Self-Employment Income & Expense Summary Form 2014

advertisement

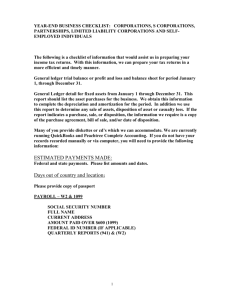

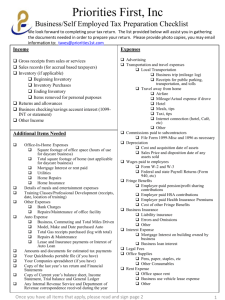

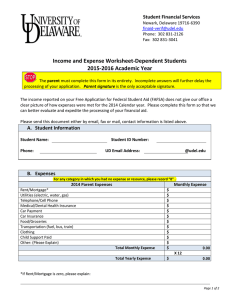

Phone: 604-684-1101 Fax: 604-684-7937 E-mail: admin@rolfebenson.com 2014 SELF-EMPLOYMENT INCOME AND EXPENSE SUMMARY Please provide the information noted below if you are self-employed. Separate, total and summarize any receipts provided by each expense category, noting additional details on a separate sheet if required. Sales, Commissions or Fees Cost of Goods Sold Inventory beginning of year + purchases Is Rolfe, Benson LLP to prepare 2014 GST/HST return? _____Y ____N Do your revenue & expense amounts include GST/HST? _____Y ____N + direct wage costs + subcontracts + other costs Motor Vehicle Expenses Make & year of vehicle If acquired or sold during the year, indicate the purchase/sale date & cost/proceeds. + inventory end of year = cost of goods sold Km for business/employment Total km driven Fuel & oil Maintenance & repairs Insurance License & registration Interest Leasing costs Parking Expenses Advertising Meals & entertainment Bad debts Insurance Interest Business fees, licenses & dues Office expenses Supplies Legal, accounting & other professional fees Management & administration fees Rent (except home office) Maintenance & repairs Salaries, wages & benefits Property taxes (except home office) Travel (fares & accommodations) Telephone & utilities Fuel costs (except motor vehicle expenses) Delivery & freight Employed trade person’s tools Other Home Office Area for business use (s.f. or # of rooms) Total house area (s.f. or # of rooms) Heat Electricity Insurance Maintenance Mortgage interest (n/a for employees) Property taxes Other Capital Assets Acquisitions: Dispositions: Description & cost of each asset: Description & cost of each asset: Internet Presence % of total income generated from internet presence How many Internet/webpages or online business profiles does your business earn income from? Provide the 5 main website/webpage address(es) or online profiles for your business: 1. 2. 3. 4. 5.