Personal Finance and Economics

advertisement

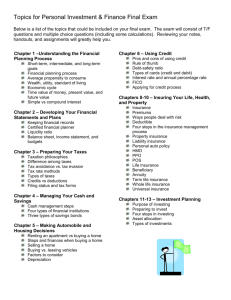

PERSONAL FINANCE AND ECONOMICS Chapter 20 Managing Your Money Section 1 Consumer Rights Consumers have rights, or protections, in the free enterprise system. A consumer is someone who buys a good or service. Two Types of Income Consumers have two types of income to spend: – Disposable Income: money left after taxes are paid – Discretionary Income: money left after bills are paid and after all necessities have been bought and paid for Protecting Consumer Rights Consumerism: a movement to educate buyers about the purchases they make and to demand better and safer products from manufacturers – Laws (ex. Pure Food and Drug Act) – Private groups (Better Business Bureau) Consumer Bill of Rights – Right to a safe product – Right to be informed – Right to choose – Right to be heard – Right to redress Consumer Responsibilities Consumers have responsibilities as well as rights. Smart Buying Strategies – Gather information – Use advertising carefully – Determine the best value – Comparison shopping is a buying strategy to get best buy for the money – Look at brand name and generic items – Balance costs and benefits Other Responsibilities – – – – – Initiate problem-solving process for faulty goods or services Keep warranty information A Warranty is the promise made by a manufacturer or a seller to repair or replace a product within a certain time period if it is faulty Respect rights of producers and sellers Report problems to government when a settlement cannot be reached Making Buying Decisions Buying a product or service costs more than money; it also costs the time it takes to make the purchase and the opportunity cost of not buying something else. Making Buying Decisions Many factors are involved in consumers’ buying decisions. Steps: – Decide whether to buy an item or not – – Invest time obtaining product information Balance opportunity cost Planning and Budgeting Section 2 Making a Budget and Sticking To It! A budget is a record of money earned and spent to help you match expenses to income. Basic Budgeting Terms – – – – – Income is money received from labor, business, or property Expenses is money spent on goods and services Balance: leftover money Surplus: More income than expenses (good) Deficit: More expenses than income (bad) How To Make A Budget List what you spend. Record what you earn. Analyze the data. Try to have surplus. Monitor spending. Credit Credit can be a valuable item in your financial toolbox; however, as with all tools, you have to know how to use it correctly. Credit Credit is money borrowed to pay for a good or service Credit allows consumers to receive a good or service and pay for it later. Recognizing Credit Terms – – – – – – A lender gives money to a borrower. A lender charges interest, expressed as the annual percentage rate (APR). APR is the annual cost of credit expressed as a percentage of the amount borrowed A credit rating evaluates how well the borrower will repay the loan. The borrower may pledge collateral for the loan. Collateral is property or valuable item serving as security for a loan Sources of Credit – – – – Usually require down payment Banks, savings and loans, credit unions, finance companies offer credit Most common—credit cards Can charge high interest rates Benefits of Credit Allows you to get what you want sooner Teaches financial discipline Drawbacks to Credit Spending more than you can afford Bankruptcy is the inability to pay debts Poor credit rating Your Responsibility As A Borrower – – – Have a plan to make payments Use budget skills Understand credit agreement Saving and Investing Section 3 Saving For The Future To save is to set aside income for later use. Why Save? – Money for large purchases – Emergency aid – Luxuries – Benefits the whole economy Saving Regularly – – – – Automatic deposits into savings accounts Budgeting for savings Earning interest by saving through financial institutions Interest is the payment people receive when they lend money or allow someone else to use their money Deciding About Your Saving – Trade-offs: Less to spend today More to spend tomorrow Types of Savings Many ways exist for people to save portions of their incomes. Savings Accounts Savings accounts – Earn low interest on principal – Financial institutions loan the money to others Checking Accounts Checking Accounts – Money for purchases – – Must keep careful records Debit cards allow paperless money transfer Money Market Accounts – Money Market Accounts Allows you to write checks, like a checking account Pays interest like a savings account Certificates of Deposit – Certificates of Deposit Type of time deposit Agreement to leave money in financial institution for a set amount of time Investments Making wise investments in a variety of stocks and bonds is an important part of achieving long-term financial goals. Investing in stocks and bonds leads to higher returns than other types of savings. Returns is the profit earned through investing Stocks – Shares of stock provide partial ownership in a company – A stock is an ownership share of a corporation – Stock prices may go up or down, based on company performance. – Investors may earn dividends. – Dividend is the payment of a portion of a company’s earnings – Higher possible return, but at greater risk Bonds – – – – A bond is a contract to repay borrowed money with interest at a specific time in the future Loans money to company or government Pays set rate of interest over several years U.S. government bonds are a very safe investment. Mutual Funds – – – – Mutual Funds are pools of money from many people who are invested in a selection of individual stocks and bonds chosen by financial experts. Pools money to invest in different stocks and bonds Chosen by financial experts Less risk than investment in individual stocks Achieving Your Financial Goals Section 4 What Kind Of Spender Are You? Careful spenders avoid pitfalls, such as impulse buying, on their way to meeting their financial goals. Impulse buying is purchasing an item on the spot because of an emotional rather than planned decision Setting financial goals can help you spend money wisely. Evaluate your spending to help you meet financial goals. Impulse Buying Beware of impulse buying. – Try not to buy too quickly based on emotions. – – Some impulse-buying is okay. Too much is bad. Follow guidelines to avoid too much impulse buying. Your Goals and Your Buying Decisions The buying decisions you make can have a major impact on your life and career choices. Consider goals when buying items. Now or Later? Long-term goals can conflict with short-term goals. Must balance long and shortterm goals. Long-term planning can improve finances down the road (e.g., saving for college will lead to higher income later) Chapter Summary Buying Strategy Making consumer decisions involves deciding the following: • whether to spend your money • what you will purchase • how to use your purchase Comparison shopping involves making comparisons among brands, sizes, and stores. Consumerism Consumer Rights Include: the right to safety the right to be informed the right to choose the right to be heard the right to redress Budget • • A budget is an organized plan for spending and saving money. What you do with the information in a budget is up to you. No one can force you to spend less and save more unless you want to. Credit • • When buying on credit, the amount you will owe is equal to the principal plus interest. Financial institutions that provide credit include commercial banks, savings and loan associations, and credit unions. Saving and Investing • • • It is important to get into the habit of saving. Individuals have many places to invest their savings, including savings accounts and certificates of deposit. Shares of stock entitle the buyer to a certain part of the future profits and assets of the corporation that is selling the stock.