ch25, lecture

advertisement

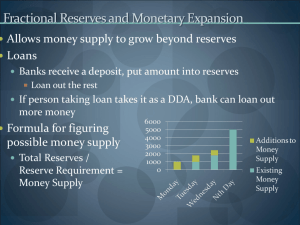

Chapter 25 Money Creation • Key Concepts • Summary • Practice Quiz • Internet Exercises ©2002 South-Western College Publishing 1 In the Middle Ages, what was used for money? Gold was the money of choice in most European nations 2 Who were the founders of our modern-day banking? Goldsmiths, people who would keep other people’s gold safe for a service charge 3 What was the first currency? People would use the receipts they received from goldsmiths as paper money 4 How did the early goldsmiths act as the first banks? Some goldsmiths made loans and received interest for more gold than the actual gold held in their vaults 5 What is fractional reserve banking? A system in which banks keep only a percentage of their deposits on reserve as vault cash and deposits at the Fed 6 What are required reserves? The minimum balance that the Fed requires a bank to hold in vault cash or on deposit with the Fed 7 What is a required reserve ratio? The percentage of deposits that the Fed requires a bank to hold in vault cash or on deposit with the Fed 8 What are excess reserves? Potential loan balances held in vault cash or on deposit with the Fed in excess of required reserves 9 Typical Bank - Balance Sheet 1 Assets Required Reserves Liabilities $5 million Checkable $50 million Deposits Excess Reserves Loans $45 million Total $50 million 0 Total $50 million Note: The Fed requires the bank to keep 10% of its checkable deposits in reserve. 10 What are total reserves? Total Reserves = required reserves + excess reserves 11 Required Reserve Ratio of the Fed Type of Deposit Required Reserve Ratio Checkable deposits 0 - $46.5 million 3% Over $46.5 million 10% 12 Best National Bank - Balance Sheet 2 Assets Required Reserves Liabilities $10,000 Brad Rich $100,000 Account in M1 0 Excess Reserves +$90,000 Total $100,000 Total $100,000 Note: The Fed requires the bank to keep 10% of its checkable deposits in reserve. 13 Best National Bank - Balance Sheet 3 Assets Liabilities in M1 Required $19,000 Brad Rich $100,000 Reserves Account Excess $81,000 Reserves Loans +$90,000 Total $190,000 Connie Jones Account Total +$90,00 0 $90,000 $190,000 Note: The Fed requires the bank to keep 10% of its checkable deposits in reserve. 14 Best National Bank - Balance Sheet 4 Assets Liabilities in M1 Required $10,000 Brad Rich $100,000 Reserves Account Excess Reserves 0 Loans $90,000 Total $100,000 Connie Jones Account 0 0 $100,000 Note: The Fed requires the bank to keep 10% of its checkable deposits in reserve. 15 Yazoo Bank - Balance Sheet 5 Assets Liabilities Required Reserves +$9,000 Excess Reserves +$81,000 Total $90,000 Better Health Span Account +$90,000 Total $90,000 Note: The Fed requires the bank to keep 10% of its checkable deposits in reserve. 16 Expansion of the Money Supply # Bank Increase in Increase in Increase in Required Excess Deposits Reserves Reserves 1 Best Nat’l Bank $100,000 2 Yazoo Nat’l Bank 90,000 Bank A 3 81,000 Bank B 4 72,900 Bank C 5 65,610 6 59,049 Bank D 7 Bank E 53,144 $10,000 9,000 8,100 7,290 6,561 5,905 5,314 $90,000 81,000 72,900 65,610 59,049 53,144 47,830 Total all other banks 478,297 Total increase $1,000,000 47,830 430,467 $100,00 0 $900,00 0 17 What is the money multiplier? The maximum change in the money supply due to an initial change in the excess reserves banks hold 18 What is the money multiplier equal to? 1 / required reserve ratio 19 Actual money supply change M1 = ER x m Initial change in excess reserves Money multiplier 20 Can the multiplier be smaller than indicated? Yes, because of cash leakages and the chance that banks will not use all of their excess reserves to make loans 21 What would the Fed with inflation? Decrease the money supply What would the Fed do with unemployment? Increase the money supply 22 What is monetary policy? The Fed’s use of • open market operations • in discount rate • in required reserve ratio 23 What are open market operations? The buying and selling of government securities by the Federal Reserve System 24 Federal Reserve System - Balance Sheet 6 Assets Government securities Loans to banks Other assets Total Liabilities $472 1 75 $548 Fed notes $492 Deposits 34 Other liabilities and net worth Total 22 $548 25 Federal Reserve Bank - Balance Sheet 7 Initial in M1 Government +$100,00 Reserves +$100,000 +$100,00 securities of Best 0 0 Nat’l bank Assets Liabilities Note: The Fed conducted open market operations in order to increase the money supply by purchasing $100,000 in government securities. 26 Federal Reserve Bank - Balance Sheet 8 Initial in M1 Government-$100,000 Reserves -$100,000 securities of Best $100,000 Nat’l bank Assets Liabilities Note: The Fed conducted open market operations in order to decrease the money supply by selling $100,000 in government securities. 27 Fed $ $ Banks $ $ Fed sells government securities and banks loose reserves Fed buys government securities and banks gain reserves Public 28 What is the discount rate? The interest rate the Fed charges on loans of reserves to banks 29 What would the Fed do if we have inflation? A higher discount rate discourages banks from borrowing reserves and making loans 30 What would the Fed do if we have unemployment? A lower discount rate encourages banks to borrow reserves and make more loans 31 What is the federal funds market? A private market in which banks lend reserves to each other for less than 24 hours 32 What is the federal funds rate? The interest rate banks charge for overnight loans to other banks 33 What would the Fed do if we had inflation? A higher federal funds rate discourages banks from borrowing reserves and making loans 34 What would the Fed do if we had unemployment? A lower federal funds rate encourages banks to borrow reserves and make more loans 35 What is a required reserve requirement? The Fed determines how much a financial institution must keep in reserve as a percentage of its total assets 36 What is the required reserve ratio? That percentage the Fed stipulates that financial institutions must keep in reserve to meet its reserve requirement 37 If the reserve ratio is one tenth, what is the multiplier? 1 1/10 = 10 38 If the reserve ratio is one twentieth, what is the multiplier? 1 1/20 = 20 39 What would the fed do if we had inflation? Increase the reserve ratio What would the fed do if we had unemployment? Decrease the reserve ratio 40 Is changing the reserve ratio a popular monetary tool? No, changing the reserve ratio is considered a heavyhanded approach and is thus infrequently used 41 What are the shortcomings of monetary policy? • Money multiplier inaccuracy • Nonbanks • Which money definition should the Fed control? • Lag effects 42 Key Concepts 43 Key Concepts • Who were the founders of our modern-day banking? • What is fractional reserve banking? • What are required reserves? • What is a required reserve ratio? • What are excess reserves? • What are total reserves? • What is the money multiplier? • What is the money multiplier equal to? 44 Key Concepts cont. • • • • • • • What is monetary policy? What are open market operations? What is the discount rate? What is the federal funds rate? What is a required reserve requirement? What is the required reserve ratio? What are the shortcomings of monetary policy? 45 Summary 46 Fractional reserve banking, the basis of banking today, originated with the goldsmiths in the Middle Ages. 47 Because depository institutions (banks) are not required to keep all their deposits in vault cash or with the Federal Reserve, banks create money by making loans. 48 Required reserves are the minimum balance that the Fed requires a bank to hold in vault cash or on deposit with the Fed. The percentage of deposits that must be held as required reserves is called the required reserve ratio. 49 Excess reserves exist when a bank has more reserves than required. Excess reserves allow a bank to create money by exchanging loans for deposits. Money is reduced when excess reserves are reduced and loans are repaid. 50 The money multiplier is used to calculate the maximum change (positive or negative) in checkable deposits (money supply) due to a change in excess reserves. As a formula: $ multiplier = 1/required reserve ratio. 51 Monetary policy is action taken by the Fed to change the money supply. The Fed uses three basic tools: (1) open market operations (2) changes in the discount rate and (3) changes in the required reserve ratio. 52 Open-market operations are the buying and selling of government securities by the Fed through its trading desk at the New York Federal Reserve Bank. 53 Buying government securities creates extra bank reserves and loans, thereby expanding the money supply. Selling government securities reduces bank reserves and loans, thereby contracting the money supply. 54 Fed $ $ Banks $ $ Fed sells government securities and banks loose reserves Fed buys government securities and banks gain reserves Public 55 Changes in the discount rate occur when the Fed changes the rate of interest it charges on loans of reserves to banks. 56 Dropping the discount rate makes it easier for banks to borrow reserves from the Fed and expands the money supply. 57 Raising the discount rate discourages banks from borrowing reserves from the Fed and contracts the money supply. 58 Changes in the required reserve ratio and the size of the money multiplier are inversely related. Thus, if the Fed decreases the required reserve ratio the money multiplier and money supply increase. If the Fed increases the required reserve ratio the money multiplier and money supply decrease. 59 Monetary policy limitations include the following: (1) The money multiplier can vary (2) Nonbanks, such as insurance companies, finance companies, and Sears, can offer loans and other financial services not directly under the Fed’s control (3) The Fed might control M1 while the public can shift funds to M2, M3, or another money supply definition (4) Time lags occur. 60 Chapter 25 Quiz ©2002 South-Western College Publishing 61 1. If a bank has total deposits of $100,000 set aside to meet reserve requirements of the Fed, its required reserve ratio is a. $10,000 b. 10 percent c. 0.1 percent d. 1 percent B. Required reserve ratio = required deposits total deposits x 100 = $10,000 $100,000 x 100 62 2. Assume a simplified banking system in which all banks are subject to a uniform required reserve ratio of 30 percent and demand deposits are the only form of money. A bank that received a new deposit of $10,000 would be able to extend new loans up to a maximum of a. $3,000 b. $7,000 c. $10,000 d. $30,000 B. Excess reserves can be loaned. Excess reserves = total reserves - required reserves = $10,000 - (0.3 x $10,000) = $10,000 - $3,000 = $7,000 63 3. The Best National Bank operates with a 10 percent required reserve ratio. One day a depositor withdraws $400 from his or her checking account at the bank. As a result, the bank’s excess reserves a. fall by $400 b. fall by $360 c. fall by $40 d. rise by $400 B. Excess reserves = total reserves required reserves = -$400 - (0.10 x $400) = -$400 + $40 = -$360 64 4. If an increase in excess reserves of $100 in a simplified banking system can lead to a total expansion in bank deposits of $400, the required reserve ratio must be a. 40 percent b. 400 percent c. 25 percent d. 4 percent C. $ multiplier = in bank deposits initial in excess reserves = 400 $100 = 4 = 1 required reserve ratio = 1 money multiplier x 100. 65 5. In a simplified banking system in which all banks are subject to a 25% required reserve ratio, a $1,000 open sale by the Fed would cause the money supply to a. increase by $1,000. b. decrease by $200. c. decrease by $5,000. d. increase by $5,000. C. Money supply change ( M1) = initial in excess reserves x money multiplier (MM). MM = 1 required reserve ratio = 1 25/100 = 4 . M1 = $1,000 x 4 = -$4,000. 66 6. In a simplified banking system in which all banks are subject t a 20% required reserve ratio, a $1,000 open market purchase by the Fed would cause the money supply to a. increase by $100. b. decrease by $200. c. decrease by $5,000. d. increase by $5,000. D. Money supply change ( M1) = initial change in excess reserves x money multiplier (MM) MM = 1 required reserve ratio = 1 20/100 = 5 M1 = $1,000 x 5 = $5,000. 67 7. The cost to a member bank of borrowing from the Federal Reserve is measured by the a. reserve requirement. b. price of securities in the open market. c. discount rate. d. yield on government bonds. C. The Fed provides a discount window at each of the Federal Reserve districts banks to make loans of reserves to banks and change an interest rate called the discount rate. 68 Exhibit 5 Balance Sheet of Best National Bank Assets Liabilities $ Required Reserves Excess Reserves Loans 80,000 Total $100,000 Checkable $100,00 deposits 0 Total $100,000 69 8. The required reserve ratio in Exhibit 5 is a. 10%. b. 15%. c. 20%. d. 25%. C. Excess reserves = total reserves required reserves = $80,000 = $100,000 - required reserves = $20,000 Required reserve ratio = required deposits total deposits = $20,000 $100,000 x 100 = 20% 70 9. If the bank in Exhibit 5 received $100,000 in new deposits, its required reserves would be a. $10,000. b. $20,000. c. $30,000. d. $40,000. B. Required reserves = required reserve ratio x new deposits = .20 x $100,000 = $20,000 71 10. Suppose Brad Rich deposits $1,000 in the bank shown in Exhibit 25.1. The result would be a. a $200 increase in excess reserves. b. a $200 increase in required reserves. c. a $1,200 increase in required reserves. d. zero change in required reserves. B. Required reserves = required reserve ratio x new deposits = .20 x $1,000 = $200 72 11. If all banks in the system are identical to Best National Bank, shown in Exhibit 5. A $1,000 open market sale by the Fed would a. 5. b. 10. c. 15. d. 20. A. Money multiplier = 1 required reserve ratio = 1 20/100 = 5 73 12. Assume all banks in the system are identical to Best National Bank, shown in Exhibit 5. A $1,000 open market sale by the Fed would a. expand the money supply by $1,000. b. expand the money supply by $15,000. c. contract the money supply by $1,000. d. contract the money supply by $5,000. D. Money supply change ( M1) = initial change in excess reserves x money multiplier (MM) MM = 1 required reserve ratio = 1 20/100 = 5 M1 = $1,000 x 5 = -$5,000. 74 END 75