Chapter#11 Test

advertisement

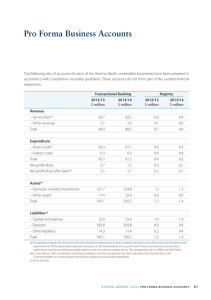

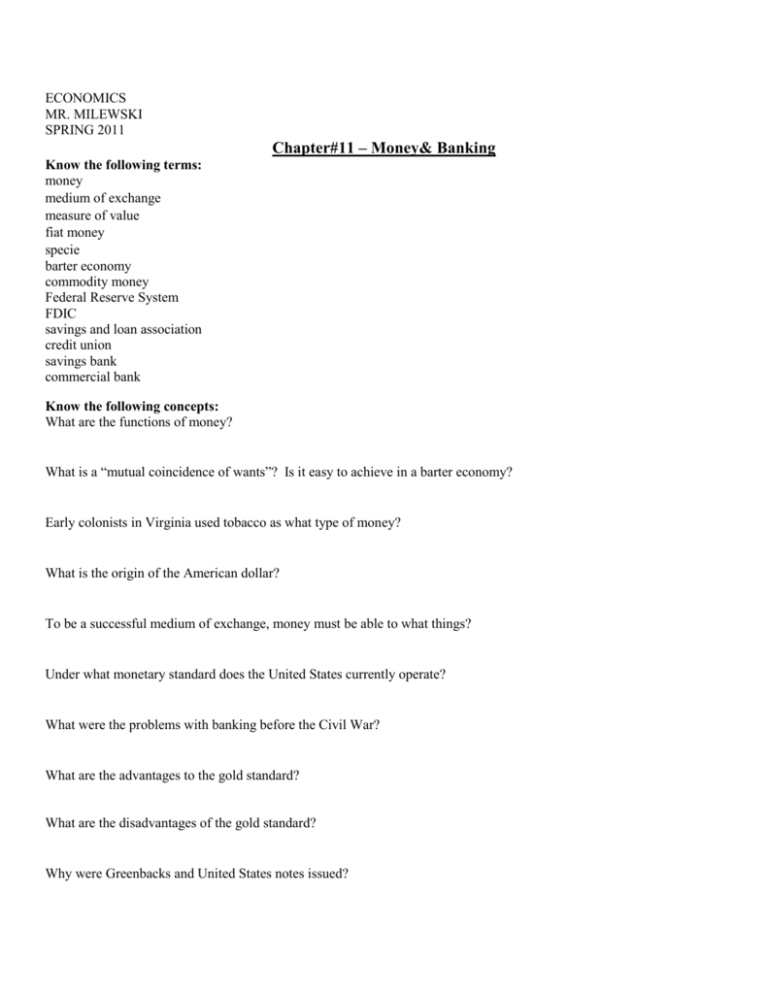

ECONOMICS MR. MILEWSKI SPRING 2011 Chapter#11 – Money& Banking Know the following terms: money medium of exchange measure of value fiat money specie barter economy commodity money Federal Reserve System FDIC savings and loan association credit union savings bank commercial bank Know the following concepts: What are the functions of money? What is a “mutual coincidence of wants”? Is it easy to achieve in a barter economy? Early colonists in Virginia used tobacco as what type of money? What is the origin of the American dollar? To be a successful medium of exchange, money must be able to what things? Under what monetary standard does the United States currently operate? What were the problems with banking before the Civil War? What are the advantages to the gold standard? What are the disadvantages of the gold standard? Why were Greenbacks and United States notes issued? What was the National Banking System? Why was it created? What is the Federal Reserve System? Which federal agency insures bank deposits in the event of a bank failure? What is one of the oldest thrift institutions in the United States? Which type of following institutions experienced serious crisis and reform during the 1980s? When does money lose its value? In what year was the Federal Reserve System established? Since 1965, what metal has the U.S. Mint used to make quarters and dimes? What do people want most in a bank? Why was green ink was used instead of black ink on the first Federal Bills? 1. In what year were the most banks losing money? 2. About what percentage of banks were losing money in 1990? 3. What trend does the graph show for the period from 1985 to 1995?