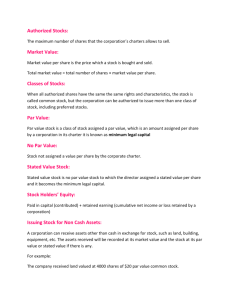

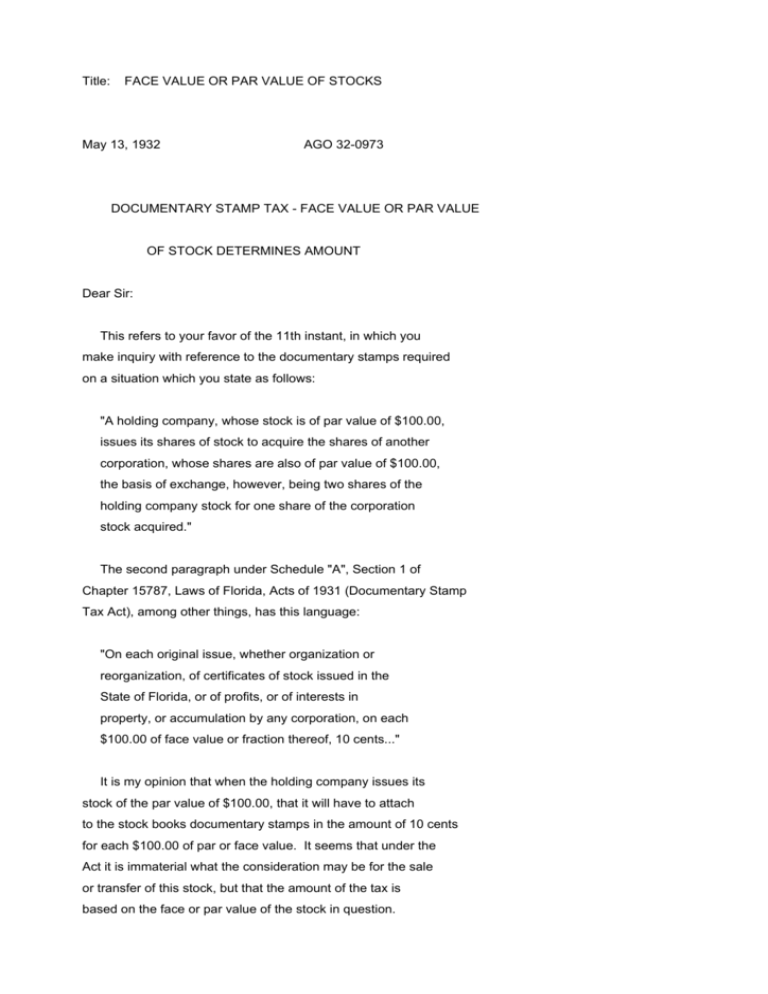

Title: FACE VALUE OR PAR VALUE OF STOCKS May 13, 1932

advertisement

Title: FACE VALUE OR PAR VALUE OF STOCKS May 13, 1932 AGO 32-0973 DOCUMENTARY STAMP TAX - FACE VALUE OR PAR VALUE OF STOCK DETERMINES AMOUNT Dear Sir: This refers to your favor of the 11th instant, in which you make inquiry with reference to the documentary stamps required on a situation which you state as follows: "A holding company, whose stock is of par value of $100.00, issues its shares of stock to acquire the shares of another corporation, whose shares are also of par value of $100.00, the basis of exchange, however, being two shares of the holding company stock for one share of the corporation stock acquired." The second paragraph under Schedule "A", Section 1 of Chapter 15787, Laws of Florida, Acts of 1931 (Documentary Stamp Tax Act), among other things, has this language: "On each original issue, whether organization or reorganization, of certificates of stock issued in the State of Florida, or of profits, or of interests in property, or accumulation by any corporation, on each $100.00 of face value or fraction thereof, 10 cents..." It is my opinion that when the holding company issues its stock of the par value of $100.00, that it will have to attach to the stock books documentary stamps in the amount of 10 cents for each $100.00 of par or face value. It seems that under the Act it is immaterial what the consideration may be for the sale or transfer of this stock, but that the amount of the tax is based on the face or par value of the stock in question. Very respectfully yours, CARY D. LANDIS, Attorney General.