Universiti Utara Malaysia

advertisement

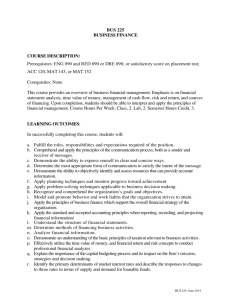

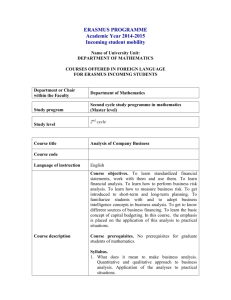

Trimester September 2012/2013 Rezzen Melaka COLLEGE OF BUSINESS UNIVERSITI UTARA MALAYSIA COURSE CODE COURSE LECTURER : : : CLASS : BDFM8013 CORPORATE FINANCIAL STRATEGY NASRUDDIN ZAINUDIN (Office: Room 135, COB Main Building, UUM; Phone: 04-928 6426; E-mail: nash@uum.edu.my) Jasmine Hall, Queenspark Hotel, Melaka Saturdays 3 p.m. – 9 p.m. (1/9; 29/9 & 13/10) Sundays 9 a.m. – 3 p.m. (2/9; 30/9 & 14/10) SYNOPSIS This course is designed to develop doctoral students’ capabilities to plan, evaluate and execute financial strategies within the context of firms’ overall corporate strategy and ever-changing financial and economic environment. Emphasis will be given to shareholder wealth creation, and the theoretical and practical issues in capital investment and financing decisions. OBJECTIVES Students are expected to: 1. exercise professional judgement as expected as a senior manager, in recommending, evaluating and executing firms’ strategic financial decisions; 2. understand how to deal with advanced and real life issues in capital investment and financing decision; 3. expose students to the theoretical and empirical literature in the area of finance. LEARNING OUTCOMES At the end of this course, students will be able to: 1. evaluate and apply professional judgement on potential strategic investment decision; 2. evaluate and apply professional judgement on potential strategic financing decision; 3. measure the consequences of strategic decisions for shareholder value; 4. plan and evaluate merger and acquisition and other corporate restructuring exercise as alternative financial strategy; 5. debate on key financial theories and their applicability in the real world; 6. undertake research work in the area of finance, particularly corporate finance. 1 Trimester September 2012/2013 Rezzen Melaka MODE OF DELIVERY The class is highly interactive, involving lectures, discussion of case, journal articles and current related issues. Students are expected to participate actively during the classes. REFERENCE Bender, R and Ward, K (2008). Corporate Financial Strategy. 3rd Ed., Elsevier Science and Technology Books. Berk, J. & DeMarzo, P. (2007). Corporate Finance. USA: Pearson. Ogden, J. P., Jen, F. C. & O’Connor, P. F. (2003). Advanced Corporate Finance: Policies and Strategies. New Jersey: Prentice Hall. Ross, S. A., Westerfield, R. W., Jaffe, J. And Jordan, B.D. (2008). Modern Financial Management, 8th Ed., New York: McGraw-Hill. Smart, S. B. Meggisson, W. L. & Gitman, L. J. (2004). Corporate Finance. USA: Thomson Learning. ASSESSMENT The assessment will comprise contribution and participation in class discussion that will be held throughout the semester, a series of quizzes, group/individual cases and assignment with presentations, and journal article reviews which make up the coursework, and a final examination. The allocation of marks is as follows: Coursework Final Examination 60% 40% 2 Trimester September 2012/2013 Rezzen Melaka COURSE CONTENT No. Topics Introduction 1 Overview of Corporate Financial Planning and Strategy Overview the key concept of corporate finance and the link with shareholders wealth Operating performance and market performance The internal and external context of corporate financial strategy 2 The business operating and strategic context The capital and financial markets Strategic Investment Decision I 3 Review the Net Present Value and Internal Rate of Return criteria Incorporating local tax system in capital budgeting analysis Incorporating real options in capital budgeting Strategic Investment Decision II 4 Incorporating risk in capital budgeting Capital Budgeting for Levered Firms Strategic Financing Decision I 5 Market Imperfection and capital structure theory Empirical evidence on capital structure theory Innovations in the capital market Strategic Financing Decision II 6 Venture Capital and Private Equity Initial Public Offerings Right issues Bond refunding Leasing Warrant and Convertible Corporate Restructuring 7 8 Accounting for Merger and Acquisition Merger valuation Divestiture and other forms of corporate restructuring Risk Management and Corporate Governance 3