FINANCIAL ACCOUNTING

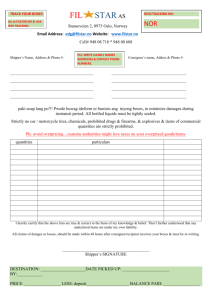

advertisement

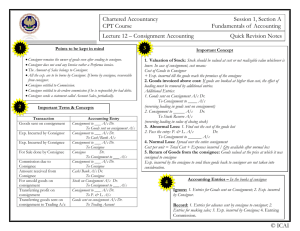

FINANCIAL ACCOUNTING CHAPTER 1 CONSIGNMENT ACCOUNTS • Consignment means sending of goods by one merchant to the agent for sale in which the sole risk remains with the sender. • Sender is the consignor & receiver is the consignee & the relationship is of the principle & agent. Sending of goods is outward consignment & receiving of goods is inward consignment. Difference between consignment & sale Basis consignment sale 1)ownership- remains transferred 2)payment- consignee not purchaser is liable till the sales liable 3)relationship- principal & buyer& a seller agent 4)riskof the consigner of the buyer 5)expenses- borne by the borne by the buyer consigner 6)commission- consignor gives not given by the buyer it Basis consignment sale 7)Return of goods- unsold goods can cannot be returned till any problem 8)Account sales- consignee sends not sent 9)Right to sell The goods consignee sells in seller sells the name of consignor in own name 10)Settlement Of disputes --Indian Contract Act, Sales of Goods 1872. Act, 1930 some important terms 1) Proforma invoice:- consist of information relating to the nature, price, quantity, weight, minimum sale price etc. of the goods sent by the consigner. 2) Expenses on consignment:a) non-recurring: incurred to bring goods to the godown or place of agent e.g. freight, custom duty, insurance in transit, octroi, unloading charges. b) Recurring : incurred after the goods reached the place of consignee e.g. godown expenses, selling expenses, repair expenses, etc. 3)Commission:- given on amount of sales. In additiona) Del-credere- given on total sales to make the consignee bear the loss on account of bad debts. b) Overriding comm- given to make the consignee sell the goods at higher prices. It is paid as per the agreement and on the excess price. 4) Account sales:- sent by the consignee showing the quantity sold, expenses incurred, commission, amount sent by the consignee,& the amount payable by the consignor, etc. 5)Advance amount by consignee:- may be in the form of cash, bank draft or B/R and is given by consignee as security for the goods sent on consignment. Accounting procedure Accounts opened in the books of consignor:1)Consignment account- is a nominal a/c and prepared like trading/p&l a/c. The profit or loss of this a/c is transferred to general P&L a/c 2)Goods sent on consignment a/c- a real a/c. balance is transferred to the credit side of trading a/c. 3)Consignee’s a/c- personal a/c. represents the amount due by or due to the consignee. 4) Stock on consignment a/c- real a/c. balance is carried forward. Accounts to be opened in the books of Consignee:1) Consignor’s a/c- personal a/c. amount to or from the consignor is known. 2) Commission a/c- nominal a/c. balance transferred to the credit side of the P&L a/c. CHAPTER 2 JOINT VENTURE ACCOUNTS A joint venture is a temporary partnership of two or more than two persons which has been established for doing a specific transaction and for dividing the profit or loss thereof in the agreed ratio. This partnership comes to an end as soon as the specific transaction is over. This is also known as joint trade or joint adventure. Characteristics:- 1)There should be two or more than two persons. 2)There should be an agreement between the co-ventures. 3)It comes into existence for doing a specific transaction. 4)It comes to an end as soon as the specific transaction is over. 5)The main objective is to earn profit. 6)The control and mangt. May be done by all or by any one or more co-venturers on behalf of all the co-venturers. Need and objectives: The main purpose is to combine the capital , skills and specialized facilities with different persons for earning the profits. It may consist of consignment, contract, speculation etc. Accounting treatment:- four methods1)Joint banking method 2) To keep record of JV by one co-venturer 3)To keep record of JV by all co-venturers separetly 4) Memorandum method