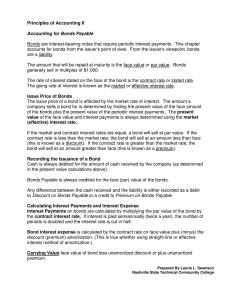

SI chapter 10 bonds3

advertisement

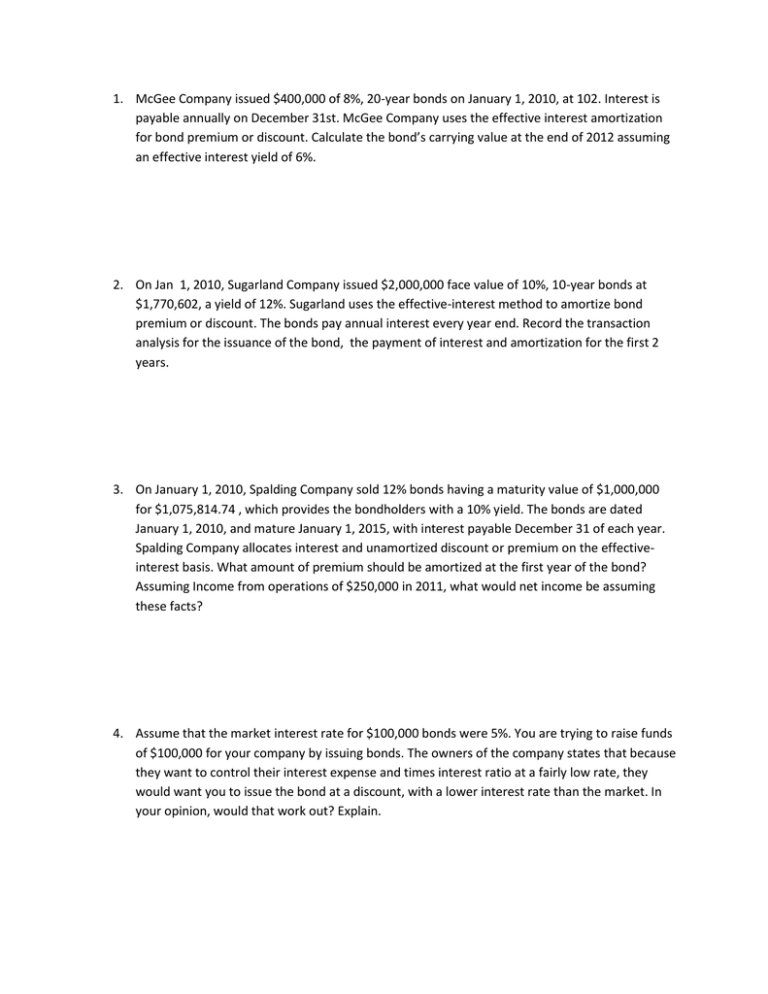

1. McGee Company issued $400,000 of 8%, 20-year bonds on January 1, 2010, at 102. Interest is payable annually on December 31st. McGee Company uses the effective interest amortization for bond premium or discount. Calculate the bond’s carrying value at the end of 2012 assuming an effective interest yield of 6%. 2. On Jan 1, 2010, Sugarland Company issued $2,000,000 face value of 10%, 10-year bonds at $1,770,602, a yield of 12%. Sugarland uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest every year end. Record the transaction analysis for the issuance of the bond, the payment of interest and amortization for the first 2 years. 3. On January 1, 2010, Spalding Company sold 12% bonds having a maturity value of $1,000,000 for $1,075,814.74 , which provides the bondholders with a 10% yield. The bonds are dated January 1, 2010, and mature January 1, 2015, with interest payable December 31 of each year. Spalding Company allocates interest and unamortized discount or premium on the effectiveinterest basis. What amount of premium should be amortized at the first year of the bond? Assuming Income from operations of $250,000 in 2011, what would net income be assuming these facts? 4. Assume that the market interest rate for $100,000 bonds were 5%. You are trying to raise funds of $100,000 for your company by issuing bonds. The owners of the company states that because they want to control their interest expense and times interest ratio at a fairly low rate, they would want you to issue the bond at a discount, with a lower interest rate than the market. In your opinion, would that work out? Explain.