Department Rep Meeting - Auditor

advertisement

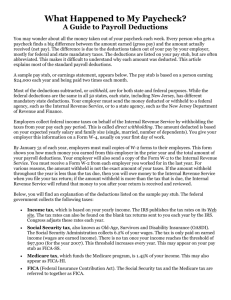

Department Representative Payroll Meeting Paul Angulo, CPA, MA County Auditor-Controller Welcome Frankie Ezzat, MPA Assistant Auditor-Controller Welcome Jennifer Fuller, CPP Chief Accountant Personnel & Other Updates • New Staff. • New format for Meetings. – Two full meetings per year. – Two Summer Sessions (AKA round tables) per year. • Survey Monkey. Payroll Announcements Mark Delsigne, FPC Supervising Accounting Tech Payroll Announcements • No prior pay period adjustments involving Industrial Injury. • Military Leave reminder. • ACO will return to 9/80 work schedule on CO16-2013. • No voluntary garnishments. • Updating Mailing address vs. Home address. – Please ensure that both are updated when a change of address is submitted • Please submit request to ACO_Payroll e-mail Accounting Reports Pam Torres Principal Accountant Accounting Reports • RVPAY640 Actual Costing Interface file • RVPAY752 Employee Earnings Employer PD (Paid Deduction) • RVPAY018 by Department Year End Updates May Galera Senior Accountant Tax Updates • W-2 availability, including eW-2 • Tax changes for 2013 • Gross to Box 1 (and Box 3) ePay Services • Employee Self-Services(ESS) provides access to • • • • Direct Deposit W-4 Entry Pay Advice/Stub W2 = 2007-2012 ePay Services ePay Services ePay Services ePay Services What about mailed W-2s? • • • • Legal size forms Single side printing Pressure sealed Printed the week of January 28th • Mailed on January 28th What is new in 2013? • OASDI • Soc Sec 6.2% for Employees (max $113,700) • Soc Sec 6.2% for Employers (max $113,700) • Medicare 1.45% & additional • W/H rates for California were slightly lower • W/H rates for Feds were slightly lower • Mileage rate remains at $.565 (eff 1/1/13) How do we get Box 1? Additional Information • Duplicate W-2s • Current Employees, through ESS • Termed/Retired, Call ACO • State exempt W-4s processed only by ACO • Cannot go exempt on State unless exempt from Federal • Address/E-mail Update • W-2 Box 12DD 2012 Statistics • SSA W-2 file will be sent this week • Federal Reportable wages total = $1.08 Billion • County of Riverside = $1.06 Billion • Total Taxes withheld = $245 Million • Number of W-2s prepared = 22,164 • County of Riverside = 21,837 • Reported under 8 EINs Paycheck Stub FAQ Tracey Corso, CPP Accounting Supervisor Your Paycheck Stub • Earnings • Other • Overtime changes Your Paycheck Stub • Earnings (Other) Your Paycheck Stub • Earnings (adding overtime rate) Your Paycheck Stub • Earnings (adding overtime rate FLSA) Your Paycheck Stub • Taxes – Additional Medicare handling Your Paycheck Stub • Taxes – CO26 to W-2 Boxes Not the same Your Paycheck Stub • Taxes – CO26 to W-2 Boxes Your Paycheck Stub • Deductions – Before Tax Deductions (with Tier 1) Your Paycheck Stub • Deductions – Before Tax Deductions (with Tier 2) Your Paycheck Stub • Deductions – Before Tax Deductions (with Tier 3) Your Paycheck Stub • Deductions – Before Tax Deductions (W-2 12DD) Your Paycheck Stub • Deductions – After Tax Deductions (with garnishments) Your Paycheck Stub • Deductions – After Tax Deductions (with child support) Your Paycheck Stub • Employer Paid my|CalPERS Update Cindy Laurenson, CPP Supervising Accountant my|CalPERS • • • • www.calpers.ca.gov Members have access Will provide real-time data Annual Member Statements are available online. They will no longer be mailed unless you “opt in” my|CalPERS • Transmit four agency files on Monday of pay week • Reporting Retirees’ earnings and hours • 95% posted by Thursday of pay week – 150 – 300 errors per pay period – Errors mostly due to PPA dates, LDW errors, adjustments, duplicate ApptIDs – Entering separation dates timely eliminates LDW errors – TAP retro separations - use beginning date of the next pay period to separate employees to prevent errors my|CalPERS • CalPERS Formula and Contribution Rate changes in FY 2013 – Tier2 effective 08/23/12 reduced Misc retirement benefits from 3% @ 60 to 2% @ 60 and employee paid member contributions from 8% to 7% – Tier2 reduced Safety benefits from 3% @ 50 to 2% @ 50 – PEPRA’s (T3) reduced Misc benefits from 2% @ 60 to 2% @ 62 and also reduced member contributions from T2 7% to T3 @ 6.5% – PEPRA’s (T3) Safety’s benefits were changed from 2% @ 50 to 2.7% @ 57, their member contributions increased to 10.75%, EE pd @ 9%, ER paid @ 1.75% my|CalPERS • CalPERS Formula and Contribution Rate changes in FY 2013 – DA’s contract is unique which required additional programming changes – CalPERS gave County and Flood a rate reduction for Employer Contribution rates effective PP06 – PP14 to help offset RBP Replacement Benefit Plan invoices for some retired employees – Each fiscal year our employer contribution rates change effective with the payroll period that includes July 1. FY13/14 rates will change on PP15-2013 PEPRA • PEPRA Public Employees’ Pension Reform Act of 2013 – Effective 1/01/2013 – Misc 2% @ 62, 6.5% EE paid member contributions, pensionable earnings capped @ 113,700 this year – tied to Social Security Base, then will follow CPI Consumer Price Index – Safety 2.7% @ 57, 10.75% member contributions, 9% EE paid and 1.75% ER paid, capped @ 136,440 this year – UNA not available to Tier3 employees – UNFT3 new TRC non-reportable code for Tier3 employees receiving actual pay for Uniforms (Earnings code UN3) – Prohibits purchase of air time Questions??