Income Tax

Income

Monday, Jan 13 th

Priorities

• Priority 1

• Essential to life

• Priority 2

• Not essential to life, but important

• Priority 3

• Neither essential, nor important

Needs VS Wants

• In a well developed paragraph, explain how the media turns wants into needs through advertising.

Story

• What sources of income was Rio planning to have as a professional athlete?

• What are some other sources of income that a professional athlete or celebrity could have?

• Rio talked about making 2 million a year, how much money do you think sport figured and celebrities make?

Story

• Does that sound like enough money to meet Rio’s, or another celebrity’s, needs and wants?

• How does Rio’s dream compare with that of a business owner, a professional, a trade-worker, or a student?

Student Sources of Income

• Typical sources of student income include:

• Allowances and gifts

• Wages and tips

• Payments for occasional work

• Income from personal business

• Income from government sources

• Income from investments

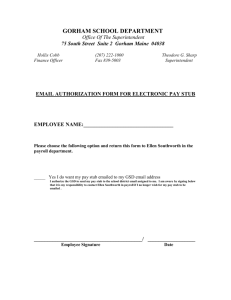

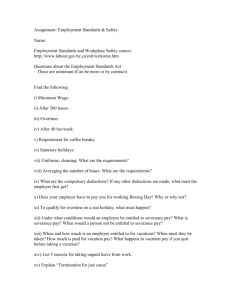

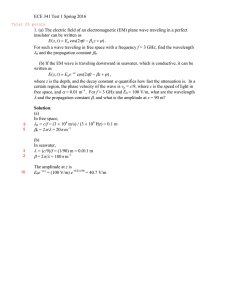

Pay Stub

• General Information: name, employee number, pay period, cheque number, etc.

• Earnings:

• type of earnings (regular, overtime, etc.)

• hours or days worked

• amount earned in a current period

• year-to-date (YTD).

Pay Stub

• Deductions:

• income tax, employment insurance, Canadian Pension Plan

• may also include union dues, medical plan and extended medical coverage, life and disability insurance, savings plans, etc.

• Deductions = automatic payments to government and other organizations that your employer makes on your behalf to pay services or benefits

Pay Stub

• Vacation Pay:

• Employees are entitled to be paid four per cent of their total wages (six per cent after five days) for vacation pay.

• This lets employees take two or three weeks of vacation with pay

• Casual and part-time employees often receive their vacation pay on each paycheque

Pay Stub

• Income Tax:

• a portion of your income that is sent to the Governments of

Canada and BC to pay for federal and provincial government services

• The federal, provincial and territorial governments require you to pay a portion of your income in tax so that the government will have money to operate through the year

Pay Stub

• Income Tax:

• Paid on your total income, minus a number of allowable deductions.

• Eg. Basic personal amount people who have taxable income of less than $10,320 paid no tax

• People who earned more that that could pay between 15 and 29% of their taxable income (federal) and 5.06 to 14.7% (BC)

• Canada has a progressive tax system, meaning that those who have higher earnings pay a higher percentage of their income in taxes

Pay Stub

• Income Tax:

• Not always deducted at the source (by the employer)

• Tax may not be deducted if:

• Your projected income for the year is below the amount of the basic exemption

• You do contract work that is not regular employment

• Whether tax is deducted or not, you are responsible for reporting and paying any income tax you owe

Pay Stub

• Canada Pension Plan (CPP):

• Percentage of gross income paid by employees and employers to provide income when workers retire or become disabled

• Employment Insurance:

• percentage of gross income paid by employees and employers to provide temporary payments if workers become unemployed

Group Work

• Please get into your groups (for your characters):

• Luna, Nikos, Rio, Sienna, Indigo, Quinn, Kane, Gaia

Monthly Income

• Many paycheques are bi-weekly (every two weeks) or semimonthly (twice a month)

• Other types of income may be quarterly (four times a year), annual (once a year), or irregular

Monthly Income

• You can convert income to a monthly amount using the following formulae:

• Semi-monthly income x 2 = monthly income

• Bi-weekly income x 2.17 = monthly income

(the 2.17 comes from 26÷12)

• Quarterly income ÷ 3 = monthly income

• Yearly income ÷ 12 = monthly income

• How would you calculate annual income?

Group Work

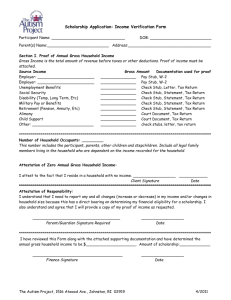

• Handout 5-2:

• Use income records to complete the handout

Individually

• Handout 5-3:

• List your own income from various sources (gifts, part-time jobs, allowance, etc.)

• Total your income

• Project your income to determine an anticipated income after deductions over a month and a year.