Ch. 5 section 2 notes

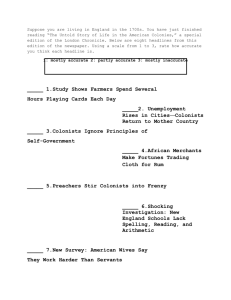

advertisement

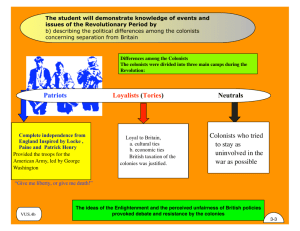

Turmoil over Taxation Ch. 5 Section 2 Objective • Analyze the events leading up to the start of the American Revolution • Evaluate the impact that the taxing of the colonists had on the start of the war New Troubles on the Frontier • By 1760, French had been driven out of the Ohio Valley • Caused influx of British colonists to the land • Clashes with Native Americans • 1762 – Lord Jeffery Amherst keeps order • French traders on frontier held feasts for Indians and gave presents • Amherst did not do this, raised prices of goods instead • Also allowed settlers to build on Indian land New Troubles on the Frontier cont. • Pontiac – Leader among Native Americans • Very respected by fellow Indians • Pontiac – British were “dogs dressed in red” • War on the Frontier • Pontiac led attacks, quickly captured most British forts in Ohio Country - Pontiac’s War, did not last long • 1763 – Treaty of Paris signed, Indians could no longer hope for French support, slowly stopped fighting and returned home Proclamation of 1763 • Aftermath of Pontiac’s War • Dangerous for colonists to settle on Western Frontier • Issue Proclamation of 1763 – Colonists were forbidden to settle west of Appalachian Mountains • Purpose was to protect Colonists and Indians • British sent 10,000 troops to the colonies to enforce law • Few troops actually went to the Frontier, most stayed in cities • Proclamation angered colonists • Many colonies claimed lands in the west • Colonists now had to pay for more British troops in the area • Many ignored proclamation and moved anyway Britain Imposes New taxes • Debt from French and Indian War • Taxes paid by British citizens rose, colonists should share burden • Sugar Act – 1764 • Replaced a tax on molasses so high, merchants smuggled or bribed tax collectors • Made it easier to bring smugglers to trial • Stamp act – 1765 • New duties on legal docs – wills, diplomas, marriage papers • Tax on newspapers, almanacs, playing cards, dice • All items must have stamp, used in Britain to raise money, but never used in colonies Protesting the Stamp Act • Stormy Protests • Threw rocks at, tarred and feathered tax agents • British shocked – fought war to protect colonists • British at home were paying higher taxes • “No Taxation Without Representation!” • Taxes went against principle • Since colonists did not elect representatives to Parliament, Parliament had no right to tax them Protesting the Stamp Act cont. • Uniting in Peaceful Protest • Petition – formal written request to someone in authority • Colonists also boycotted British goods, or refused to buy or use them • Boycotts took their toll, British merchants and workers were facing ruin • 1766 – Repealed Stamp act • Parliament also passed law saying they could raise taxes in “all cases whatsoever” The Townshend Acts • Taxed goods such as glass, paper, pain, lead and tea • Colonists objected for same reason • Searching Without a Reason • Townshend Acts set up new ways to collect taxes • Writs of Assistance – officers could inspect ship’s cargo without reason • Colonists say writs violate rights as British citizens • Sons of liberty formed to protest British • Staged hangings of cloth British officials to scare them • Boycotted British goods The Boston Massacre • Quartering act • Colonists must provide housing and bedding to British soldiers in the colonies • A Bloody Night – March 5th, 1770 • Crowd gathered outside Boston Customs house shouting insults at soldiers • Soldiers panicked, fired into crowd • Boston Massacre – five colonists dead A Temporary Calm • Parliament repeals • Townshend and Quartering acts, most offensive taxes repealed • Core issue remained unsettled – British can still tax colonists • Still did not have representation in Parliament • Debate over taxes had forced colonists to begin thinking more carefully about their political rights