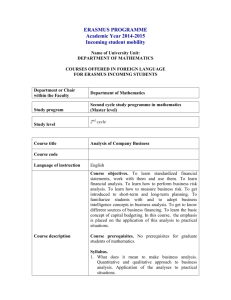

FI 014 Financial Management

advertisement

AD029 Financial Management Course: 2010-2011 Course Contents This course focuses on making financial management decisions, to include: investing, cash flows, project analysis, risk management, capital budgeting, cost of capital and corporate financing. This course assumes that the students already have a basic knowledge of finance and accounting, and are ready for more in-depth analysis and managerial decision making. Whatever career path the student chooses, they will likely be faced with these financial management decisions. Objective: The objective of this course is to expand their knowledge of the following financial management concepts: discounted cash flow, investment decisions, project analysis, risk vs. return, capital budgeting, weighted average cost of capital, capital structure, company valuation, and financing decisions. Methodology Lectures will follow closely the structure and content set out in the main textbook “Fundamentals of Corporate Finance”, 6th Edition by Brealey/Myers/Marcus. We will aim to cover chapters 9 - 15 of the book. Class participation, a group presentation, a mid-term, and a final exam will count towards the final grade, so students are advised to stay current with all required coursework. The methodology will include both quantitative and qualitative analysis of financial management. Readings Students will be required to understand and apply the topics covered in the required textbook. Additional readings will be posted on the estudy intranet or handed out in class. Required Textbooks Richard A. Brealey/ Stewart C. Meyers/Alan J. Marcus, “Fundamentals of Corporate Finance”, 6th Edition Students will need to be able to use a financial calculator Other essential reading:- Wall Street Journal Continuous Assessment Attendance and participation 15% Group Presentation 20% Mid-term exam 25% Final examination 40% Agenda Sessions 1. Discounted Cash-Flow Analysis (Chapter 9). Discount rate, capital investment, working capital, operating cash flow, and calculating NPV. 2. Calculating Cash Flows (Chapter 9, continued). Cash flow case study. 3. Project Analysis (Chapter 10). Capital budget, investment process, senstivity analysis and scenario analysis. 4. Project Analysis (Chapter 10, continued). Break-even analysis. Project case study. 5. Introuction to Risk (Chapter 11). Introduction to risk, return and the opportunity cost of capital. Capital markets, measuring risk, and diversification. 6. Risk and Return (Chapter 12). Measuring market risk, risk and return. 7. Captial Budgeting (Chapter 12, continued). Capital budgeting and project risk. Case study. 8. Weighted-Average Cost of Capital (Chapter 13). Calculating WACC, capital structure, and calculating required rates of return. 9. Mid-term Exam. 10. Company Valuation (Chapter13, continued). Valuing entire businesses. Case study. 11. Introduction to Corporate Financing (Chapter 14). Financing decisions, common stock, preferred stock, corporate debt and convertible securities. 12. Patterns in Corporate Financing (Chapter 14, continued). Patterns and common practices in Corporate Financing. Case study. 13. Venture Capital, IPOs, Underwriting, Offers (Chapter 15): Venture capital companies, initial public offerings, and underwriting, cash offers and market reactions. 14. Group Project / Presentation. 15. Private placement (Chapter 15, continued). Private placement. Overall course review. 16. Final Exam. Observations Professor: Kim Kastorff Email: kkastorff@salle.url.edu ABOUT THE PROFESSOR Kim Kastorff holds an MBA in Finance and Accounting from Regis University in Colorado, USA and a Bachelors of Finance from University of Wisconsin-Whitewater in Wisconsin, USA. Her professional work background is diverse to include: Private Banking, Commercial Lending, Mutual Funds and Investment Banking, Corporate Accounting, Disaster Recovery, IT Planning, Credit and Risk Analysis, Environmental Risk and Sustainability Reporting, Hedging Portfolios, Insurance, Strategy Planning, Budgeting and Forecasting, Project Management, Mergers and Acquisitions, and Corporate Finance. Her core industries / sectors are banking, investment firms, energy, teaching, and Big 4 consulting (PricewaterhouseCoopers and KPMG). She has educational and work experience in the USA, New Zealand, Australia and Spain. In 2009, she completed the TEFL course to teach business English. Currently, she is working in Barcelona as a Professor of Finance, and also provides professional business English training.