chapter 11 part 2

advertisement

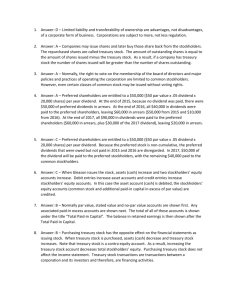

1). ). Madison Motors, Inc., had the following shares outstanding during 2005: (a) Preferred stock, 6%, $50 par value, cumulative, 1,000 shares with dividends in arrears for 2003 and 2004. (b) Common stock, $100 par value, 2,000 shares. a. b. c. d. The total dividends declared for the current year were $21,000. The total amount of dividends to which the preferred stockholders are entitled is $ 3,000. $ 6,000. $ 9,000 $12,000. 2). ). A company declares a 2/1 stock split. Which of the following is true? A) Par value will increase. B) Retained earnings would be decreased and contributed capital would be increased. C) Total stockholders' equity would decrease. D) No assets or liabilities are affected by the split. 3). The balance sheet of Warner Company showed the following data about its common stock, par $1: authorized shares, 5,000,000; outstanding shares, 2,300,000; and issued shares 2,500,000. Therefore, the number of treasury stock shares was A) 0. B) 2,700,000. C) 2,500,000. D) 200,000. 4). The Pottery Barn has the following classes of stock: Preferred stock, 8%, $100 par, 100,000 shares issued and outstanding, cumulative. Common stock, par $5, 100,000 shares issued, 50,000 shares outstanding. The Pottery Barn was incorporated in Delaware and it paid no dividends in its first year of existence. In its second year, the board of directors of The Pottery Barn declared a total dividend of $1,800,000 to be paid to the holders of preferred and common stock. What was the amount of the dividend paid in the second year on each share of common stock? A) $4.00 B) $8.00 C) $1.10 D) $0.55 5). GE buys back 300,000 shares of its stock from investors at $45 a share. Two years later it reissues this stock for $65 a share. The stock reissue would be recorded as: A. An increase to Cash of $19.5 million and a decrease to Treasury Stock of $19.5 million. B. An increase to Cash of $13.5 million, an increase to Additional Paid-in Capital of $6 million, a decrease to Treasury Stock of $13.5 million, and an increase to Stockholders' Equity of $6 million. C. An increase to Cash of $19.5 million, a decrease to Treasury Stock of $13.5 million, and an increase to Additional Paid-in Capital of $6 million D. An increase to Cash of $13.5 million, and a decrease to Stockholders' Equity of $6 million, a decrease to Treasury Stock of $13.5 million, and an increase to Gain on Sale of $6 million. 6). A company sells 1 million shares of common stock with a par value of $0.02 for $15 a share. To record the transaction, the company would: A. Increase Cash for $20,000 and increase Common Stock for $20,000. B. Increase Cash for $15 million and increase Common Stock for $15 million. C. Increase Cash for $15 million, increase Common Stock for $20,000 and increase additional paid-in Capital for $14,980,000. D. Increase Cash for $20,000, increase Capital Receivable for $14,980,000, increase Common Stock for $20,000 and increase additional paid-in capital for $14,980,000. 7). A company had 1,500,000 shares of its $.20 par value common stock issued and outstanding when the Board of Directors declared a 40% stock dividend. The market price of the stock on the declaration date was $45 per share. How did the stock dividend affect stockholders’ equity? A) Common Stock increased $120,000. B) Retained Earnings decreased $27,000,000. C) Additional Paid-in Capital increased 26,880,000. D) Total stockholders’ equity increased $5,400,000.