PST/GST and HST Powerpoint by the Crew

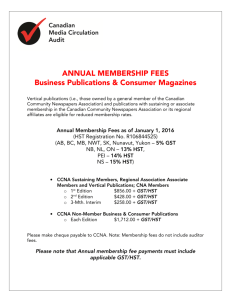

advertisement

Chemistry 12 (Actually for Mi'kmaq Studies 10) By: The Squad Squad Leader: Andrews What is Sales Tax? • In Canada, the government imposes sales tax on certain items. Businesses, by law, are the agents of the government for the collection of sales taxes! • A customer pays sales tax to a company and the company sends the money to the government. • In most Provinces, retailers collect both provincial sales taxes and federal goods and service tax or the harmonized sales tax. PST PST stands for Provincial Sales Tax. All provinces except Alberta ( and the three territories) enforce PST. It is charged on the price of goods (tangible stuff) sold to consumers. A few services such as telephone services are charged PST. Each province determines the rates of sales tax and these are subject to change. • Exempt Items Food Drugs School Supplies & Children’s Clothes GST GST stands for Goods and Services Tax • GST is a tax charged on most sales of services or merchandise. It must be added to the selling price by manufacturers, wholesalers, and retailers of merchandise (service provider). HST HST stands for Harmonized Sales Tax. • Nova Scotia, New Brunswick, Ontario, Newfoundland and Labrador, and Prince Edward Island have the harmonized sales taxes. The HST Nova Scotia New Brunswick P.E.I Ontario NFLD 15% 13% 14% 13% 13% Current HST, GST and PST rates Canada's Province Rate type (HST, GST, PST) Provincial rate Canada rate Total Alberta GST 0% 5% 5% British Columbia (BC) GST+PST 7% 5% 12% Manitoba New-Brunswick Newfoundland and Labrador GST+PST HST 8% 8% 5% 5% 13% 13% HST 8% 5% 13% Northwest Territories GST 0% 5% 5% Nova Scotia Nunavut Ontario HST GST HST 10% 0% 8% 5% 5% 5% 15% 5% 13% Prince Edward Island (PEI) HST 9% 5% 14% Québec Saskatchewan Yukon 9.975% 5% 0% 5% 5% 5% 14.975% 10% 5% GST + QST GST + PST GST How to Calculate • When you sell a service to a customer you must charge them tax. (By law) In NovaScotia we add 15% to the final total of the purchase. For example: • Mighty-Mechanics charge $100 for an oil change. Then add the 15% tax. • As a business when you purchase items like supplies you must also pay tax on the supplies you purchase. That means that the amount that will be deducted from your cash account will be more than the value of the supplies on the asset side of your balance sheet. • We will now learn how to record transactions so the balance sheet will balance. How to Record • Record taxes on sales to HST Payable, GST Payable, or PST Payable. Depending on which tax is applied. • Record taxes on purchases to HST Refundable, GST Refundable, or PST Refundable. Depending on which tax is applied. Example #1 • On Oct 31 Monster Inc. sells $1000 worth of scares with $150 HST. Cash Oct. 31 1000 Revenue Oct. 31 850 HST Payable Oct. 31 150 Example #2 • On Oct 11 The Krusty Krab buys $4000 worth of claws with $600 worth of HST. Cash Oct. 11 4600 Inventory Oct. 11 4000 HST Receivable Oct. 11 600 What is a Sales Tax Payable Account? • A payable account for example, PST Payable, PST Payable is used when you collect PST from a customer, and it now becomes a payable to the government. • Ex. You provide a service to a customer, and they pay you sales tax in addition to their purchase. • The tax they pay is not your money to keep, you owe it to the government and must keep it recorded in a separate account. What is a Sales Tax Receivable Account? • A Receivable account is when you buy something for your business such as supplies or snowplowing and you are owed the amount of tax you paid on those purchases back from the government. • Ex. C&A Auto buys a new muffler for $700 with a HST of $105 and you will get the $105 back from the government. Journalizing • Jun. 23. Boudreau Inc. sells $3000 worth of haircuts including HST. The HST amount calculates to $450. Your boss asks you to record the General Journal entry. Receipt No. 1 General Journal Date Account Title 2015 Jun 23Cash Revenue HST Payable Sold Haircuts for Cash. Receipt No. 1 Doc. No. Post. Ref. Page 1 General Debit Credit 3000.00 2550 450 Journalizing #2 • Jun. 24. Mi’kmaq Inc. bought $2000 worth of feathers. With $300 worth of HST. Receipt No. 420 Date 2015 Jun Account Title 24Supplies HST Receivable Cash Bought feather. Receipt No. 420 Doc. No. Post. Ref. General Debit Credit 2000.00 300.00 2300 Questions • • • • Pg. 331 #20- 24 Pg. 332 # 19,20 Define: Sales Tax, PST, GST, HST What sales tax applies in our Province? Now it’s your turn! • Journalize these entries. • In N.S. on Oct. 4 XYZ company bought $800 worth of cleaning supplies. • In Quebec on Apr. 20 Darts Company sold $800 worth of Fire Fighting. More Chem 12 Questions!! • 1) What type of accounts are PST Payable, GST Payable and GST Refundable? • 2) A service is provided for $200 cash. GST is 5% and PST is 10%. Calculate the base price. • 3)