Loan classification and provisioning – Overview paper

advertisement

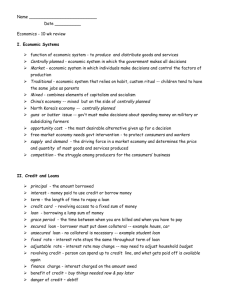

Katia D’Hulster Overview paper objectives a. NPL definition comparison b. Interactions with IFRS c. Good practice and further work Countries covered in the overview paper Host countries: Albania, Bosnia Herzegovina, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Georgia, Kosovo, Latvia, Lithuania, Macedonia, Montenegro, Poland, Romania, Serbia, Slovakia, Slovenia Home countries: Austria, Denmark, France, Germany, Italy, Greece, Norway and Sweden Basis for classification World Bank survey 2011-2012 Desk review of regulation Expert judgment where needed Comments and suggestions on individual country classifications welcome I. NPL definition comparison “..payment of principal and interest past due for more than 90 days” “..interest payments equal to 90 days interest or more have been capitalized, refinanced or rolled over..” “…in addition, NPLs should also include those loans with payments less than 90 days past due that are recognized as non performing under the national supervisory guidance. That is, evidence exists to classify a loan as non performing even in the absence of the 90 days past due …” Source: Financial Soundness Indicators: Compilation Guide Dimensions analyzed 1. Asset classification systems 2. Defining non performing loans 3. Loan forbearance 4. Multiple loans to a single borrower 5. Collateral valuation 6. Write offs Other dimensions 1. Exposure measurement 2. … The majority of the 26 countries in the survey have an asset classification system Do you have an asset classification system? No, 28% Yes, 72% Government exposures are generally included in the asset classification system Of those that have an asset classification system, 72 % have a system that covers government exposures. Asset classification systems are more common in host countries 14 out of the 18 countries in the survey have an asset classification system, while only 4 out of the 7 home countries have one. Generally: five buckets and worst three buckets: substandard, doubtful and loss are generally NPL …but difficult to draw conclusions 90 days past due or unlikely to pay Unlikely to pay, with or without realization of collateral? Materiality thresholds, grace periods… Very little guidance on exit criteria 2. Defining non performing loans Number of days past due for classification as substandard other, 15% 30 days, 23% 90 days, 31% 60 days, 31% Number of days past due for classification as loss other, 31% 365 days, 31% 180 days , 38% Number of days past due for classification as doubtful other, 15% 270 days, 16% 180 days, 23% 90 days , 40% Generally referred to as “restructuring” Wide variety in the definitions Generally 2 components: change in contract terms and financial difficulty of the borrower “Embedded” forbearance clauses Sometimes reduction in cash flows or loss required Forborne loans not always non performing loans Do regulations require forborne loans to be classified as non performing ? No , 17% Yes , 83% Review of credit worthiness 45% of the surveyed countries require a review of the credit worthiness of the borrower before it can be upgraded to performing exposures. Are banks allowed to upgrade the classification of a loan immediately after it has been forborne ? other , 5% yes , 32% no, 63% Host countries are stricter than home countries 10 host countries out of 15 do not allow immediate upgrade while 2 out of 4 home countries allow immediate upgrade after forbearance. Are multiple loans to a single borrower all classified as non performing? Not specified, 4% No, 22% Yes , 74% EBA position on product vs customer view The EBA proposes to assess NPL exposures on an individual basis (transaction approach), or when more than 20% of the retail borrower’s total exposure is non performing, based on the debtor’s approach. Do the provisioning requirements allow the value of collateral to be deducted from the amount of the loan before provisioning is applied? Not specified, 39% Of those countries that consider collateral, is there any differentiation between prime and other collateral ? No, 30% Yes , 56% Yes , 70% No, 5% Some countries allow exposure upgrades because of the existence of good quality collateral e.g. 120 days past due can be upgraded into 90 days past due because of prime collateral. Other countries allow split of exposure into collateralized part and uncollateralized part e.g. collateralized part: substandard uncollateralized part: doubtful Do regulators require banks to write off non performing loans after a specific time period ? Yes , 10% Good practice for write offs It is good practice to require the Board to review the NPL portfolio every 6 months and to decide if exposures need to be written off. No, 90% Requiring prompt write offs of fully provided and uncollectable loans is an area where prudential supervisors and tax authorities can provide the right incentives to banks. II. Prudential impact of IFRS implementation 1. 2. 3. 4. 5. Basel: Expected and unexpected losses Basel vs IFRS Provisioning Accrued interest Other issues when transitioning Basel - Expected Losses IAS 39 - Incurred losses Anticipated Forward looking Trigger event Objective evidence of impairment One year horizon Lifetime of the loan Averages of the economic cycle Or stressed conditions Current economic conditions Definition of “default” is generally 90 days past due (Basel II para 452 and 453) Breach of contract Economic loss Carrying value of loan minus PV of cash flow discounted at effective rate Exposure at default includes future draws Exposure is balance sheet amount Expected losses and incurred losses - overlaps Expert judgment layer Historical data Segmentation IFRS 9 from 2018 Stage 1: 12 months ECL Stage 2: lifetime ECL Stage 3: lifetime ECL Relative assessment of risk Rebuttable assumption of default at 90d past due Are there minimum levels of specific provisions set by the supervisor? No, 48% Yes , 52% Substandard provisioning levels > 20% Doubtful provisioning levels >50%, 15% < 20% < 50%, 39% 50%, 46% 20% Loss provisioning levels < 100%, 15% 100%, 85% Does accrued unpaid interest enter the income statement whileenter the the loan is Does accrued unpaid interest income statement whileperforming? the loan is classified as non classified as non performing? Not specif., Not specif., 21% 21% No,No, 53%53% Yes , 26% Yes , 26% How to deal with the “excess” regulatory provisions when starting IFRS? Asset classification systems generally compliant with IFRS ..but regulatory provisioning may have to be revisited Adjust using capital ratio (Pillar 2) or implement regulatory provisioning by retained earnings when under-provided III. Good practices and areas for further work Include government exposures in asset classification and provisioning framework Require banks to clearly flag and report forborne loans, including keeping track of the number of forbearances for each loan Report non performing loans using the gross value of the loan, not amount overdue, the value net of provisions or collateral Include maturity extensions and embedded forbearance clauses in the regulatory definitions of forbearance Perform in depth assessment of bank’s statistical provisioning methodologies and, where applicable, understand the differences with the risk inputs used for the regulatory capital calculation Include clear qualitative criteria in the definition of default Define clear criteria for regulatory provisions, not just minimum percentages Consider incentives to establish prompt write offs of fully provided and uncollectable loans … Deeper understanding Regional cooperation Sharing of knowledge Regional data collection and benchmarking IFRS – With discounting effects A bank extends a two year loan for 100 Euro (1) on 1 January X0. The principal is to be repaid in two equal installments, at 31 December X0 and X01. No commissions are taken at loan origination, thus the contractual interest rate equals the effective interest rate. At year-end, interest is accrued at 10% (2) On 1 January X1, the loan is identified as impaired. The book value of the loan at the time of impairment amounts to 110 Euro (100 principal + 10 accrued interest). The bank assesses the recoverable amount of the loan at 66 Euro, to be received on 31 December X1. The present value of the recoverable amount is 60 Euro (66/(1+10%)=60). The provision to be created is 50 Euro (3)(110 – 60 Euro). At the end of the second year, the interest accrued is 10% on the net book value of the loan principal, which is now 6 (60x10%). No discounting effects A bank extends a two year loan for 100 Euro (1) on 1 January X0. The principal is to be repaid in two equal installments, on 31 December X0 and X1. At year-end, interest is accrued at 10% (2) On 1 January X1, the loan is identified as impaired. The book value of the loan at the time of impairment amounted to 110Euro (100 principal+10 accrued interest). The bank assesses the recoverable amount of the loan at 66 Euro, to be received on 31 December X1. The provision to be created is 44Euro (3)(110–66 Euro). On 31 December X1, the interest accrued is 10% on the net book value of the loan principal, which is now 6.6 (66X10%). Regulatory adjustment is required: 27.4 + 6.6 = 34 This is exactly the result IAS 39 gave, without regulatory adjustment.