ACCT 3305

advertisement

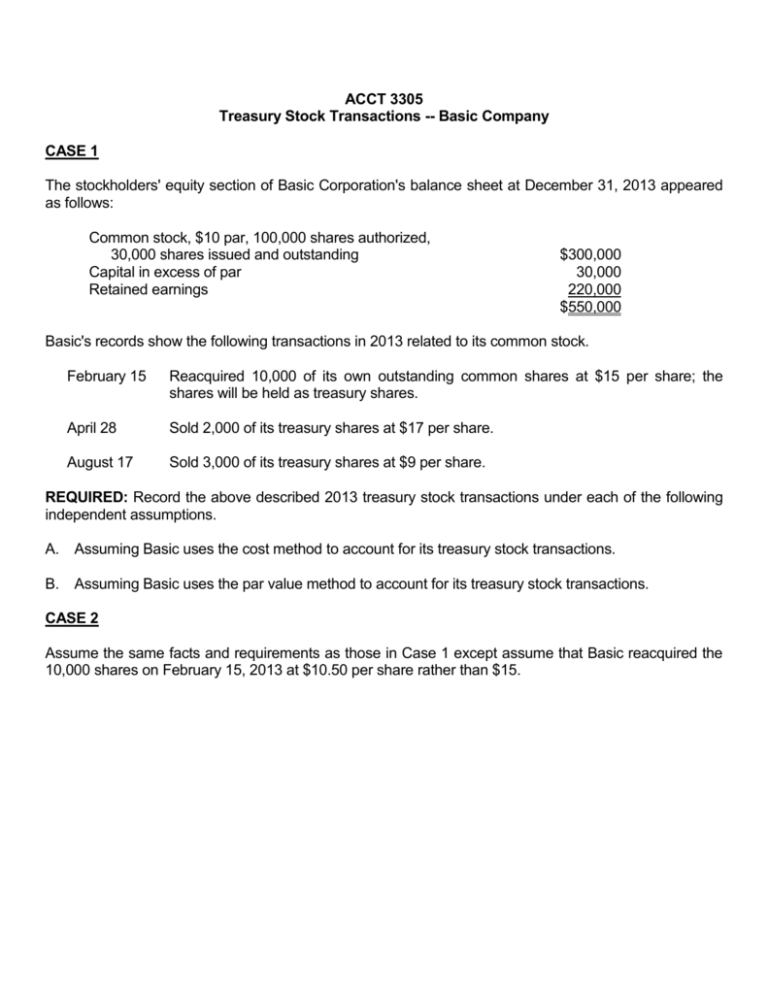

ACCT 3305 Treasury Stock Transactions -- Basic Company CASE 1 The stockholders' equity section of Basic Corporation's balance sheet at December 31, 2013 appeared as follows: Common stock, $10 par, 100,000 shares authorized, 30,000 shares issued and outstanding Capital in excess of par Retained earnings $300,000 30,000 220,000 $550,000 Basic's records show the following transactions in 2013 related to its common stock. February 15 Reacquired 10,000 of its own outstanding common shares at $15 per share; the shares will be held as treasury shares. April 28 Sold 2,000 of its treasury shares at $17 per share. August 17 Sold 3,000 of its treasury shares at $9 per share. REQUIRED: Record the above described 2013 treasury stock transactions under each of the following independent assumptions. A. Assuming Basic uses the cost method to account for its treasury stock transactions. B. Assuming Basic uses the par value method to account for its treasury stock transactions. CASE 2 Assume the same facts and requirements as those in Case 1 except assume that Basic reacquired the 10,000 shares on February 15, 2013 at $10.50 per share rather than $15. ACCT 3305 SOLUTION TO TREASURY STOCK -- BASIC COMPANY CASE 1 COST METHOD Feb. 15 Apr. 28 Aug. 17 TS (10,000 X 15) Cash PAR VALUE METHOD 150,000 150,000 TS (10,000 X 10) APIC (1/3 of 30,000) Retained earnings Cash 100,000 10,000 40,000 Cash TS (2,000 X 15) APIC 34,000 Cash Retained earnings TS (3,000 X 10) 27,000 3,000 TS (10,000 X 10) APIC (1/3 of 30,000) Cash APIC-TS 100,000 10,000 Cash 34,000 TS (2,000 X 10.50) 21,000 APIC-TS 13,000 Cash TS (2,000 X 10) APIC 34,000 Cash 27,000 APIC-TS 4,500 TS (3,000 X 10.50) 31,500 Cash APIC-TS TS (3,000 X 10) 27,000 3,000 Cash TS (2,000 X 15) APIC-TS 34,000 Cash APIC-TS Retained earnings TS (3,000 X 15) 27,000 4,000 14,000 30,000 4,000 150,000 20,000 14,000 30,000 45,000 CASE 2 Feb. 15 Apr. 28 Aug. 17 TS (10,000 X 10.50) 105,000 Cash 105,000 105,000 5,000 20,000 14,000 30,000