File

advertisement

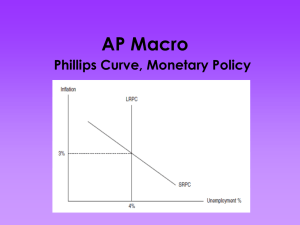

Economic Theories Chap 12, 16, 17, 19 and Last Word Pg 177 Chap 12,16,17,19 Vocabulary Supply-side fiscal policy Say’s Law Laissez-faire Stagflation Aggregate supply shocks Classical View Keynesian View Monetarism Equation of exchange Monetary rule Rational Expectations Theory Neo-classical Economics John Maynard Keynes (pronounced: kaynz) John Maynard Keynes, 5 June 1883 – 21 April 1946), was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments. He greatly refined earlier work on the causes of business cycles, and advocated the use of fiscal and monetary measures to mitigate the adverse effects of economic recessions and depressions. Keynesian (Mainstream) Economic Theory John Maynard Keynes, 1930s •Prices and Wages are downwardly Inflexible •Active Government action is required to stabilize the Economy •Economy does not self correct • Horizontal Aggregate Supply Curve moves to Full-Employment • Unstable Aggregate Demand • Velocity of money is NOT stable (New)Keynesian (AS/AD) Price Level Full Employment B A AS A deepening recession moving from point A to B P1 AD1 AD2 Q2 Q1 Real Domestic Output/GDP Classical Economic Theory Adam Smith - 1776 • Laissez-faire – NO government intervention • Economy is self-correcting (Invisible Hand) • Prices are upwardly and downwardly flexible • Vertical Aggregate Supply Curve (LRAS) • Stable Aggregate Demand • Say’s Law – supply creates its own demand • Real Output Depends Upon… • Quantity of money possessed by households & businesses Full Employment THE LONG RUN AGGREGATE SUPPLY (LRAS) REPRESENTS FULL EMPLOYMENT. LRAS SRAS MAYBE,THE MOST IMPORTANT GRAPH IN MACROECONOMICS Price Level P AD YF Full Employment GDPR Real GDP Definitions for Long-Run v. Short-Run Long-Run • When wages become adjusted for price level changes. These wage changes have the effect of shifting the SRAS to an equilibrium point on the LRAS. On the next slide, movement from point “b” to point “c” indicates a response in the long run. Short-Run • In the short run, wages are fixed and do not affect the cost of production, despite an increase or decrease in price level. For example on the next slide movement from point “a” to point “b” reflects the short run. Keynesian Correction for a Recession The next slide shows how Keynesian (or Mainstream) economic theory moves to correct a recession. The Economy moves from point “b” to “c” as aggregate demand increases and full employment is restored. KEYNESIAN VIEW FOR HOW A RECESSION IS CORRECTED ASLR AS2 Price Level AS1 c P3 b P2 a P1 Maybe higher price levels *and an inflationary spiral AD2 AD1 o Q2 Q 1 Real domestic output Classical View of how an Economy Corrects a Recession The next slide reflects how an economy self corrects a recession (movement from point “a” to “b”) As unemployment increases to point “b”, workers are willing to accept lower wages and Aggregate Supply increases as production costs decline. The economy returns from point “b” to point “a” without government intervention. CLASSICAL VIEW OF HOW A RECESSION IS CORRECTED ASLR AS2 Price Level AS1 b P2 a P1 Nominal wages fall & AS returns to its original location AD1 o Q2 Q 1 Real domestic output How Classical Economics self-corrects inflation • Normally, there is a short-run trade-off between the rate of inflation and the rate of unemployment. • Approximately 70% of the cost of production is wages. As unemployment decreases, upward pressure is put on wages and AS decreases resulting in wage-push inflation and increased production costs. The economy moves from point “b” to point “c”. CLASSICAL VIEW OF SELF-CORRECTION FOR INFLATION SRAS2 AS LR Price Level SRAS1 P3 P2 P1 Selfc Correction b for an a AD2 increase in AD AD 1 Q1 Real Domestic Output A Review of the Classical Economic Graphs You must know what happens to Price Level, Output (GDP), and the unemployment rate as AS or AD shift. Increase in AD: LRAS PL SRAS P P1 AD1 AD Y YF GDPR Price level increases, GDP increases and unemployment decreases Decrease in AD: LRAS PL SRAS P P1 AD AD1 YF Y GDPR The decrease in AD causes the price level to decrease, The GDP to decrease and unemployment to increase. Increase in SRAS SRAS LRAS PL SRAS1 P P1 AD Y YF GDPR Price level decreases, GDP increases and unemployment decreases Decrease in SRAS SRAS1 LRAS PL SRAS P P1 AD Y1 YF GDPR Increase in input costs causes SRAS to decrease. GDP decreases, unemployment increases and Price increases Recessionary Gap An Recessionary gap exists when equilibrium occurs below full employment output. AD PL LRAS SRAS P Y YF GDPR Inflationary Gap An inflationary gap exists when equilibrium occurs beyond full employment output. PL LRAS SRAS P AD YF Y GDPR ECONOMIC GROWTH LRAS1 PL SRAS LRAS SRAS1 P AD1 YF AD YF GDPR Economic growth occurs as an economy is able to produce more goods and increase the Real GDP. In the graph above, growth occurs as both AD and SRAS increase simultaneously and this enables price level to remain stable. This is what occurred In the U.S. during the 1990s. This is the same as an increase reflected on the Production Possibilities Curve. Capital Goods Growth Illustrated on PPC or Increased LRAS . PPC Consumer Goods PPC1 Full Employment THE LONG RUN AGGREGATE SUPPLY (LRAS) REPRESENTS FULL EMPLOYMENT. PL LRAS SRAS AGAIN, MAYBE, THE MOST IMPORTANT GRAPH IN MACROECONOMICS P AD YF GDPR The “Original” PHILLIPS CURVE Phillips curve suggests inflation and unemployment are inversely related. Annual rate of inflation (percent) 7 6 5 4 3 2 1 0 SRPC 1 2 3 4 5 6 7 Unemployment rate (percent) Trouble for the Phillips Curve in the 70s and 80s I N F L A T I O N π% 4% 2% (symbol for Pi = inflation rate in macroeconomics) The relationship between unemployment and inflation was not as strong. . . . . .. . . . . . .. . 5% UNEMPLOYMENT 7% . PC u% The Long-Run Phillips Curve π% LRPC I N F L A T I O N The LRPC is the same as the Full Employment Rate (NRU). If NRU changes, so does the LRPC SRPC un % u% The Long-Run Phillips Curve (LRPC) Because the Long-Run Phillips Curve exists at the natural rate of unemployment (un), structural changes in the economy that affect un will also cause the LRPC to shift. Increases in un will shift LRPC Decreases in un will shift LRPC (and if we think back to Chapter 8, we may remember that economists are predicting that the NRU will increase for the U.S. economy so the LRPC and the LRAS will shift to the left. The Short-Run Phillips Curve (SRPC) Today many economists reject the concept of a stable Phillips curve, but accept that there may be a short-term trade-off between u% & π% (symbol for Pi = inflation rate in macroeconomics) given stable inflation expectations. Most believe that in the long-run u% & π% are independent at the natural rate of unemployment. Modern analysis shows that the SRPC may shift left or right. The key to understanding shifts in the Phillips curve is inflationary expectations! Relating Phillips Curve to AS/AD Changes in the AS/AD model can also be seen in the Phillips Curves An easy way to understand how changes in the AS/AD model affect the Phillips Curve is to think of the two sets of graphs as mirror images. NOTE: The 2 models are not equivalent. The AS/AD model is static, but the Phillips Curve includes change over time. Whereas AS/AD shows one time changes in the price-level as inflation or deflation, The Phillips curve illustrates continuous change in the price-level as either increased inflation or disinflation. Increase in AD = Up/left movement along SRPC PL SRAS SRPC π1 π P1 .. AD1 AD Y YF P . . LRAS π% GDPR un u C↑, IG↑, G↑ and/or XN↑ .: AD .: GDPR↑ & PL↑ .: u%↓ & π%↑ .: up/left along SRPC u% Decrease in AD = Down/right along SRPC LRAS PL P1 . SRAS SRPC π . P π% . . π1 AD AD1 YF Y GDPR u un u% C↓, IG↓, G↓ and/or XN↓ .: AD .: GDPR↓ & PL↓ .: u%↑ & π%↓ .: down/right along SRPC SRAS = SRPC PL LRAS . P1 Y YF LRPC π1 . GDPR un π AD SRPC1 . SRAS1 SRPC . P π% SRAS u u% Inflationary Expectations↓, Input Prices↓, Productivity↑, Business Taxes↓, and/or Deregulation .: SRAS .: GDPR↑ & PL↓ .: u%↓ & π%↓ .: SRPC (Disinflation) SRAS = SRPC SRAS1 SRAS . . π1 π AD Y1 YF LRPC SRPC P1 P π% LRAS PL SRPC1 . . GDPR u n u1 u% Inflationary Expectations↑, Input Prices↑, Productivity↓, Business Taxes↑, and/or Increased Regulation .: SRAS .: GDPR↓ & PL↑ .: u%↑ & π%↑ .: SRPC (Stagflation) Monetarist Economic Theory (a Neoclassical Theory) Neoclassical Theories agree with the basic premises of Classical Theory but have expanded on the basic theory. They use the LRAS Model. Milton Friedman (Monetarist Theory) Agrees with Classical Theory (no Government intervention). His Equation of Exchange is basis of Monetarism: M V = P Q (like: C + In + G + Xn = GDP) M=money supply V=velocity of money P=price level Q=quantity of goods produced (AS) Monetarist (contd.) MV = PQ similar to C+I+G+Xn=GDP Government’s role in the economy is to increase Money Supply by the same amount as projected GDP growth (3.5%) Government should adopt the prescribed increase in M as a “Monetary Rule” Velocity of money is stable Discretionary monetary and fiscal policies disrupt self-correction By adopting a “Monetary Rule”, businesses and consumers can better anticipate Fed actions. Rational Expectations Theory Another neoclassical theory which uses a LRAS model. Assumes there should be monetary rule but it is not specifically contained in the theory Any actions by the government to “fix” the economy will be offset by individuals who act rationally (e.g. if G lowers interest rate to fight a recession, personal consumption and investment spending may still not occur as people and businesses may assum that the recession may NOT be ending.) Supply Side Economic Theory •Government should focus on Aggregate Supply, not Aggregate Demand •Decrease Taxes and create Incentives to Work •Creates Incentives to Save and Invest •Supply Side economics was tried during the Reagan Administration and was commonly referred to as “Reaganomics”. (or in Ferris Bueller as “VooDoo Economics) •The Laffer Curve is a basic assumption of Supply Side economics. A criticism of the Laffer Curve is that it is difficult to identify the “optimum” tax rate. THE LAFFER CURVE Tax rate (percent) 100 n m m Maximum Tax Revenue l 0 Tax revenue (dollars) How Theories Differ Role of Government Economy self corrects Flexibility of prices Laissez Faire Economics Monetary Rule Velocity of Money