Upgrading Life Insurance

advertisement

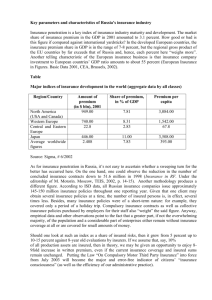

Upgrading Life Insurance Michael Tove Ph.D., CEP, RFC April 2015 There are many different types of life insurance but all essentially fall into one of two broad categories: Term and Cash Value. Most people know those words but many don’t fully appreciate what they mean or what the differences are. Simply put, Term Insurance is temporary and Cash Value is permanent, but there’s a bit more to it than that. A Term Insurance policy is coverage for a specific period of time (e.g., 10, 20 or 30 years). These policies are relatively inexpensive because the risk to the insurance company of paying a claim is quite small. In a way, a Term Insurance policy is a bet you make with the insurance company where you say: “Insurance company, I bet you I die.” and the insurance company replies: “Bet you don’t.” Because the insurance company has the statistics on their side, before they issue the policy, they KNOW what the probability of them “losing the bet” is and they price the policy accordingly. When the Term of that bet is up, the policy is finished. It’s like playing a game of BINGO. When the game is over, it’s over and unless you had the winning card, you’re done. None of this is meant to denigrate Term Insurance. It’s a valuable and necessary form of protection when used for the right reason. For example: Imagine a single income family. If that income earner dies before retirement, the surviving spouse and children could face serious financial hardship. A Term policy sufficient to cover the working years through retirement would be the most economical way to protect against an untimely death. Determining the proper amount of coverage requires identifying two variables: how many years (from now) that potential financial need would last and how much money would be required to protect the family. The other category of insurance is Cash Value or permanent insurance. Technically while no life insurance policy is truly “permanent,” any well-constructed Cash Value policy is designed to easily outlive the person they insure. Under such circumstances, the insurance company’s response to your “I bet you I die.” changes to “Yes, but we bet it won’t be soon.” While this is certainly a more attractive arrangement for the insured, it is also a more expensive one. Put another way, the difference between this and term is that the number of variables you need to determine drops from two to one (number of years of coverage and how much money becomes only how much money). The insurance company’s risk of paying a claim has increased therefore the policy will be more expensive. The way life insurance pricing works (in very simple terms) is that the insurance company uses massive amounts of statistics to predict the probability of a person, based on age and health, dying in the next year and the company having to pay a claim. It’s called the Cost of Insurance. 1 Assume 1000 people of the exact same age, health and sex with $100,000 life insurance policies have a 3 in 1000 chance of dying. That means 3 of those 1000 people will die and the insurance company will have to pay a total of $300,000 in claims. The cost of insurance then is $300 per person. The annual premium they receive from each policy owner must then be $300 plus whatever overage is built in to cover operational expenses, etc. But, ten years later, the cost of insurance for those same 1000 people (less the 30 who died), will be greater. Term Insurance is priced based solely on the cost of insurance for a certain number of years and anyone outliving the term will be a “no claim.” It’s an easy calculation for an insurance actuary to make. However, when dealing with permanent insurance, calculating the cost of insurance becomes trickier because not only is there an assumption that 100% of policy owners will die, the time frame in which those deaths will occur is much greater. Long ago, insurance companies realized that if they “overcharged” the cost of insurance in early policy years, the payments in excess of the cost could grow through some sort of investment and be available to pay for the higher cost of insurance in later years when it exceeds the annual premium. Unlike Term, this arrangement permits the policy to exist as long as the insured lives. This is the purpose of the Cash Value account. There are two basic forms of Cash Value policies: Whole Life and Universal Life. In simplistic terms, the main difference is that with Whole Life, the assumed return to the Cash Value account is predetermined from the start of the contract and is constant. If the actual return is greater than assumed, the insurance company issues dividends which can be used to purchase additional death benefit. These are called “Paid-up Additions.” Universal Life directly applies the realized return to the Cash Value account. There are no dividends and no paid-up additions but the amount of insurance that a dollar of premium buys is usually far greater. Thus, while Whole Life will see increasing death benefit over a number of years and the death benefit of Universal Life remains constant, most people will not live long enough for a whole life policy to grow larger than what they would initially get with Universal Life. Since the middle of the 20th Century, human life expectancy, especially in modern countries such as the United States has increased significantly and continues to do so. According to the Administration on Aging (2013), the population of Americans aged 90 and above is expected to quadruple over the next few decades. In regards to life insurance, this means the cost of insurance should decrease. However, life insurance policies are contracts, the terms and conditions of which cannot be altered by the insurance company once the policy is issued. Moreover, the assumed cost of insurance in a policy is based on the life expectancy tables used at the time of policy creation. 2 With increasing longevity, since the start of the 21st Century, the life insurance industry has seen two significant shifts in policy pricing and construction. 1. In the 1980’s and before, the industry standard was to assume nobody would live past age 95. In the 1990s, that assumption increased to age 100. By 2010, many carriers projected minimum guaranteed death benefits through age 105 to 120, some longer. 2. The cost of insurance for a person of a given age decreased. The broad implication from these facts is that many older insurance policies are “overpriced” compared with contemporary standards of mortality and cost of insurance. The good news is that many people with existing Cash Value insurance policies have the ability to make them bigger without sacrificing coverage or increasing premium. This is done through a process called a “1035 Exchange.” Internal Revenue Code 1035 permits a tax-exempt transfer of Cash Value in one insurance contract to another of “like kind.” In this case, “like kind” means from “Person A” to “Person A” and not “Person A” to “Person B.” These exchanges can significantly increase the policy amount at no cost to the insured. Of course, the amount of benefit increase is dependent on the insureds age and health, and the details of the replacing and replaced insurance policies. The graph plots the amount of death benefit per $1000 of premium for different ages. It assumes Non-tobacco users of average health (“Standard”). Death Benefit Amounts per $1000 Cash Value Transfer (As of March 2015) $9,000.00 $8,000.00 $7,000.00 Female $6,000.00 Male $5,000.00 $4,000.00 $3,000.00 $2,000.00 $1,000.00 $- 40 1 45 2 50 3 55 4 60 5 Age 65 6 70 7 75 8 80 9 3 For example: A male age 60 with a $100,000 paid-up (meaning no more premiums are due) policy, should have not more than $30,450 of current Cash Value. If Jim’s $100,000 policy has $40,000 of Cash Value, a 1035 swap could result in a new policy with $121,800 face amount (death benefit). In this case, a 1035 exchange would result in $21,800 more insurance with no additional premium due. Moreover, where the former policy may have been scheduled to endow (meaning terminate and pay out) at age 95 or 100, the new policy could be guaranteed to last until age 120. SUMMARY When done properly, there is NO DOWNSIDE to upgrading a life insurance policy. The policy owner gets: more coverage for a guaranteed longer period of time for no additional premium (or even reducing or terminating a current premium) However, not all carriers calculate the cost of insurance the same and shopping for the right (meaning best) upgrade requires using an independent insurance professional with access to a wide range of carriers. 4