceptance loans. When the Seven Years' War ended, he failed to fulfill his obligations, leading to a confidence crisis and failure of other banks in northern Europe. As the global financial system integrated, there were more international banking crises. The earliest U.S. banking crisis arose when William Duer, Assistant Secretary of the Treasury used information and connections along with leverage to speculate in new U.S. debt and various bank stock issues, – led to the Panic of 1792. – Geisst [2004] wrote that "The New York City economy crashed along with him, and Duer was nearly disemboweled by an enraged mob that chased him through the streets." – Contributing to Duer's shenanigans was the expansion of credit by the Bank of the United States which led to a run on it. – The panic was short-lived as Hamilton encouraged the Bank to make collateralized loans at high rates and supported other banks in extending credit. Central Banks and Bank Crises • The U.S. experienced bank panics in 1819, 1837-9, 1857, 1873, 1884, 1890, 1893, 1896, 1907, and 1933. • Only one occurred after the Fed was created in 1913. • Note that the 2007-09 financial crisis in the United States did not involve a bank panic, even though banks were obviously inextricably linked to the crisis. • The United Kingdom has experienced no banking panics after the Bank of England followed Walter Bagehot’s suggestions to engage in discount window lending. Recent Bank Failures • 414 U.S. FDIC insured banks and thrift institutions failed over the 4-year period 2008-2011. • The majority (85%) of these banks held less than $1 billion in assets. • Many of these failed banks also had implemented aggressive growth strategies: – using nontraditional, riskier funding sources – maintaining weak underwriting practices – Maintaining weak credit administration practices. Models and Causes of Bank Crises • An early view of banking crises is that they are a natural result of the business cycle (e.g., Mitchell [1941]) and supported by Gorton (1988) who finds a link between business cycles and subsequent panics. • Here, the economy experiences some economic shock or goes into recession or depression, and fundamentals lead to default on bank loans causing depositors to withdrawal deposits. • More recent models of banking crises build on the view of Kindleberger [1978] as occurring spontaneously as a result of mob psychology or panic. Models of Bank Crises • Friedman and Schwartz [1963]: banking panics are the result of real shocks. The early 1930s banking panics were not precipitated by weakening macroeconomic indicators; they were panic-based. Insufficient Federal Reserve discount window lending intensified the crisis. – Calomiris and Mason [2003] fail to support this panic hypothesis, arguing that fundamentals were the cause of most but not all of the failures. • Diamond and Dybvig [1983]: banks create liquidity by offering deposits that are more liquid than their assets (business loans). A bank run is the result of depositors initiating one so as to not be victimized by such a run; that is, bank runs occur because they are expected to occur. – Concludes that deposit insurance (relative to suspension of convertibility) best reduces the incidence of runs by eliminating the incentive for the patient depositor to participate. • Allen and Gale [1998]: bank runs are triggered by signals or expectations of low investment returns (economic fundamentals). They conclude that deposit contracts (deposit payouts being a function of time) and discount window lending can prevent crises. B. Bank Regulators • Banking regulations seek to support the real economy through: – – – – – – payments facilities credit facilities maintaining economic stability protecting consumers managing failure supporting monetary objectives, etc. • Admati and Hellwig [2011] argue that banking regulation effectiveness is weakened by “the mixing of conflicting objectives: – Concerns for the safety and soundness of the system are often diluted by attempts to mobilize bank funding for worthy purposes, concern for the global competitiveness of a nation’s banks, and desire to use the industry’s professional risk management. – There has been a lack of clarity about what regulation is actually doing, and whether it is cost effective in addressing its objectives. • Clearly, bank regulations objectives vary through time and around the world, and regulatory systems can be quite different. U.S. Regulators • • U.S. regulation is complicated by both individual state and federal regulators, with federal regulation enforced by three separate federal entities: The Federal Reserve System – – • FDIC – – – • Established in 1933 to insure deposits of member banks. FDIC was created to create security for depositors maintaining accounts in banks, and to prevent instability and runs conducts examinations OCC – – – – – • 12 Federal Reserve Banks ithat operate check clearing facilities, route wire transfers, conduct bank examinations, provide discount loans to member banks and perform research activities and other services. The Fed regulates state-chartered member banks, bank holding companies (most larger banks are held by BHC's), foreign branches of U.S. national and state member banks, Edge Act Corporations and statechartered U.S. branches and agencies of foreign banks. The Office of the Comptroller of the Currency (OCC) is a sub-agency of the U.S. Treasury Department. Charters, regulates, supervises and closes national banks. Employs bank examiners that conducts on-site reviews of national banks and federal savings associations. take supervisory actions against institutions that fail to comply with relevant laws and regulations or that otherwise engage in unsound practices. removes officers and directors, negotiate agreements to change banking practices, and issue cease and desist orders as well as civil money penalties. Regulators in Other Countries • E.U. Regulators – The E.U. also maintains multiple regulatory authorities, both at the E.U. and national levels within each member country. – The European Banking Authority (EBA) is the umbrella regulatory agency of the E.U. • Japan and China – The Financial Services Agency (FSA) is the primary regulatory authority of Japanese financial institutions, including banks. – The Bank of Japan (Japan’s central bank) facilitates the regulatory process by conducting bank examinations. – The China Banking Regulatory Commission (CBRC) regulates the banking system of the People’s Republic of China except for the special administrative regions of Hong Kong and Macau. C. Resolving Bank Failures • Pre-20th century failed banks were typically liquidated by authorities and their records were seized. – Kohn notes that "it was not unusual in Venice for a failed banker to flee the city with the bank’s books and then to negotiate personal immunity in exchange for their return." – Early European failed bankers were subject to prison or worse. – In 1360, the Catalonian banker Francesch Castello was beheaded in front of his failed bank. – Washington Mutual CEO Alan H. Fishman was offered approximately $19 million (he declined 2/3rds of it) for 17 days on the job when his bank failed in September, 2008. His predecessor received $14 million for his one year of service. U.S. Bank Resolution • US bank resolutions are administered by the FDIC, which acts as conservator (operate by FDIC as an ongoing concern) or receiver (winding down and liquidating) for the failed bank. • Bank failures are handled outside the bankruptcy court system. • The primary goal of FDIC in its capacity as receiver is to resolve the failure in the least costly manner and recoup as much value from its assets as is possible. • The FDIC has a responsibility to retain public confidence in the banking system, largely by assuring bank customers that they will be able to fully access their deposits in the most timely manner. • FDIC prepares an inventory of assets, collects liabilities and sells assets. FDIC has the right to allow or disallow claims on the failed institution's assets as well as repudiate certain contracts and eliminate employment bonuses. Regulatory Remedies for Bank Failure • The FDIC is required by legislation (FDICIA of 1991) to resolve the failed bank in the least costly manner and recoup as much value from its assets as is possible. • FDICIA did allow for a "too big to fail" exemption, which, as of late 2013, has not been resolved by implementation of Dodd-Frank. Prior to resolving the distressed institution, FDIC (or the Fed in the latter case) can: – Suspension of Deposit to Cash Convertibility (This means to prohibit depositor withdrawals) – Serve as the Lender of Last Resort: (Undertaken by the Fed through its discount window) • When the decision has been made to resolve the distressed institution, the FDIC (or, in some cases other regulators) can: – Arrange the Acquisition of the Troubled Bank – Establish a Bridge Bank: Here, FDIC charters a new bank to receive the failed bank's assets and insured deposits, normally with reduced capital requirements and other regulatory concessions and operates it for up to 5 years. – Bail out the Distressed Bank: lend to a distressed institution. – Liquidate and Pay Depositors' Insured Deposits: Typically, last resort D. Banking Legislation • The primary purpose of financial institutional regulation is to prevent market failure, where a competitive market fails to function effectively. More specifically, financial institution regulation seeks to ensure: • 1. Safety and stability of financial institutions and markets • 2. competition in financial markets • 3. fairness and transparency and prevent fraud in financial markets • 4. appropriate levels of real economic and financial market activities • 5. effectiveness of monetary policy • Banks are tightly regulated because: – – – – – Banks are where the money is. Bank failures are costly to the financial and real sectors. Bank failures disrupt or destroy long-standing credit relationships. Bank failures lead to hoarding, diminishing productive activity. Bailing out failed banks is expensive.