Chapter 5

Any corporate policy and plan which is typical of the industry is doomed to mediocrity

Bruce Henderson – former

Managing Partner of Boston

Consulting Group

If a man write a better book, preach a better sermon, or make a better mouse-trap than his neighbor, tho’ he build his house in the woods, the world will make a beaten path to his door.

Ralph Waldo Emerson

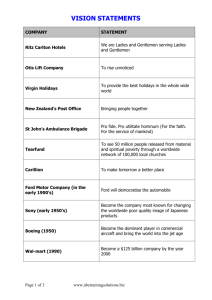

Company

Oskosh Truck

Paccar

Johnson Controls

Ford Motor

General Motors

Median

Federal Signal

Fleetwood Enterprises

Tenneco Automotive

Federal Mogul

Exide Technologies

Returns (%)

36

23

18

7

6

6

1

(6)

(11)

(38)

(50)

Table 5.1. 1993-2003 median returns of selected companies in the

US ‘motor’ industry (Source: Fortune.com)

There are two generic forms of competitive advantage or positioning:

Cost advantage: a firm can do the same things as its rivals but do so at a lower delivered cost , i.e. total costs – not just product/service costs. Such firms exploit economies of scale, scope and learning

(experience) effects and are obsessed with efficiency and cost control.

Differentiation advantage: a firm offers something of value that is unique or sufficiently better than rivals to be seen as unique. These businesses create a form of monopoly in that no other firm can deliver the same product/service-based value to the target market. Their obsessions centre on protecting and improving their uniqueness in brand, product, process for instance.

Competitive strategic positions manifest themselves in three ways:

1. The position a company adopts in terms of its stance against competitors and its choice of buyer segments as it attempts to fit with industry CSFs.

2. The source of value that is the primary driver of the company’s offering.

3. The resources and capabilities underpinning that value and the position of the firm.

Mintzberg’s four generic approaches to scope:

Unsegmentation: the firm offers the same products across a broad range of market segments e.g. Coca Cola, Wal-

Mart, Google

Segmentation: the firm still addresses a broad range of market segments but designs different products for those segments, e.g. Honda, Dell, British Airways

Niche: the firm focuses on one segment of the market e.g.

Ryanair, Cray Computers, Morgan Cars

Customisation: the firm focuses on individual customers and shapes their offering to the unique requirements of that buyer, e.g. upmarket homes, event organization, golf course design

Slack’s five advantage categories from Manufacturing

Advantage:

1. Quality advantage (or, “doing it right”);

2. Speed advantage (or, “doing things fast”);

3. Dependability advantage (or, “doing things on time”);

4. Flexibility advantage (or, “being able to adapt what you do”);

5. Cost advantage (or, “doing things cheap”).

Strategy

Image

Description

Price (low cost) A lower price than rivals e.g. the no frills airlines verses the big carriers in the

US and Europe

A brand or reputation e.g. Coca cola, Mercedes, Gucci, Harvard Business

School, etc.

Support Provision of back-up or after sales service e.g. Dell

Quality A more durable or reliable product or one with higher performance e.g. digital cameras (pixels)

Design Different product functions e.g. pharmaceuticals, mobile phones

Undifferentiation Same as the others e.g. Car rental firms, financial service firms, petrol stations, steel companies etc.

Table 5.2 Differentiation strategies (Source: Mintzberg, 1998)

Resources and capabilities – the resource-basedview (RBV)

CASIS outlines how a resource/capability can provide a competitive advantage for a company if it is:

1. Congruent with CSFs of the Industry +

2. Non-Appropriable +

3. Non-Substitutable +

4. Non-Imitable: + a. Physically unique b. Expensive to develop c. Path-dependency d. Causal ambiguity

5. Supported organizationally

1. Account for the rise of

Tesco’s.

2. Explain Tesco’s strategic strength today.

3. What strategies might

J. Sainsbury have pursued to combat

Tesco’s?

1. Could you define Ottakar’s position on the back of a business card?

2. Ottakar’s had generally taken an evolutionary approach to change in order to build on their existing resources and capabilities…?

3. While Ottakars new websites may have only constituted a change to operational facilities how might its operations and performance ripple through the organization and its strategic positioning?

4. If you were James Heneage how would you have responded to The

Sunday Times’ review?

1. Do you think that BMI’s

‘low-cost, full-frills’ position could have provided them with a competitive advantage?

2. Will the advent of

BMIbaby help or hinder

BMI’s attempts to position itself effectively?

3. How would you seek to position BMI and

BMIbaby? Can you express each of these positions in eight words or less?

1. Draw up a list of the key questions that are critical to understanding whether

Universal should enter the

UK market.

2. What data would you need to aquire (and how would you get it) to be able to answer your questions?

1. Define Hugyhe’s strategic advantage.

2. Define Interbrew’s strategic advantage.

3. If you were a fund manager which firm would you choose to invest in?

Give reasons for your answer.

4. What advice would you give Huyghe and

Interbrew for the future?

1. Assuming you can get no further information, what would your overall intention for this decision making process be?

2. Assuming you can get no further information, what would your first decision on furniture be?

3. What then would your strategy be as the rest of the decision making process unfolds?

4. What does this case and the application of game theory teach us about strategy?

1. Has IBB identified imperfections in the market, or is this really a mirage?

2. How can IBB compete with large well-resourced incumbents?

3. Should IBB focus on increasing its product range (scope) or open new branches?

4. Would the creation of an online banking facility help? Why?

1. What resources and capabilities might Tayto’s have that will be difficult for

Walkers to replicate?

2. If you were CEO of

Tayto’s, what strategies would you employ to protect the company’s advantage?

3. If you were CEO of

Walker’s Ireland, what strategies would you employ to build the company’s advantage?

1. Can you broadly draw

Komatsu’s strategic position (or positions) relative to Catapillar on the generic strategy matrix?

2. What advantages might this simple drawing provide to Komatsu employees, suppliers and distributors?

3. How might Catapillar position itself in response to Komatsu’s encircling strategy, should Komatsu’s strategy prove to be successful?

1. Do you think Cereality have a sustainable competitive advantage? If not, why not? If so how would you articulate it?