1439080526_216109

advertisement

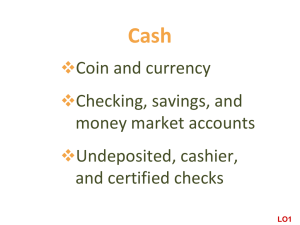

Cash and Internal Control 6 PowerPoint Author: Catherine Lumbattis COPYRIGHT © 2011 South-Western/Cengage Learning Cash Coin and currency Checking, savings, and money market accounts Undeposited, cashier, and certified checks LO1 Cash Equivalents Readily convertible to cash Original maturity to investor of three months or less Examples: Commercial paper U.S. Treasury bills Certain money market funds Cash Management Necessary to ensure company has neither too little nor too much cash on hand Tools • Cash flows statement • Bank reconciliations • Petty cash funds LO2 Bank Statements Cash balance, beginning of period +Deposits +Customer notes and interest collected by bank +Interest earned Canceled checks NSF checks Service charges = Cash balance, end of period Bank Reconciliation – Step 1 •Trace deposits listed on the bank statement to the books. •Identify the deposits in transit. •Add to the bank balance. Deposits in transit: Late period deposits not yet reflected on bank statement Bank Reconciliation – Step 2 •Trace checks cleared by the bank to the books. •Identify outstanding checks. • Subtract from the bank balance. Outstanding checks: Checks written but not yet presented to bank Bank Reconciliation – Step 3 List all other additions (credit memoranda) shown on the bank statement. Add to the book balance. Credit memoranda: Interest earned, customer notes collected, etc. Bank Reconciliation – Step 4 •List all other subtractions (debit memoranda) shown on the bank statement. •Subtract from the book balance. Debit memoranda: NSF checks, service charges, etc. Example of Reconciliation Cash Account Adjustments: Debit Memoranda Balance per books, June 30 Add: Customer note collected Interest on customer note Interest earned during June Error in recording check 498 Deduct: NSF check Collection fee on note Service charge for lockbox Adjusted balance, June 30 $2,895.82 $500.00 50.00 15.45 54.00 $245.72 16.50 20.00 619.45 (282.22) $3,233.05 Bank Reconciliation – Step 5 Identify errors made by the bank or the company in recording the transactions during the period. Bank Reconciliation – Step 6 Use the information collected in steps 1 through 5 to prepare the bank reconciliation. Bank Reconciliation Balance per bank $$$ Adjusted balance $$$ Balance per books $$$ Adjusted balance $$$ Example of Reconciliation Bank Statement Adjustments Balance per statement, June 30 $3,308.59 Adjusted balance, June 30 $3,233.05 Cash Account Adjustments Balance per books, June 30 Adjusted balance, June 30 $2,895.82 $3,233.05 Bank Reconciliation Adjusting Entries Bank Reconciliation Balance per bank $$$ Adjusted balance $$$ Balance per books $$$ Adjusted balance $$$ Book adjustments are the basis for adjusting entries Bank Reconciliation Adjusting Entries Accounts Receivable 245.72 Collection Fee Expense 16.50 Rent Expense—Lockbox 20.00 Cash 337.23 Notes Receivable Interest Revenue Supplies To record bank reconciliation adjustments. 500.00 65.45 54.00 Petty Cash A check is written Journalize establishment of fund Disbursement with proper documentation Fund replenished Petty Cash Transactions for Mickey’s Marathon Sports Original fund balance Petty cash expenditures: U.S. Post Office Overnight delivery service Office supply express Coin and currency per count $200.00 55.00 69.50 45.30 26.50 Prepare the journal entry to record the petty cash fund replenishment Accounting for Petty Cash Journal Entry to Replenish Fund: *$200.00 – ($55.00 + 69.50 + 45.30 + 26.50) = $200.00 – $196.30 = $3.70 short Internal Control System Consists of the policies and procedures necessary to ensure: • The safeguarding of an entity’s assets • The reliability of its accounting records • The accomplishment of its overall objectives LO3 Sarbanes-Oxley Act of 2002 (SOX) Act of Congress intended to bring reform to corporate accountability and stewardship in response to corporate scandals Internal Control Control Environment Accounting System Internal Control Procedures The Control Environment Management’s competence and operating style Personnel policies and practices Influence of board of directors The Accounting System Methods and records used to report transactions and maintain financial information Can be manual, fully computerized, or a combination of both Use of journals is an integral part of any system Internal Control Procedures Independent Review and Appraisal The Design and Use of Business Documents Proper Authorizations Independent Verification Safeguarding Assets and Records Segregation of Duties LO4 Proper Authorizations Authority and responsibility go hand in hand Segregation of Duties Separate physical custody from the accounting for assets Independent Verification One individual or department acts as a check on the work of another Safeguarding Assets and Records Protect assets and accounting records from loss, theft, unauthorized use, etc. Independent Review and Appraisal Provide for periodic review and appraisal of the accounting system and the people operating it The Design and Use of Business Documents Capture all relevant information about a transaction and assist in proper recording and classification. Are properly controlled Limitations on Internal Control No system is entirely foolproof • Employees in collusion can override the best controls • Cost vs. benefit tradeoff Computerized Business Documents and Internal Control Cash receipts should be deposited intact in the bank on a daily basis All cash disbursements should be made by check LO5 Control over Cash Receipts Cash received over the counter (e.g., cash sales) Cash received in the mail (e.g., credit sales) Controls over Cash Received over the Counter Cash registers Locked-in cash register tape Prenumbered customer receipts Investigate recurring discrepancies Controls over Cash Received in the Mail Two employees open mail Prelist prepared Monthly customer statements Document Flow for Merchandise Purchase Requisition Receiving Report Purchase Order Invoice Approval Purchase Invoice Check Prepared End of Chapter 6