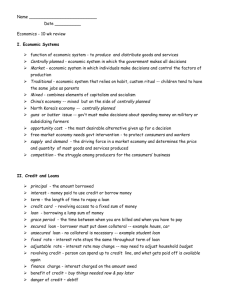

etail banking concepts

advertisement

CONTENTS 1.1 1.2 1.3 Overview Objective Products/Services Operative account Non operative account Miscellaneous services 1.4 Instruments of operative account 1.5 Types of operative account 1.6 Savings account –definition /facilities 1.7 Types of flexi deposit 1.8 Current account –definition/facilities 1.9 Advances- definition /types 1.10 Cycle of operative account 1.11Types of non operative account 1.12 Types of deposits 1.13 Cycle of non operative account 1.14 Types of loans 1.15 Cycle of loans 1.16 Types of miscellaneous services Overview Retail Banking denotes catering to the requirements of retail customers viz..individuals,professionals,self employed etc. Retail banking has seen a transformation over the past two decades with respect to business focus, delivery channel emphasis and the overall approach to the banking business. Today, given the greater stress being placed on mass customisation, banks are increasingly relying on technology to provide customised solutions to consumers. Objective Of Retail Banking • The objective of the Retail Bank is to provide its target market customers a full range of financial products and banking services, giving the customer a one-stop window for all his/her banking requirements. The products are backed by world-class service and delivered to the customers through the growing branch network, as well as through alternative delivery channels like ATMs, PhoneBanking, NetBanking and MobileBanking. Products/Services Offered • Operative accounts • Non operative account • Miscellaneous services Operating account The Main services offered in this sector are : • Savings account 1. Flexi deposits – Auto sweep – Reverse sweep • • Current account Advances Instruments of operative accounts • • • • Cheques Demand drafts Managers cheques Cash Savings account A minimum quaterly balance needs to be maintained in this type of account.The minimum balance criteria differs from bank to bank. Non Maintenance of minimum balance in the account attracts a quarterly fee which again is determined by the bank and varies for each bank Facilities offered for Savings account Debit-cum-ATM card Auto Invest Account Internet Banking Phone Banking Anywhere Banking Standing instructions Doorstep service Flexi Deposit There are two types: 1) In a savings account,the amount held over and above the prescribed minimum balance would be automatically put in a term deposit earning higher return for customer.This is termed ‘AUTO SWEEP’ Auto Sweep Eg : If ‘A’ hold an savings account with bank ‘ABC’ where the minimum balance is Rs 5000.If ‘A’ has a balance of Rs 6000 in his account the remaining 1000 ( 6000-5000) will be automatically put in a term deposit. Reverse Sweep Whenever the customer issues a cheque which brings down his savings account balance below the prescribed limit,the shortfall amount will be automatically taken from the term deposit.This is called ‘reverse sweep’. Reverse sweep Eg : Considering the pervious example of ‘A’ where Rs 1000 from his account is held as term deposit.If ‘A’ has issued a cheque for Rs 1000,when this cheque debits his account his balance reduces to rs4000 which is below the minimum limit of Rs5000.In such a case Rs 1000 which was held in term deposit gets adjusted to savings account to bring back the saving account minimum balance to Rs 5000 Flexi Deposit 2)The fixed deposit of a customer is held in units of 1000 or so as prescribed by the bank.In case of need the customer can withdraw part amount of deposit without closing the deposit. In case of fore-closure,the deposit would earn interest at rates applicable for the period run without any penalty. Flexi Deposit Eg :If ‘A’ holds a deposit of Rs 10000 with bank ‘ABC’ broken into units of 1000 for a period of 6 months.Incase he withdraws Rs 700 after 3 months. Cal: He will earn interest for Rs 10000 for 3 months.When he withdraws Rs 700 from his account the deposit is broken and Rs 1000 is moved to savings account.The remaining 9000 will earn interest for the remaining time period. Current Account • What is Current account? • A running account supporting unlimited withdrawals and deposits • A current account is meant for convenience and not to save money Facilities offered for current account • • • • • • • • • • • Unlimited Withdrawal and Deposit Unlimited Cheque book Demand Drafts and Payorders Funds Transfer ( Local or Anywhere) Collection of Cheques/ Drafts Statements,Advices, Daily statement by e-mail Cash withdrawal and Deposits Multicity Cheque payment facility Anywhere Banking facility Doorstep Banking - Pick up and delivery of Currency / Cheque Mobile Banking STANDING INSTRUCTIONS • STANDING INSTRUCTIONS Standing instructions can be given to the Bank for transfer/remittance of funds from one account to other account/s maintained in the same branch, any other branch of the Bank or any other bank or any other third party Advances • An advance is a credit facility provided by the bank to its customers. It differs from loan in the sense that loans may be granted for longer period, but advances are normally granted for a short period of time. Further the purpose of granting advances is to meet the day-to-day requirements of business. The rate of interest charged on advances varies from bank to bank.Interest is charged only on the amount withdrawn and not on the sanctioned amount. Advances • Bank has a very wide bouquet of types of credit facilities which can be tailor-made to suit customer specific requirements. In a nutshell, the Bank offers : Types of Advances • Cash Credit • Over draft • Discounting of bills Cash Credit • Cash credit is an arrangement whereby the bank allows the borrower to draw amount upto a specified limit. The amount is credited to the account of the customer. The customer can withdraw this amount as and when he requires. Interest is charged on the amount actually withdrawn. Cash Credit is granted as per terms and conditions agreed with the customers. Overdraft • Overdraft is also a credit facility granted by bank. A customer who has a current account with the bank is allowed to withdraw more than the amount of credit balance in his account.It is a temporary arrangement. Overdraft facility with a specified limit may be allowed either on the security of assets, or on personal security, or both Discounting of Bills • Banks provide short-term finance by discounting bills, that is, making payment of the amount before the due date of the bills after deducting a certain rate of discount. The party gets the funds without waiting for the date of maturity of the bills. In case any bill is dishonoured on the due date, the bank can recover the amount from the customer. Advances • What is the minimum & maximum period for which customer can avail advance from the Bank? • The Minimum period for which an advance may be sanctioned starts is one day. The maximum period for which an advance can be sanctioned depends upon:- • The Debt Service Capacity of the borrower reckoned from the cash flow from the business operations; and, • The purpose of the advance Cycle of Operative account • Origination • Service • Closure Application Operative Account Origination Scrutiny & Account opening & verification maintenance Applicant should submit Verify and check validity Account opening of documents form provided Address proof Communication Welcomepack Account opened Cheque book printing Mapping of signature With debit card, cheque book, details of Account sent to customer Identity proof Self cheque or cash for minimum balance SERVICING OPERATIVE ACCOUNT Transactions Fee & Charges Interest Reportin g Customer Relations Deposit Withdrawal Frequent Withdrawals Balances overdraws Periodic account statements Transaction profile statement Transfers Issue of Cheque books/ Account statements Standing Instructions Duplicate Records Bill payments Returned Cheques Issue of cheque books Cancellation of Drafts Account statements Account closure Addition/ Changes to account holders Addition/ Changes to groups Regulatory Reporting CLOSURE OF OPERATIVE ACCOUNT Request Processing Administration Closure Customer request for closure Striking balance Collection of unused cheques Closing of accounts Banks decision to close Status on - Standing instructions - Uncleared cheques inward - Uncleared cheques outward Cancellation of authorization - ATM - Phone - Online Repayment of balance Transfer to Nonoperative account Special conditions - Lien - Approvals Fee/ Charges Removal of accounts Non operating account • Deposits • Loans Deposit Services They can be broadly classified as • Fixed deposit • Recurring deposit Deposit Services The products or features offered by banks under these categories varies from bank to bank Mentioned below are a few of such products offered by banks Fixed Deposits Fixed Deposits impose a Simple Interest Formula on the Principle amount deposited by the customer. Interest can be paid Quarterly, SemiAnnually or Annually as req. by customer. Recurring/Monthly Deposits • Every month the Customer Pays the Installment which is fixed in the beginning. • For Preclosure a Penalty of 1% -2 %is Charged. Cycle of Non operating Account • Origination • Servicing • Closure Application Non Operative Account Origination Scrutiny & Opening Of verification Provide the following Request form Deposit Validity of documents Certifcate of Deposit opened,details Of maturity maintained Proof of indentity Cheque or cash for On system Amount to be Deposited PAN details or Form 60 for Communication Deposit Despatched Stating maturity Date ,rate of If existing customer And holds account, Beyond deposit of Mapped to customer Rs 50000 Savings account Interest and Amount to be Earned end of tenure Non Operative Account Servicing Transctions Fee & Charges Interest Collect monthly deposit For recurring deposit Movement for funds To savings account Loss of interest Quarterly interest Monthly Accrued to account Statements with For recurring deposit Interest Calculations For reverse sweep For fixed deposit Withdraw of funds Loss of interest From Issue of duplicate Deposit receipt Reporting quarterly,semi Annually or annually Nominal charge Non Operative Account Closure Request On Maturity Processing If no confirmation Received from Customer The deposit gets Preclosure Payment The principal plus Closure Certificate of Interest earned during Deposit recovered The tenure And deposit closed Renewed for another By issuing demand Same tenure draft Recover penalty Certificate of Fee for recurring Deposit Principal plus interest Deposit recovered For the period when And deposit closed The funds where held Issuing demand Renew Change maturity date Pay interest or reinvestdraft On system As desired by customer LOANS AND ADVANCES HOME LOAN • AUTO LOAN 1. TWO-WHEELER LOAN • 2. CAR LOAN • • EDUCATION LOAN • PERSONAL LOAN • CONSUMER LOAN • LOAN AGAINST SECURITIES - DEPOSITS, SHARES • • Housing loan • • • • Housing loans are referred to the loans provided by the banks for the following purposes For construction/purchase of flat/house Repairs/Renovation of existing house/flat Purchase of flat/house resold Purchase of land Home Loan The criteria for providing housing loans differs from bank to bank. The eligibility is mainly for Individuals Salaried class,businessmen, professionals with minimum period of service Age – Upto 50-55 years Housing loan sanction The loan amount will be calculated based on the value of property the customer is going to buy and also based on the earnings of the customer. The loan amount would be 36 times gross salary or 60 times net salary of the customer which ever is higher.Spouse income also considered Margin: 15% on total project cost ( cost of land + cost of construction) 30% - For repairs Housing loan Interest Rate There are 2 options • Fixed rate • Floating rate The rate also varies with the tenure selected by customer.There is maximum of 20 years tenure offered by banks Housing loan Repayment • Repayment period: For purchase/ construction: 20 years EMI. For repairs/ renovation : 10 years EMI. • Processing Fee: 0.5% to 1% from bank to bank. • Security: Mortgage of house to be purchased. Cycle of a housing loan • • • • • Origination Verification Sanction Disbursal Closure ORIGNIATION OF HOUSING LOAN Application Eligibility Criteria Margin Documentation •You must be at least 21 If customer has identified property to Be purchased years of age when the loan is sanctioned. Customer contribution Submit housing loan application •The loan must terminate •15% for new house/ flat before or when you turn •20% for old house/ flat •20% for repairs and 65 years of age or before renovation retirement, whichever is earlier. •You must be employed or self-employed with a regular source of income Details on next slide Documents for housing loan origination • • • • • • • • • • • • • Passport size photograph Proof of residence (This applies only to new or non-bank customers, and could be either a PAN identity card, voter identification card or passport) Sale Deed/ Agreement of Sale Bank account Statement or passbook, for the last six months For employees or people in service, you also need to provide: Salary certificate and other information, if any, about your repayment capacity Form 16 or a copy of the Income Tax Returns for the last 2 years For self employed and other IT assessees: IT returns for the last 3 years· Receipts of advance tax paid Any other information about your repayment capacity In addition to the above mandatory documents, you are also required to furnish one or more of the following documents wherever applicable:· Letter of allotment from the housing board or society Copy of the approved plan Permission for construction Copy of the relative order in the case of conversion of agricultural land. (not required where the house/flat has been constructed by an approved builder) Documents for Housing loan • Additional documents required for an old house/flat : • In the case of an old existing house, you will need to get a valuation certificate from approved valuers as well as a certificate from a government approved architect /structural engineer regarding the condition of the flat/house as well as its remaining life. Housing loan Origination Customers who have not identified the property to be bought : In-principle approval Banks give in-principle approvals based on the customer income and capacity to repay, to enable them to identify a house/ flat with full confidence. All loans are at the sole discretion of the Bank. Customer needs to identify the property within 3 months from the loan being sanctioned Verification & Processing of Housing loan • • • • • Stages in verification & processing Scrutiny of the application and documents Verification Processing charges Sanctioning of loan Disbursal of loan Housing loan Verification & Processing SCRUTINY VERIFICATION SANCTION DISBURSAL Check credit Verify the property Collect Post dated Demand draft is worthiness To ascertain the Cheques,ECS, Issued to the of customer Market value Standing instruction Builder or seller of from Customer The property after for EMI Default Verify the validity of documents Collect 0.5-1% Processing charge blacklisted The customer Shows proof for his margin 80-90% of the value Of the property Any other loans held Ascertained by the Bank is sanctioned Contribution Closure of Housing Loan Request Loan tenure completed Customer defaults payments and bank fore closes the Loan Closure Loan account closed and documents pertaining to The property returned to the customer. Bank has the authority to sell the property and to Recover its dues from the sale proceeds.Amount Left after bank dues are covered is returned back To customer and loan account is closed ,post dated Cheques returned Customer request for foreclosure Recover complete dues from customer and return The property documents.Bank charge a foreclosure Charge and closed loan account Customer request another bank to take Over the existing housing loan Banks receive the outstanding balance from another Bank taking over the loan and returns the property Document to the bank taking over the loan Foreclosure charges are paid by the bank taking over The loan.Loan is closed once all settlements are done Auto Loan Auto loan are provided by the banks to Customer for the following purposes To buy : • A new car, jeep or Multi Utility Vehicles (MUVs) (any make or model) • An old car / jeep / MUV (not more than 4 years old). (any make or model) Eligibility for Auto loan • A Permanent employee of State/Central Government, Public Sector Undertaking, Private company or a reputed establishment or • A Professionals or self-employed individual who is an income tax assessee or • A Person engaged in agriculture and allied activities. Auto loan amount criteria • There is no upper limit for the amount of a car loan. It is limited only by your repaying capacity. A maximum loan amount of 2 times the net annual income can be sanctioned. If married, your spouse's income could also be considered provided the spouse guarantees the loan • The loan amount includes finance for onetime road tax, registration and insurance Margin for Auto loan • Margin • New vehicles10-15% when loan is upto Rs.4 lacs • 15-20% when loan exceeds Rs.4 lacs • Old vehicles 20-30%for vehicles upto 2 years old • 30-40% for vehicles 2-4 years old Repayment options • Repayment period for new vehicles : Maximum of 84 months • Repayment period for old vehicles : Maximum 60 months for vehicles upto 2 years old ; Maximum 36 for vehicles which are 2-4 years old • You may prepay at will with no prepayment penalty whatsoever. Interest Rates on Auto Loans 2 options • Fixed rate • Floating rate Fixed Rate of Interest • In the case of a fixed rate loan, the interest rate on the loan will remain fixed through the entire tenure of the loan Floating Rate of Interest • In the case of a floating rate loan, the interest rate could decline or rise in line with the changes in the Bank's Medium Term Lending Rate Loan Terms Hypothecation: When a property is hypothecated to a bank it means the original documents pertaining to the property will be held with the bank until the loan amount is completely repaid by the customer. An authority given to a banker, usually a letter of hypothecation to enable the bank to sell goods that have been pledged to them as security for loan. Life cycle of a Auto Loan • Origination • Process & Sanction • Recovery & closure ORIGNIATION OF AUTO LOAN Application Eligibility Criteria Margin Documentation Loan to Value of the vehice Submit auto loan application (LTV). Age of the Borrower (There Customer contribution New vehicle is a minimum and 10-15 % upto 4 lacs Maximum age limit). 15-20% above 4 lacs Tenure of the Loan. Employment Period (balance years in service for the person borrowing). Collateral Requirements (normally the vehicle for which the loan is taken is kept as a collateral with the financier Old vehicle 20-30% upto 2 yrs old 30-40% for 2-4 yrs old Details on next slide Documentations • The Documents required for a Salaried Individual a. Proof of Income - latest 2 attested salary slips with TDS certificate/Form 16. b. Proof of Residence - Ration Card/Driving License/Voter Icard/Electricity Bill/Insurance Policy. c. Banking History - photocopies of the bank statement showing last 3-months transactions. d. Photographs. e. Proof of Identity - Passport Copy/Voter's I-card/Driving License/Employer's Card. f. Signature verification from the bank. Documentation • The Documents required for a Self-Employed Individual a. Balance sheet and P&L account for the last 2 years certified by an Auditor. b. Acknowledged copy of IT Returns for the last 2 years. c. Proof of Residence - Ration Card/Driving License/Voter Icard/Electricity Bill/Insurance Policy/Telephone Bill. d. Banking History - photocopies of the bank statement showing last 3-months transactions. e. Photographs. f. Proof of Identity - Passport Copy/Voter's I-card/Driving License/Employer's Card. g. Signature verification from the bank. h. Sole Proprietorship Declaration on the letterhead Auto loan Verification & Processing SCRUTINY VERIFICATION SANCTION DISBURSAL Check credit Verify the address Collect Post dated Demand draft is worthiness And office of Cheques,ECS, Issued to the of customer customer Standing instruction from Customer seller of The vehicle after for EMI Default Verify the validity of documents Collect 0.5-1% Processing charge blacklisted Shows proof for his margin Sanction 80-90% of Any other loans held The customer The value of vehicle Contribution Closure of Auto Loan Request Loan tenure completed Closure Loan account closed and documents pertaining to The vehicle returned to the customer. Customer defaults payments and bank fore closes the Loan Bank has the authority to sell the vehicle and to Recover its dues from the sale proceeds.Amount Left after bank dues are covered is returned back To customer and loan account is closed ,post dated Cheques returned Customer request for foreclosure Recover complete dues from customer and return The vehicle documents.Bank charge a foreclosure Charge and closed loan account Education loan • These loans are specifically offered for the pursuit of academics in recognized schools, colleges and various other educational institutions, both in India and abroad. You may avail of this loan facility to meet: Eligible Courses • Graduation courses/ Post graduation courses/ Professional courses • Other courses leading to diploma, degree etc. conducted by colleges, universities approved by UGC/ Government/ AICTE etc. Education Loan • • • • • • • Expenses considered for loan Fees payable to college/school/hostel Examination/Library/Laboratory fees Purchase of Books/Equipment/Instruments/Uniforms Caution Deposit/Building Fund/Refundable Deposit Travel Expenses/Passage money for studies abroad Purchase of computers considered necessary for completion of course • Cost of a Two-wheeler upto Rs. 50,000/- Education Loan Amount • Loan Amount • For studies in India, maximum Rs. 10 lacs • Studies abroad, maximum Rs. 20 lacs • • • • • Margin For loans up to Rs.4.0 lacs : No Margin For loans above Rs.4.0 lacs: The Margins are as under: In the case of Education in India, the margin is 5% In the case of Education Abroad, the margin is 15% No processing fee/ upfront charges Education loan Interest Loans up to Rs.4 lakh may be advanced at interest rate not exceeding PLR of the bank. Above Rs.4 lakh, the interest rate may be PLR+1% Repayment method • The repayment would begin one year after the course period or six months after you get a job, whichever is earlier. You are expected to pay a minimum amount equivalent to the EMI on a monthly basis. However, you can choose to pay more than the EMI, and we do not charge any prepayment penalty. ORIGNIATION OF EDUCATION LOAN Application Eligibility Criteria Margin Documentation Should be an Indian National Existing Customer Submit form Secured admission to professional/ technical courses through Entrance Test/ Customer contribution Upto 4 lacs – No margin Above 4 lacs- 5% india 15% abroad Selection process Secured admission to foreign New Customer Submit form Provide guarantor details university/ Institution Details on next slide Education loan documents • You will need to furnish the following documents along with the completed application form. Relevant information would relate to the guardian and the student both, when the loan is jointly taken. · Mark sheet of last qualifying examination for school and graduate studies in India · Proof of admission to the course · Schedule of expenses for the course · Copies of letter confirming scholarship, etc. · Copies of foreign exchange permit, if applicable. · 2 passport size photographs · Statement of Bank account for the last six months of borrower · Income tax assessment order not more than 2 years old · Brief statement of assets and liabilities of borrower If you are not an existing bank customer you would also need to establish your identity and give proof of residence. Education loan Verification & Processing SCRUTINY VERIFICATION SANCTION DISBURSAL Check credit Verify the address Collect Post dated Demand draft is worthiness And office of Cheques,ECS, Issued to the of customer / Customer/guarantor Standing instruction Educational from Customer guarantor for EMI Verify the validity of Default blacklisted Documents No Processing charge Sanction loan based On margin Any other loans held institute Closure of Education Loan Request Loan tenure completed Customer Request for foreclosure Closure Ensure all dues are recovered and account closed No prepayment charges.Recover all dues and Close customer account.Return post dated cheques Personal loan • To meet any kind of personal expenses, e.g., marriage, family functions, medical, educational, travel expenses, etc. Personal loan Eligibility • • • • • A State/Central Govt. Employee, employee of public sector undertaking/reputed profit making public limited company, reputed institutions, MNC with a minimum service experience of 2 years. A self employed engineer, doctor, architect, chartered accountant, MBA, with a minimum 2 years standing. You should be 60 years of age or less. A Pensioner of PSU/Govt. (Central/State)/Public Sector Bank who has taken premature voluntary retirement and is 60 years of age or less Agents of insurance/KVP/Mutual funds etc. with 3-5 years standing who are tax assesses and whose gross annual income exceeds Rs. 2 lacs. Traders, who have cash flows to repay the loans and can provide adequate tangible collateral security. They should restrict their banking requirements to the branch where the loan is proposed to be taken. Personal Loan amount • Loan Amount Your personal loan limit would be determined by your income and repayment capacity. • Minimum : Rs.24,000/Maximum : 12 times Net Monthly Income for salaried individuals and pensioners and 1 year's net annual income in case of self employed professionals with the under noted ceilings; Additionally, your spouse's income can be considered in calculating the loan amount provided he/she guarantees the loan or the loan is taken jointly. Salaried individuals and self employed professionals : Rs.2.50 lacs (Rs.5.0 lacs in select Metros and can be further increased to Rs.10.0 lacs under certain conditions) For pensioners : Rs.1.5 lacs For Traders : Rs.1.0 lac Documents Required • Documents Required • Important documents to be furnished while opening a Personal Loan Account: For existing bank customers: • Passport size photograph. From salaried individuals • Latest salary slip and Form 16 From Self-employed individuals and Professionals • IT returns for the last two financial years, • Proof of Professional Qualification : Copy of highest professionals degree held • Proof of official address.This can include shop and establishment certificate/Lease deed/Telephone Bill. Repayment • The loan is repayable in 48 EMI. You are allowed to pay more than the EMI if you wish to, without attracting any prepayment penalty. Processing Fee : • Processing charges are 1 per cent of the loan amount. This is amongst the lowest fees in the industry. Processing fees have to be paid upfront. There are no hidden costs or other administrative charges ORIGNIATION OF PERSONAL LOAN Application Existing Customer Eligibility Criteria Salaried Individuals Self Employed Individuals Submit form New Customer Submit form Provide guarantor details Address proof Salary proof Documentation For 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. For 1. 2. 3. 4. 5. Salaried Individuals Application Form Photograph Proof of date of birth Proof of Residence Salary Slip for last few months Proof of work experience Bank Statement for last few months (where the salary is credited or deposited) Form 16 Signature Verification Upfront Processing Fee Cheque (in case of some lenders) Self-Employed Individuals Application Form Photograph Proof of date of birth Proof of Residence Profit and Loss account and Balance Sheet attested by Chartered Account 6 Bank Statement for last few months 7 Income Tax Return 8 Signature Verification 9 Upfront Processing Fee Cheque 10 (in case of some lenders) Personal loan Verification & Processing SCRUTINY VERIFICATION SANCTION DISBURSAL Check credit Verify the address Collect Post dated Demand draft is worthiness And office of Cheques,ECS, Issued to customer of customer Customer Standing instruction from Customer for EMI Verify the validity of Default blacklisted Existing Customer Documents Processing charge Closure of Personal Loan Request Loan tenure completed Customer Request for foreclosure Closure Ensure all dues are recovered and account closed Recover all dues and prepayment charges Close customer account.Return post dated cheques Consumer Loan • PURPOSE: For purchasing consumer durables like TV, VCR, Washing Machine, AC, furniture etc. • Loan Amount: Calculated at certain times of monthly salary. Consumer Loan • Margin: 15%. • Security: Hypothecation of articles/equipments purchased. • Repayment: Equated monthly instalments. Max. period upto 60 months. Loan against Deposit • Purpose: For meeting educational/ consumption/other expenses. • Loan amount: 85% on the interest accrued value of the deposit. • Repayment: Upto the maturity date of the deposit in instalments. If not paid fully, the amount due will be adjusted from the maturity proceeds. Loan against Securities Leverage your investments in shares, debentures, public sector bonds and Government securities for loans to meet unforeseen expenses! Avail of loans up to Rs.20.0 lacs against your shares/debentures to enable you to meet contingencies, personal needs or even for subscribing to rights or new issue of shares. Loan Against Securities • • • • • • Margin You will need to provide a margin amount of 50% of the prevailing market prices of the shares/ non-convertible debentures be in Documents Required You will be required to submit a declaration indicating : Details of loans availed from other banks/ branches for acquiring shares/ debentures. Details of loans availed from other banks/ branches against security of shares/ debentures g offered as security Loan against securities • Purpose • For meeting contingencies and needs of personal nature. Loan will be permitted for subscribing to rights or new issue of shares / debentures against the security of existing shares / debentures. Loan will not be sanctioned for (i) speculative purposes (ii) inter-corporate investments or (iii) acquiring controlling interest in company / companies. Loans against Securities • Repayment Schedule : • To be liquidated in maximum period of 30 months through a suitable reducing DP programme. • In case of a default or if the outstanding is over Rs.20.0 lacs, the shares/debentures will be transferred in the name of the Bank. Loan Against Securities • Essential Parameters for acceptance of shares as security i)The equity shares and debentures offered as security should be fully paid. Preference shares will not be acceptable as security(ii)The shares/ debentures offered as security must be in demat form.(iii)The share/ debenture should be of a company listed in BSE 100 Index, except those of SBI (list of BSE 100 Index companies is available on www.bseindia.com).(iv)The market price of the security should not have fallen below par for preceding 52 weeks.(v)The market price of the security should not be as variance with the arithmetical average of preceding 52 weeks high and low by more than 25% in downward direction.vi)( P/E ratio of the company should not exceed 40 as published in Economic Times. In case P/E ratio is not available the shares/ debentures of the company should not be accepted as security. (vii)The total number of shares of the company traded on NSE and BSE should exceed 25000 on the day of financing and on each preceding 2 days.(viii)Security where the market price 52 week high is 4 times of the 52 week low should not be accepted. Loan against Securities • Documentation *Application for overdraft limit against security of shares/ debentures indicating details of shares (i.e. ISIN of the company whose shares/ debenture are offered as security, number of shares/ debenture offered as security) along with borrowers DP ID and DP account number.*Applicant has to submit consent letter agreeing to regularize the account/ replenish the margin shortfall, on account of adverse market price variation, immediately on receipt of notice from the branch. Applicant will also submit consent to the condition that in the event of his failure to regularize the account immediately, Bank has the right to get the security transferred in its name and arrange for its sale, without any further reference to him. The Bank shall exercise this option without prejudice to its rights to recover the dues by other means also.*DP Note and DP Delivery letter.*Irrevocable Letter of Undertaking addressed to the Bank signed by all holders of the shares.*Dividend collection mandate(s).*Either or Survivorship Letter(if applicable). Miscellaneous Services • • • • • • • Safe Deposit lockers Credit Cards Cheque collection Remittance facility Internet Banking Phone banking Demat Facilities Safe deposit lockers • The facility of Safe Deposit Lockers is an ancillary service offered by the Bank. The Bank's branches offering this facility will indicate/display this information. The major aspects governing the services are : • • • • • • • • • A locker may be hired by an individual ( not minor), firms, limited companies, specified associations and societies etc. Nomination facility is available to individual hirer of Safe Deposit Locker. Loss of key should be immediately informed to the Branch. Lockers are available in different sizes. Lockers are rented out for a minimum period of one year. Rent is payable in advance. In case of overdue rent, the Bank will charge penalty as decided from time to time. With standing instruction, the rent may be paid from the deposit account of the hirer. The Bank will hire locker only to properly introduced persons. The Bank reserves right to break open the locker if the rent is not paid inspite of giving notices as per the Bank rules and recover charges thereof. The locker can be surrendered by the hirers as indicated in Memorandum of Letting. Internet Banking • Internet Banking" refers to the internet banking service offered by the Bank to the user including services such as enquiry about balance in the Account, details about transactions in the Account(s), statement of Account, transfer of funds and any other service as the Bank may decide to provide from time to time through internet. • The customer will be given a user id and password at the time of opening his account. This id & password enables the customer to access his bank account through the bank website on the internet. Phone Banking • The customer will also be given a specific telephone code at the time of account opening. • With this code the customer can access his bank account by calling the help line phone number to know his bank balance, make bill payments,account to account transfer within the same bank,request for Demand draft,cheque books etc DEMAT SERVICES • Depository Participant Services Depository is an organization, which holds your securities in the form of electronic book entries. This will be done at the request of shareholders through the medium of a Depository Participant (DP). If an investor wants the services of a Depository, he has to open an account with the DP. Further, a depository transfers securities as per the investor's instructions without actually handling securities, through the electronic mode. The DP will maintain the account balances of securities bought and sold by the investor from time to time. The DP will also give the investor a statement of holdings, which is similar to a passbook. DEMAT ACCOUNT • Depository Account Opening An investor needs a satisfactory introduction and identification to open a Demat account with our DP.Every account holder in our Bank can open a Demat account. An investor has to fill up an Account Opening Form and execute an agreement with the DP for opening a Demat account. DEMAT SERVICES • Benefits of holding Shares in Electronic form Transactions take place much faster in electronic trading compared to a 30-60 days settlement cycle that is presently experienced. Transfer of shares is effected within a few days after payment is made. * Elimination of bad deliveries and all risks associated with physical certificate such as loss, theft, mutilation, forgery, etc. * Easy liquidity. * No stamp duty on transfer. * No postage/courier charges. * Faster disbursement of corporate benefits like rights, bonus, etc. * Facility for creating charge on dematerialized shares for granting loans and advances against shares DEMAT ACCOUNT • Account opening An investor (investors are called Beneficial owners in Depository system) intending to hold securities in the electronic form in the Depository system will have to open an account with a DP of NSDL. The investor has to fill up an account opening form and sign an Agreement. The investor can open multiple accounts with same DP as also with different DPs. The DP will provide the investor a statement of holdings and transactions. In case the shares are held in joint names then the account is to be opened in the same order of names. Separate account needs to be opened for each combination of names Dematerialisation/Remateria lisation Dematerialisation is the process by which an investor gets his physical certificates converted into electronic form and reflected in his account with the DP. * One has to just fill in Dematerialisation Request Form available with his DP. Submit his share certificates along with the above form (legend like 'Surrendered for Dematerialisation' should be written on the face of each certificate before its submission for Dematerialisation). The beneficial owner's account will be credited with in 15 days and he will be informed by the DP. * In one whishes to convert his electronic shares back to physical shares at a later stage, he can still do so by applying for rematerialisation through a Rematerialisation Request Form available with his DP. The new rematerialized certificates with new range of certificate number may use existing Folio number or a new folio number for the certificates. Electronic Trading Trading in the Depository mode takes place in the following manner: * If the investor wants to sell his shares, he has to place an order with his broker and give a "Delivery Instruction" to his DP. The DP will debit his account with the number of shares sold by him. * If one wants to buy shares, he is to inform his broker about his Depository Account Number so that the shares bought by him are credited into his account. * Payment for the electronic shares bought or sold is to be made in the same way as in the case of physical securities. * The shares one buys are transferred in his name promptly after he makes the payment. * No formalities of filling transfer deeds, affixing stamps and applying to the Company for registering the shares in Beneficial owner's name are required to be observed, neither there is any fear of bad delivery.