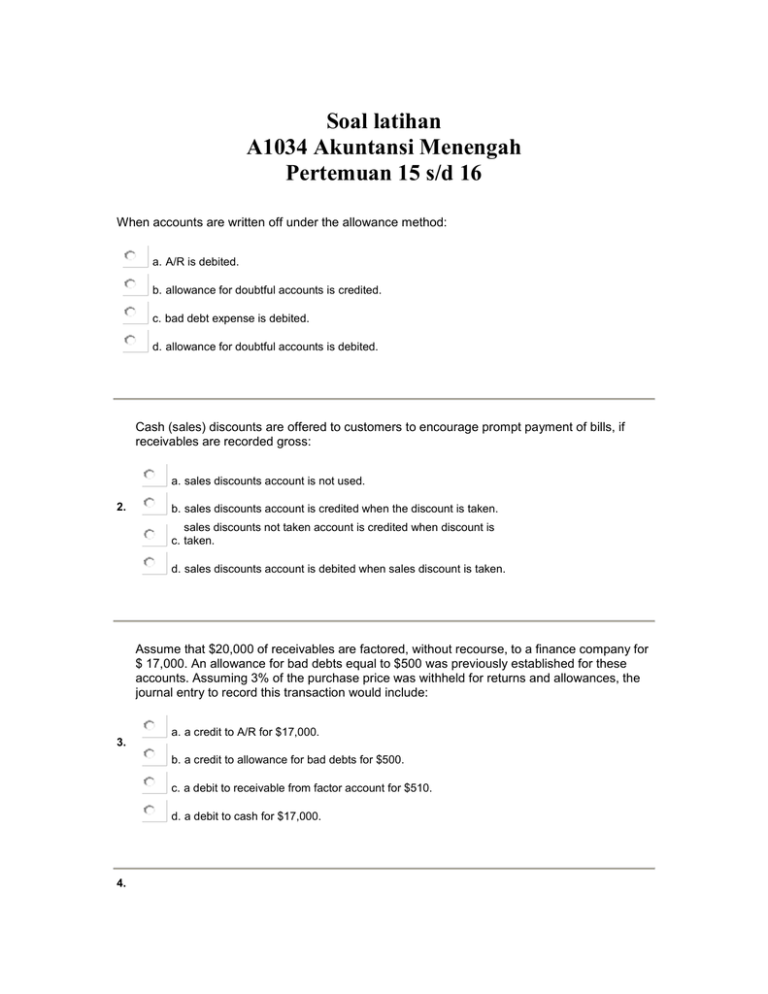

Soal latihan A1034 Akuntansi Menengah Pertemuan 15 s/d 16

advertisement

Soal latihan A1034 Akuntansi Menengah Pertemuan 15 s/d 16 When accounts are written off under the allowance method: a. A/R is debited. b. allowance for doubtful accounts is credited. c. bad debt expense is debited. d. allowance for doubtful accounts is debited. Cash (sales) discounts are offered to customers to encourage prompt payment of bills, if receivables are recorded gross: a. sales discounts account is not used. 2. b. sales discounts account is credited when the discount is taken. sales discounts not taken account is credited when discount is c. taken. d. sales discounts account is debited when sales discount is taken. Assume that $20,000 of receivables are factored, without recourse, to a finance company for $ 17,000. An allowance for bad debts equal to $500 was previously established for these accounts. Assuming 3% of the purchase price was withheld for returns and allowances, the journal entry to record this transaction would include: 3. a. a credit to A/R for $17,000. b. a credit to allowance for bad debts for $500. c. a debit to receivable from factor account for $510. d. a debit to cash for $17,000. 4. Non-trade receivables include all of the following except: a. claims for tax refunds. b. deposits to guarantee contract performance. c. dividends and interest receivable. d. credit sales of goods to customers. Assume 1% of sales are considered doubtful and sales for the period were $250,000. In addition, there was a $1,200 debit balance in the allowance for doubtful accounts before this adjustment. The entry to record bad debt expense would include: a. a debit to bad expense for $3,750. 5. b. a debit to allowance for bad debts for $3,750. c. a debit to bad debt expense for $4,950. d. a credit to A/R for $4,950. Assume 1% of account receivables are considered doubtful and ending account receivables at year end totaled $250,000. In addition, there was a $1,200 debit balance in the allowance for doubtful accounts before this adjustment. The entry to record bad debt expense would include: 6. a. a debit to bad expense for $3,750. b. a credit to allowance for bad debts for $3,750. c. a debit to bad debt expense for $4,950. d. a credit to A/R for $4,950. All of the following are classified as cash except: 7. a. petty cash funds. b. cashiers checks. c. change funds. d. post-dated checks. The basic characteristics of a system of cash control includes all of the following except: a. internal audits at regular intervals. 8. b. daily deposits of all cash received. c. double record of cash, bank and books. d. limit the handling and recording of cash receipts to one person. Cowboy Company has a cash balance per books of $66,500 and a balance per bank statement of $72,000. Cowboy's outstanding checks totaled $3,000 and a deposit in transit was $1,000. Compute the reconciled (adjusted) balance. a. $68,500 9. b. $74,000 c. $70,000 d. $64,500 The normal operating cycle of a business includes: a. the sale. 10. b. the collection of the receivables. c. acquisition of inventory. d. all of these choices.