Funding Your Future Financial Aid Overview

Funding Your Future

Financial Aid

Overview

Topics

Introduction

What is financial aid?

Sources of financial aid

Limitations of federal aid programs

FAFSA/Dream Act Application & Processing

Whose info goes on a FAFSA/CA Dream Act Application?

Eligibility requirements for Federal and State aid

When & Where to apply for 2015-16?

What happens next?

Where do I get help?

Other information

Consumer Information

What is financial aid?

Financial aid are funds provided to students and families to help pay for postsecondary educational expenses

Sources of Financial Aid

Federal and State Grants

Student Loans

Work Study

Private sources-scholarships

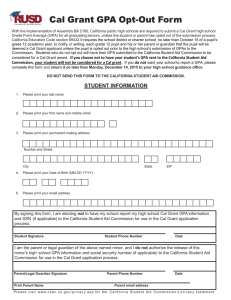

SLO County High School Graduates

All future Promise students will be guaranteed fee-free fall & spring

Deadline- August 3rd, 2015

Guaranteed to all students who complete

ALL Cuesta Promise steps regardless of income or GPA

STEPS

3.

4.

5.

6.

1.

2.

Submit your Cuesta College admissions application

Submit your Promise scholarship application

Apply for FAFSA or the Dream Act

Complete the Cuesta College assessment process

Complete the Cuesta College online orientation

Register for your classes

The Promise is yours! Check your email for announcements and updates.

Common Federal Programs

Pell Grant

Federal

Supplemental

Opportunity Grant

Federal Work Study

Teach Grant

Federal Loans

-Subsidized

-Unsubsidized

PLUS- Parent Loan

L imitations of Federal Aid

Programs

Pell Grant – 6 full-time years

Direct Subsidized Loans - 150% of the length of academic program before they may lose interest subsidy

Common CA State Programs

Board of Governors Fee Waiver

Cal-Grants

Chafee Grant

University Grants

Middle Class Scholarship for UC & CSU

AB 540 BOGW & Cal Grants

Board of Governors Fee Waiver

Waives enrollment fees at California

Community Colleges

You must complete online FAFSA or

Cal Dream Act

Cal-Grants

Cal Grant A – Pays tuition at a CSU or

UC

Cal Grant B - Pays tuition at a CSU or UC and pays an access fee at a California

Community College

Cal Grant C – Pays for vocational programs

Chafee

Available for foster-youth in the

Independent Living Program (ILP)

Must complete an online application

Limited funds

University Grants

Available at private and public universities

Funds may be limited

Follow-up with your school of choice

Middle Class Scholarship Program

New, transfer and returning undergraduate students

University of California or California

State University

Family income of up to $150,000

Complete the FAFSA or Cal Dream Act application

California State Programs

Residency requirements

Aid awarded on the basis of both GPA and financial need

Must complete the FAFSA or Cal

Dream Act application

Deadline March 2 nd each year

AB540

Allows non-resident students to receive state grant opportunities

Must complete application at college/university

Admissions Office determines eligibility

Student is able to complete the

FAFSA or Cal Dream Act application

Scholarships

Awarded on the basis of skills, GPA or unique characteristic

Free money

Foundations, high schools, businesses, charitable organizations, employers, unions

Deadlines vary

www.fafsa.gov

© 2014 CASFAA

Application & Processing

2015-2016 Application Processing

Personal Identification Number (PIN)

Access the PIN Website www.pin.ed.gov

Why use a PIN?

•

Sign FAFSA electronically

•

Access your FSA records online

•

Make corrections

Who can apply?

• Students

• Parents

© 2014 CASFAA

FSA ID to Replace FSA PIN!

What this means: Where to use an FSA ID:

New login process

User-selected username

User-selected password

Replaces the FSA PIN

Eliminates need to supply

SSN and date of birth for login

FAFSA on the Web

NSLDS Student Access

StudentLoans.gov

StudentAid.gov

TEACH Grant website

© 2014 CASFAA

Available in Spring 2015

(after March 2 nd )

Cal Dream Act Application

http://www.csac.ca.gov/dream_act.asp

Cal Dream Act Application

Only for AB540 students who do not have a SSN

Students complete this instead of the

FAFSA

DOMA and FAFSA/CA Dream Act applications

FAFSA & CA Dream Act applications: Language is gender neutral – Parent 1 , Parent 2 as designated by filers, not processor.

FAFSA/CA Dream Act applications now collect the information of unmarried parents living together and parents or parent/step-parent in a legally recognized same-sex marriage.

© 2014 CASFAA

Whose info goes on a FAFSA/

CA Dream Act application?

The FAFSA & CA Dream Act applications now use the relationship of the parent to the student , vs. the legal relationship between parents for the basis of collecting information

Relationship of Student to Parent

Parents married, living together

Parents not married, living together

Includes both parents’ incomes on the app?

YES

YES

Only includes one parent’s income on the app?

NO

NO

Parent is widowed, not remarried

Parents are divorced or separated, not living together

Parent and step-parent, living together

Legal guardians

*

Foster Parents

*

Grandparents, brothers, sisters, uncles, or aunts

*

NO

NO

YES

NO

NO

NO

YES

YES (include the parent the student lived with most during the last 12 months. If equal time, include the income and assets from the custodial parent who provided most of the student’s financial support during the last 12 months)

NO

NO

NO

NO

*Students living with legal guardians, foster parents, or relatives are usually considered to be independent students, unless adopted.

Eligibility Requirements for

Federal and State Aid

Be a U.S. citizen or eligible non-citizen

***Have a valid social security number***

Register with Selective Service

High school diploma/GED/home schooled

Enrolled in an eligible degree or certificate program

When & Where to apply for

2015-16?

Complete the FAFSA online at www.fafsa.gov

or

Cal Dream Act Application online at www.csac.ca.gov/dream_act.asp

Applications are available starting

January 1 st

Colleges may set their own deadlines

Frequent Application Delays

Transposed Social Security Numbers

Marital status

Income information

Taxes paid

Household size

Number in college

Asset information missing

Missing student/parent signatures

What happens next?

Student will receive a Student Aid

Report (SAR); make corrections

Student will have an Expected Family

Contribution (EFC)

School may require student/parent to submit additional documentation

Need Varies Based on Cost

1

2

Cost of

Attendance

(Variable)

3

EFC

Expected Family

Contribution

(Constant)

X

Y

EFC

Need

(Variable)

Z

How can I help as a parent?

Complete income taxes early

Use the IRS Data Retrieval Tool

Request IRS Transcripts

Online: www.irs.gov

Transcript Type: Return Transcript

Phone number: 1-800-908-9946

Have your son/daughter follow-up with the financial aid office!

Where can I get help?

Cash for College Workshop:

February 10 th Cuesta SLO Campus

(from 5pm to 8pm at Bldg. 3400)

FAFSA, Cal Dream Act, Cuesta

Scholarship Application

Special Circumstances

Change in employment status

Medical expenses

Unusual dependent care expenses

Loss of parent or student income

Any other unusual circumstances that affect a family’s ability to contribute to higher education

Electronic Payments

Students have options to receive financial aid disbursements or tuition refunds:

Receive disbursement on a debit card

Direct deposit into a personal bank account

Request a paper check

© 2014 CASFAA

Consumer Information

College Navigator http://nces.ed.gov/collegenavigator/

College Scorecard http://scorecard.cccco.edu/scorecardrates.aspx?CollegeID=641

Shopping Sheet

Your student portal

StudentAid.gov

https://studentaid.ed.gov/

FSA Social Media http://www.financialaidtoolkit.ed.gov/tk/outreach/social-media.jsp

Net Price Calculator http://www.cuesta.edu/student/aboutmoney/finaid/resources/Net_Price_Calculat or.html

© 2014 CASFAA

College Navigator Tool

CollegeNavigator.gov

© 2014 CASFAA

College Scorecard

collegecost.ed.gov

© 2014 CASFAA

Shopping Sheet

Standardized, clear, and concise format for personalized financial aid offers

Better understanding of the costs of college before making a final decision on where to enroll

Identifies the types and amounts of aid qualified for and allows for easy comparison of aid packages

Consumer comparison tool

Transparently provides information to students

© 2014 CASFAA

© 2014 CASFAA

StudentAid.gov

© 2014 CASFAA

Twitter.com/FAFSA

© 2014 CASFAA

© 2014 CASFAA