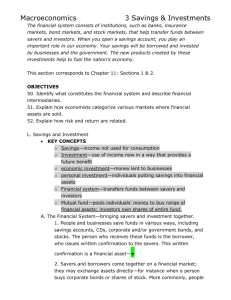

Sec1.SavingsAndInvestment

advertisement

FrontPage: NNIGN From his studio in Buenos Aires, Photoshop wizard Martín De Pasquale creates all kinds of digital wonders and illusions. His work is witty and full of surreal flourishes, from invisible bicycles to lawn mowers cutting away a man’s beard. The human body is where he is most effective, transforming the everyday into the fantastic. The Last Word: No homework Savings and Investment Chapter 11: Financial Markets Sections 1 and 2 Savings and Investment: Savings is income not used for consumption. Investment is the use of income today that allows for a future benefit. Savings and Investment: The Financial System The financial system, which consists of institutions such as banks, insurance markets, bond markets, and stock markets, allows for the transfer of funds between savers an investors. Financial Intermediaries Sometimes savers and borrowers come together directly in a financial market. However, many transactions involve a financial intermediary, an institution that collects funds from savers and invests them in financial assets. Financial intermediaries can include commercial banks, S&Ls, and credit unions. Other common intermediaries: a mutual fund – an investment company that gathers money from individual investors and purchases a range of financial assets. The Financial System Savings and Investment: Pension Funds A pension fund – allows employees to save for retirement sometimes with the help of their employer; the fund pools together contributions and invests them in order to provide workers more money when they retire. Financial Asset Markets Economists classify markets based on 2 factors: Time, and Whether financial assets can be resold. Based on time, there are: The capital market – the market for buying and selling long-term financial assets (ex. stocks, bonds, mortgages) The money market - the market for buying and selling short-term financial assets (ex. short term CDs, Treasury bills) Financial Asset Markets Based on resalability, there are: The primary market – the market for buying newly created financial assets directly from the issuing entity. (ex. savings bonds, small denomination CDS) The secondary market - the market where financial assets are resold (ex. stocks, bonds) Investing in a Market Economy: Why are you investing? When investing, it is important to define your own investment objective – a financial goal used to determine if an investment is appropriate. It should consider: Time: short-term vs. long term goal Income: how much can be invested? Investing in a Market Economy: Risk and Return Once an investor defines their financial objective, they need to consider the risk and return involved in an investment. Risk is the possibility for loss on an investment. Return is the profit or loss made on an investment. Investing in a Market Economy: Risk and Return Risk and return have a direct relationship – the higher the risk of the investment, the greater the possible return. Ex. US Govt. Bonds – low risk, low return Stocks – high risk, high return Most investors try to balance risk and return through diversification, the practice of distributing investments among different financial assets to maximize return and limit risk. Calculating Interest