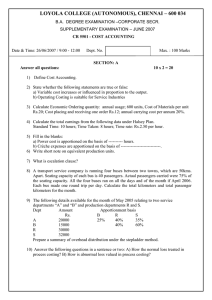

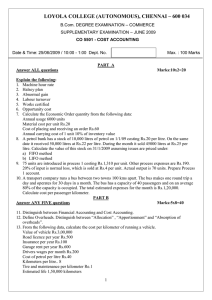

Review Questions

advertisement

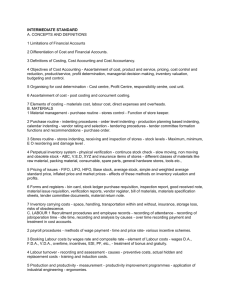

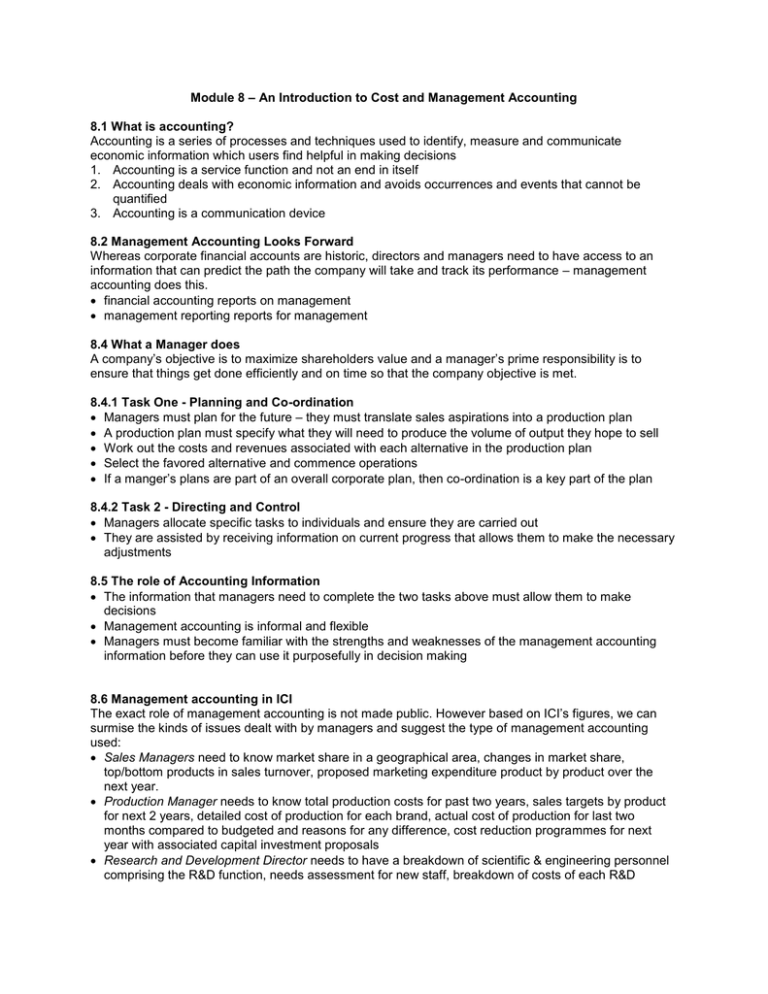

Module 8 – An Introduction to Cost and Management Accounting 8.1 What is accounting? Accounting is a series of processes and techniques used to identify, measure and communicate economic information which users find helpful in making decisions 1. Accounting is a service function and not an end in itself 2. Accounting deals with economic information and avoids occurrences and events that cannot be quantified 3. Accounting is a communication device 8.2 Management Accounting Looks Forward Whereas corporate financial accounts are historic, directors and managers need to have access to an information that can predict the path the company will take and track its performance – management accounting does this. financial accounting reports on management management reporting reports for management 8.4 What a Manager does A company’s objective is to maximize shareholders value and a manager’s prime responsibility is to ensure that things get done efficiently and on time so that the company objective is met. 8.4.1 Task One - Planning and Co-ordination Managers must plan for the future – they must translate sales aspirations into a production plan A production plan must specify what they will need to produce the volume of output they hope to sell Work out the costs and revenues associated with each alternative in the production plan Select the favored alternative and commence operations If a manger’s plans are part of an overall corporate plan, then co-ordination is a key part of the plan 8.4.2 Task 2 - Directing and Control Managers allocate specific tasks to individuals and ensure they are carried out They are assisted by receiving information on current progress that allows them to make the necessary adjustments 8.5 The role of Accounting Information The information that managers need to complete the two tasks above must allow them to make decisions Management accounting is informal and flexible Managers must become familiar with the strengths and weaknesses of the management accounting information before they can use it purposefully in decision making 8.6 Management accounting in ICI The exact role of management accounting is not made public. However based on ICI’s figures, we can surmise the kinds of issues dealt with by managers and suggest the type of management accounting used: Sales Managers need to know market share in a geographical area, changes in market share, top/bottom products in sales turnover, proposed marketing expenditure product by product over the next year. Production Manager needs to know total production costs for past two years, sales targets by product for next 2 years, detailed cost of production for each brand, actual cost of production for last two months compared to budgeted and reasons for any difference, cost reduction programmes for next year with associated capital investment proposals Research and Development Director needs to have a breakdown of scientific & engineering personnel comprising the R&D function, needs assessment for new staff, breakdown of costs of each R&D programme, assessment for each ongoing program including time to launch, likely market share, knowledge base gained in the area Managing Director of a geographic area needs information on profit margins for each product range, margins by country, pricing strategies for new products, costs charged by other parts of the company in supplying materials to his geographic area Board of directors set the dividend level and so need to know the estimated net profit for this year, cash resources of the company from which dividends are paid, payout ratios for competitors, analysts forecast of dividends, the effect on share price of different levels of payout, the impact on the stock market of offering new shares instead of a cash dividend 8.7 Differences between Management and Financial Accounting Structure Management Accounting No formal structure Rules No externally imposed rules Compulsory No, but few companies succeed without some type of system Not exclusively – can include nonmonetary information like labor hours or energy consumed Information is future oriented, less emphasis is placed on precision than in financial accounting Its fragmented by nature, often looking at individual product lines or processes Money Terms Time Span Whole or Parts? Audit Strictly speaking, no – although external auditors may use the management accounting system to test the internal controls Financial Accounting Highly structure around accounting equation Limited by generally accepted accounting principles Yes Yes, exclusively Historical and as accurate as possible Reports on the economic events of the company as a whole Yes 8.8 Management Accounting and Cost Accounting Cost accounting is a major part of management accounting The classification, collection and analysis of costs (cost accounting) are fundamental to management accounting 8.9 Where Costs come from Costing systems are designed to facilitate the allocation or apportionment of expenditure to cost centers or to products. A cost center is the smallest unit of activity or area of responsibility for which costs are accumulated. Costs are allocated to products if the relationship is obvious – e.g. the production of an item of furniture requires a certain number of man hours to assemble. These are direct costs. Other costs such as overheads like light and heat are indirect costs and have to be apportioned by some given formula to the products Prime Cost = Direct Materials + Direct Labor Types of Cost include: 1. Direct Material is material that actually becomes part of the specified finished product. It should be distinguished from other materials used in the workshop but not on each unit produced, like lubricating oils. Materials first need to be quantified by recording the amount of raw material drawn from stores. Then the price per unit is determined either by the cost of the individual item (if the item is sufficiently distinctive) or by a stock valuation method (e.g. LIFO, FIFO) 2. Direct Labor is that part of overall labor that can be traced to the units of output produced. Typically direct labor comprises of those employees closest to the manufacturing process. Its measured in terms of time and price. The time spent by each employee on a particular task is recorded. The time info is converted into monetary terms but multiplying each hour by the rate of pay for that employee. 3. Manufacturing Overheads includes all costs associated with manufacturing other than direct material and direct labor. These are recorded in the manner described previously in the accounting equation and apportioned to individual units of output by one of the variety of methods discussed in later modules. 4. Non Manufacturing Overheads like administrative and selling costs are accumulated and allocated in a manner similar to manufacturing overheads – but they cannot be included in product costs according to SSAP 9 (see Page A1/28 Question 13) 8.10 Process Costing Job costing (described above) is appropriate where the units of output are sufficiently identifiable to pinpoint the direct material and labor applied to each unit. Job costing is not suitable for situations where the items produced are very homogenous – e.g. refinining or manufacturing where products are continuously produced in an unvarying mix. Instead Process Costing is used. Process costing systems collect costs for all the products worked on during an accounting period and by dividing these total costs by the total number of units worked on during the same period, determine the cost for each unit. 8.11 Costs Relevant to Management Decisions The skill of a Management Accountant as opposed to a cost accountant comes in presenting to management the costs relevant to the decision under consideration Routine decisions are concerned with the day to day operations of the enterprise – e.g. encouraging staff to achieve the company’s objectives as efficiently as possible. For this the manager needs cost information which the cost accounting system is designed to produce Special decisions need special cost information which may not fall out of the cost accounting system easily. The management accountant must package the relevant cost information for managers to make a decision Special decisions include ‘Should we change supplier and purchase a cheaper slightly inferior product?’ or ‘How far can we afford to drop our prices in order to capture more market share?’ To know which costs will be relevant to a decision you must first know precisely the circumstances of the situation as well as the various alternatives that confront management Costs must be interpreted carefully and may have to be ‘reshuffled’ from the format in which they are produced by the cost accounting system Review Questions 1. False 2. c 3. True 4. b 5. d 6. c 7. c 8. a & d 9. d 10. b 11. a 12. c 13. b 14. b 15. c 16. 17. 18. 19. 20. d False False True d