common stock.

advertisement

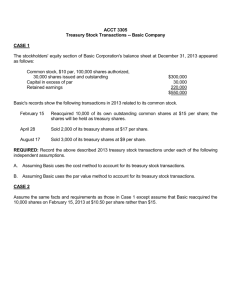

1 Chapter 15 Contributed Capital An electronic presentation by Douglas Cloud Pepperdine University 2 Objectives 1. Explain the corporate form of organization. 2. Know the rights and terms that apply to capital stock. 3. Account for the issuance of capital stock. 4. Describe a compensatory stock option plan. 5. Recognize compensation expense for a compensatory stock option plan. 6. Account for a fixed compensatory stock option plan. Continued 3 Objectives 7. Account for a performance-based compensatory stock option plan. 8. Understand how to use the intrinsic value method to account for a compensatory stock option plan. 9. Know the components of contributed capital. 10. Understand the accounting for treasury stock. 4 Types of Corporations 1) Private Corporations (stock and nonstock; open and closed) 2) Public corporations universities, Available for corporations hospitals, 3) Domestic purchase by churches 4)theForeign public corporations 5 Changes in Equity Affecting Assets or Liabilities Comprehensive Income Net Income Other Comprehensive Income Revenues and Expenses Gains and Losses Included in Net Income Continued on next slide Transfers Between Entity and Owners Investments by Owners Distributions to Owners 6 Continued from previous slide Changes in Equity Not Affecting Assets or Liabilities Stock Dividends and Splits Conversions of Preferred Stock to Common Stock 7 Stockholders’ Rights • The right to share in the profits when a dividend is declared. • The right to elect directors and to establish corporate policies. • The right (called a preemptive right) to maintain a proportionate interest. • The right to share in the distribution of the assets of the corporation if it is liquidated. 8 Basic Terminology Subscribed capital Issued capital stock—The Authorized capital stock—The number of shares Treasury stock— stock—The Outstanding capitalnumber of shares of capital stock The number of number of shares stock—The number ofof capital stock a corporation shares of capital ofthat capital stock shares of capital stock that a corporation issue upon the stock that a thatwill a corporation that a corporation hashas issued to its of an corporation has maycompletion issue as stated issued to its stockholders as of issued to its in itsinstallment charter. stockholders and that a specific date. purchase contract stockholders and are still being held by with an investor. has reacquired but them on a specific date. not retired. 9 Basic Terminology Authorized Capital Stock Issued Capital Stock * Outstanding capital stock * Treasury stock Unissued Capital Stock * Subscribed capital stock 10 Legal Capital Legal capital is the amount of stockholders’ equity that the corporation cannot distribute to stockholders. 11 Issuance of Capital Stock When only one class of stock is issued, it is referred to as common stock. 12 Issuance of Capital Stock A corporation issues 500 shares of its $10 par common stock for $18. Cash Common Stock, $10 par Additional Paid-in Capital on Common Stock 9,000 5,000 4,000 13 Issuance of Capital Stock A corporation issues 500 shares of its nopar stock common stock with a stated value of $10 for $18 per share. Cash 9,000 Common Stock, $10 stated value Additional Paid-in Capital on Common Stock 5,000 4,000 14 Issuance of Capital Stock A corporation issues 500 shares of its no-par, no-stated value common stock for $18 per share. Cash Common Stock, no-par (500 shares) 9,000 9,000 15 Stock Subscriptions A corporation enters into a subscription contract with several subscribers that calls for the purchase of 1,000 shares of $6 par common stock at a price of $13 per share. A $3 per share down payment is required, with the remaining $10 due in one month. Cash 3,000 $6 x 1,000 Subscription Receivable: Common Stock 10,000 Common Stock Subscribed 6,000 Additional Paid-in Capital on Common Stock 7,000 16 Stock Subscriptions The $10 per share final payment was received from subscribers to 950 of the 1,000 shares. Cash Subscription Receivable: Common Stock 9,500 Common Stock Subscribed Common Stock, $6 par 5,700 9,500 5,700 950 x $6 17 Stock Subscriptions When a default occurs, the accounting is determined by the relevant contract provisions, such as-1) Return to the subscriber the entire amount paid in. 2) Return to the subscriber the entire amount paid in, less any costs incurred to reissue the stock. 3) Issue to the subscriber a lesser number of shares based upon the total amount of payment received. 4) Require the forfeiture of all amounts paid in. 18 Stock Subscriptions The subscriber to the 50 remaining shares defaults on the contract. The contract requires the forfeiture of all amounts paid in (Option 4 in Slide 17). Common Stock Subscribed 300 Additional Paid-in Capital on Common Stock 50350 x $6 Subscription Receivable: Common Stock 500 50 x $7 Additional Paid-in Capital from Subscription Default 50150 x $10 19 Combined Sales of Stock A corporation issues 100 packages of securities for $82.80 per package. Each package consists of two shares of $10 par common stock (market value, $16 per share) and one share of $50 par preferred stock (market value, $60 per share). Common Stock: $16 x 2 shares x 100 Preferred Stock: $60 x 1 share x 100 Total market value = $ 3,200 = 6,000 $9,200 20 Combined Sales of Stock A corporation issues 100 packages of securities for $82.80 per package. Each package consists of two shares of $10 par common stock (market value, $16 per share) and one share of $50 par preferred stock (market value, $60 per share). $3,200 Common Stock: x $8,280 $9,200 $6,000 Preferred Stock: x $8,280 $9,200 = $2,880 = 5,400 $8,280 21 Combined Sales of Stock A corporation issues 100 packages of securities for $82.80 per package. Each package consists of two shares of $10 par common stock (market value, $16 per share) and one share of $50 par preferred stock (market value, $60 per share). Cash 8,280 Common Stock Additional Paid-in Capital on Com. Stock Preferred Stock, $50 par Additional Paid-in Capital on Pref. Stock 2,000 880 5,000 400 22 Combined Sales of Stock If only the separate market value of $16 per share for the common stock is known, a corporation assigns a $3,200 ($16 x 2 shares x 100 packages) of the proceeds to the common stock, and allocates the remainder to the preferred stock. Cash 8,280 Common Stock Additional Paid-in Capital on Com. Stock Preferred Stock, $50 par Additional Paid-in Capital on Pref. Stock 2,000 1,200 5,000 80 23 Stock Splits A stock split results in a decrease in the par value per share of stock accompanied by a proportional increase in the number of shares issued. A stock split ordinarily is recorded by a memorandum entry. 24 Stock Splits X Corporation issues a disproportionate stock split in which the reduction in par is not proportionate to the increase in the number of shares. Assume the par is reduced from $10 to $4. Common Stock, $10 par Common Stock, $4 par Additional Paid-in Capital from Stock Split 600,000 480,000 60,000 x $10 120,000 60,000 x 2 x $4 25 Noncompensatory Stock Option Plans The plan has no option Substantially all The discount from features the other than the full-time employees market price does not following: who meet limited exceed the greater of: purchase • The is a employment Employees areprice allowed • The a per-share per-share discount amount based solely on the date qualifications may short time from that of stock would issuance be market price price of theisstock participate in the the purchase set reasonable costs avoided in an byto offer not on the purchase date, plan on an decide whether to and of stockthe issuing to stockemployees to in theare permitted equitable basis. enroll plan, and... stockholders the public. or to cancel their others, or... participation. 26 Compensatory Stock Option Plans Measure Fair Value of Stock Options Use Fair Value on Grant Date Recognize Periodic Cost Allocate over Service Period Continued Report in Financial Statements Income Statement Balance Sheet 27 Compensatory Stock Option Plans Report in Financial Statements Disclose in Notes to Financial Statements • Description of Plan Income Statement • Increase Compensation Expense (in Operating Expenses) Balance Sheet • Increase Contributed Capital (in Stockholders’ Equity) • Information about Options Granted, Exercised, and Outstanding • Other Information 28 Recognition of Compensation Expense On January 1, 2004 Fox Corporation adopts a compensatory stock option plan and grants 9,000 stock options with a maximum life of 10 years to 30 selected employees. The $50 exercise price is equal to the market price of the stock on this grant date. At the end of 2006, a total of 7,500 stock options for 25 employees actually vest and the other 1,500 are forfeited. Fox determines that the fair value of each option is $17.15 on the grant date. Continued 29 Recognition of Compensation Expense Fox multiplies the fair value per stock option times the estimated stock options that will become vested [$17.15 x (9,000 x 0.97 x 0.97 x 0.97)] = $140,871. Memorandum entry: On January 1, 2004 the company granted a compensatory stock option plan to 30 employees. The plan allows each employee to exercise 300 stock options to acquire the same number of shares of the company’s common stock at an exercise price of $50 per share. The option vest at the end of 3 years and expire at the end of 10 years. The estimated value of the stock options expected to be exercised is $140,871. Continued 30 Recognition of Compensation Expense On December 31, 2004, Fox Corporation records the compensation expense by multiplying the $140,871 by the fraction of the service period that expired. Compensation Expense Common Stock Option Warrants 46,957 46,957 $140,871 x 1/3 Continued 31 Recognition of Compensation Expense Based on new estimations, at the end of 2005 Fox Corporation revises total compensation cost to $128,201 [$17.15 x (9,000 x 0.94 x 0.94 x 0.94)]. Two-thirds of $128,201, or $85,467, has expired. Fox previously recorded $46,957 in 2004, so a “catch-up” entry is needed ($85,467 – $46,957 = $38,510). Compensation Expense Common Stock Option Warrants Continued 38,510 38,510 32 Recognition of Compensation Expense On January 5, 2005 one employee exercises options to purchase 300 shares of Fox Corporation’s $10 par common stock. On this date the stock is selling for $90 per share. Fair market value of warrants, $17.15. Cash 15,000 Common Stock Option Warrants 5,145 Common Stock, $10 par 300 x $503,000 Additional Paid-in Capital on Common300 x $17.15 Stock 17,145 33 Performance-Based Stock A performancebased plan is set upOption Plan so that the terms will In other words, the vary depending on better the employee how well the manages the selected employee corporation, the better performs. the terms. 34 Performance-Based Stock Option Plan The terms optionfor plan on theplan increase insame market The thedepends stock option are the as share of Fox’sFox products 3-year service before except grantsover eachthe of the 30 selected period. The terms are as follows eachoptions. employee: employees a maximum of 300for stock 1) If the market share has increased 5 percent, at least 100 stock options will vest on that date. 2) If the market share has increased by at least 10 percent, another 100 stock options will vest. 3) If the market share has increased by more than 20%, all 300 stock options will vest. 35 Performance-Based Stock Option Plan 2004 2005 2006 Estimated (actual) total compensation cost $93,914 $85,467 128,625 Fraction of service period expired x 1/3 x 2/3 x 3/3 Est. compensation expense to date $31,305 $56,978 $128,625 Previously recognized com. exp. (0 ) (31,305 ) (56,978 ) 200 x (30$31,305 employees 200 x (30$25,673 x300 employees 0.97x x25$x71,647 x$17.15 0.94 x Current compensation expense 0.97 x 0.97)0.94 x $17.15 x 0.94) (fair x $17.15 value (fair value per option) per option) 36 Additional Disclosures About a Compensatory Stock Option Plan 1. A description of the plan, including the general terms. 2. The number and weighted-average exercise prices for options granted, exercised, outstanding, forfeited, and expired during the year. 3. The weighted-average grant-date fair values of options granted during the year. 4. A description of the method and assumptions used during the year to estimate the fair values of options. 37 Preferred Stock Characteristics Preference as to dividends. Accumulation of dividends. Participation in excess dividends. Convertibility into common stock. Attachment of stock warrants (rights). Callability by the corporation. Redemption at a future maturity date. Preference as to assets upon liquidation of the corporation. Lack of voting rights. 38 Cumulative Preferred Stock J Corporation has outstanding 1,000 shares of 10%, $100 par cumulative preferred stock and 10,000 shares of $10 par common stock. The dividends are two years in arrears when a $30,000 dividend is declared. Preferred stockholders would receive all of it. 1,000 shares x $100 x 0.10 x 3 years = $30,000 39 Convertible Preferred Stock Z Corporation originally issued 500 shares of $100 par convertible preferred stock at $120 per share. Each share of preferred stock may be converted into four shares of $20 par common stock. Preferred Stock, $100 par 50,000 Additional Paid-in Capital on Preferred Stock 10,000 Common Stock, $20 par 40,000 Additional Paid-in Capital from Preferred Stock Conversion 20,000 Continued 40 Convertible Preferred Stock Alternatively, assume each preferred share may be converted into seven shares of common stock. Preferred Stock, $100 par 50,000 Additional Paid-in Capital on Preferred Stock 10,000 Retained Earnings 10,000 Common Stock, $20 par 70,000 $70,000 – $60,000 7 x $500 x $20 41 Preferred Stock with Stock Warrants (Rights) M Corporation issues 1,000 shares of $100 par value preferred stock at a price of $121 per share. It attaches a warrant to each share of stock that allows the holder to purchase one share of $10 par common stock at $40 per share. Immediately after the issuance, the preferred stock begins selling ex-rights for $119 per share and the warrants for $6 each. Preferred Stock: $119,000 x $121,000 = $115,192 $119,000 + $6,000 Common Stock $6,000 Continued x $121,000 = Warrants: $119,000 + $6,000 $5,808 42 Preferred Stock with Stock Warrants (Rights) All warrants are exercised. Cash Common Stock Warrants Common Stock, $20 par Additional Paid-in Capital on Common Stock 40,000 5,808 $40 x 1,00010,000 35,808 43 Callable Preferred Stock Callable preferred stock may be retired under specified conditions by a corporation at its option. 44 Callable Preferred Stock Y Corporation has outstanding 1,000 shares of $100 par callable preferred stock that were issued at $110 per share and no dividends are in arrears. The call price is $112 per share. Preferred Stock, $100 par 100,000 Additional Paid-in Capital on Preferred Stock 10,000 Retained Earnings 2,000 Cash 112,000 45 Callable Preferred Stock Y Corporation has outstanding 1,000 shares of $100 par callable preferred stock that were issued at $110 per share and no dividends are in arrears. The call price is $105 per share. Preferred Stock, $100 par 100,000 Additional Paid-in Capital on Preferred Stock 10,000 Cash 105,000 Additional Paid-in Capital from Recall of Preferred Stock 5,000 46 Contributed Capital Section Stockholders’ Equity Contributed Capital: Preferred stock, $100 par (9%, cumulative, convertible, 10,000 shares authorized, 4,300 shares issued and outstanding) $ 430,000 Common stock, $5 par (80,000 shares authorized, 32,800 shares issued and outstanding) 164,000 Common stock subscribed, $5 par (3,600 shares at a subscription price of $34 per share) 18,000 Common stock option warrants 23,000 Additional paid-in capital on preferred stock 107,500 Additional paid-in capital on common stock 590,400 Additional paid-in capital from conversion of p.s. 10,100 Total Contributed Capital $1,343,000 47 Treasury Stock Treasury stock is a corporation’s own capital stock that... has been fully paid for by stockholders, has been legally issued, is reacquired by the corporation, and is being held by the corporation for future reissuance. 48 Treasury Stock Cost Method Issuance of 6,000 shares of $10 par common stock for $12 per share. Cash Common Stock $10 par Additional Paid-in Capital on Common Stock 72,000 60,000 12,000 49 Treasury Stock Cost Method Reacquisition of 1,000 shares of common stock at $13 per share. Treasury Stock Cash 13,000 13,000 50 Treasury Stock Cost Method Reissuance of 600 shares of treasury stock at $15 per share. Cash Treasury Stock Additional Paid-in Capital from Treasury Stock 9,000 7,800 1,200 51 Treasury Stock Cost Method Reissuance of another 200 shares of treasury stock at $8 per share. Cash Additional Paid-in Capital from Treasury Stock Treasury Stock 1,600 1,000 2,600 52 Treasury Stock Cost Method Reissuance of another 100 shares of treasury stock at $10 per share. Cash Additional Paid-in Capital from Treasury Stock Retained Earnings Treasury Stock 1,000 200 100 1,300 53 Treasury Stock Cost Method Contributed Capital: Common stock, $10 par (20,000 shares authorized, 6,000 shares issued , of which 100 are being held in treasury) Additional paid-in capital on common stock Total contributed capital Retained earnings Accumulated other comprehensive income Total contributed capital, retained earnings, and accumulated other comprehensive income Less: Treasury stock (100 shares at cost) Total Stockholders’ Equity $ 60,000 12,000 $ 72,000 39,900 10,000 $121,900 (1,300 ) $120,600 54 Treasury Stock Par Value Method Issuance of 6,000 shares of $10 par common stock for $12 per share. Cash Common Stock $10 par Additional Paid-in Capital on Common Stock 72,000 60,000 12,000 55 Treasury Stock Par Value Method Reacquisition of 1,000 shares of common stock at $13 per share. Treasury Stock 10,000 Additional Paid-in Capital on Common Stock 2,000 Retained Earnings 1,000 Cash 13,000 56 Treasury Stock Par Value Method Reissuance of 600 shares of treasury stock at $15 per share. Cash Treasury Stock Additional Paid-in Capital on Common Stock 9,000 6,000 3,000 57 Treasury Stock Par Value Method Reissuance of another 200 shares of treasury stock at $8 per share. Cash Additional Paid-in Capital on Common Stock Treasury Stock 1,600 400 2,000 58 Treasury Stock Par Value Method Reissuance of another 100 shares of treasury stock at $10 per share. Cash Treasury Stock 1,000 1,000 59 Treasury Stock Par Value Method Contributed Capital: Common stock, $10 par (20,000 shares authorized, 6,000 shares issued) Less: Treasury stock (100 shares at par) Common stock outstanding (5,900 shares) Additional paid-in capital on common stock Total contributed capital Retained earnings Accumulated other comprehensive income Total Stockholders’ Equity $ 60,000 (1,000 ) $ 59,000 12,600 $ 71,600 39,000 10,000 $120,600 60 Conceptual Overview of Treasury Stock 1. Treasury stock is not an asset. 2. Treasury stock does not vote, has no preemptive rights, ordinarily does not share in dividends, or participate in the company’s liquidation assets, but does participate in stock splits. 3. Treasury stock transactions do not result in gains or losses. Continued 61 Conceptual Overview of Treasury Stock 4. Treasury stock transactions may reduce retained earnings, but may never increase it. 5. Retained earnings usually must be restricted regarding dividends when treasury stock is held. 6. Total corporate stockholders’ equity is not affected by whether cost or par value method is used. 62 Chapter 15 The End 63