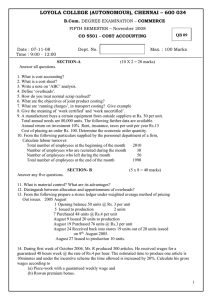

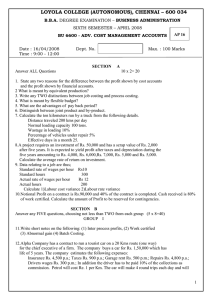

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

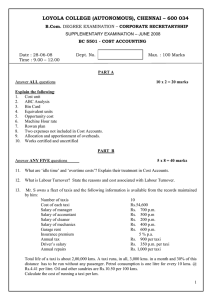

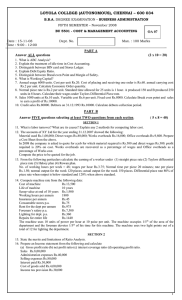

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – COMMERCE SUPPLEMENTARY EXAMINATION – JUNE 2009 CO 5501 - COST ACCOUNTING Date & Time: 25/06/2009 / 10:00 - 1:00 Dept. No. Max. : 100 Marks PART A Answer ALL questions Marks:10x2=20 Explain the following: 1. Machine hour rate 2. Halsey plan 3. Abnormal gain 4. Labour turnover 5. Works certified 6. Opportunity cost 7. Calculate the Economic Order quantity from the following data: Annual usage 6000 units Material cost per unit Rs.20 Cost of placing and receiving an order Rs.60 Annual carrying cost of 1 unit 10% of inventory value 8. A petrol bunk has a stock of 10,000 litres of petrol on 1/1/09 costing Rs.20 per litre. On the same date it received 50,000 litres at Rs.22 per litre. During the month it sold 45000 litres at Rs.25 per litre. Calculate the value of this stock on 31/1/2009 assuming issues are priced under: a) FIFO method b) LIFO method 9. 75 units are introduced in process 1 costing Rs.1,310 per unit. Other process expenses are Rs.190. 20% of input is normal loss, which is sold at Rs.4 per unit. Actual output is 70 units. Prepare Process 1 account. 10. A transport company runs a bus between two towns 100 kms apart. The bus makes one round trip a day and operates for 30 days in a month. The bus has a capacity of 40 passengers and on an average 80% of the capacity is occupied. The total estimated expenses for the month is Rs.1,20,000. Calculate cost per passenger kilometer. PART B Answer ANY FIVE questions Marks:5x8=40 11. Distinguish between Financial Accounting and Cost Accounting. 12. Define Overheads. Distinguish between “Allocation” , “Apportionment” and “Absorption of overheads”. 13. From the following data, calculate the cost per kilometer of running a vehicle. Value of vehicle Rs.3,00,000 Road licence per year Rs.500 Insurance per year Rs.100 Garage rent per year Rs.600 Drivers wages per month Rs.200 Cost of petrol per litre Rs.40 Kilometers per litre.. 8 Tire and maintenance per kilometer Re.1 Estimated life 1,50,000 kilometers 1 Estimated annual kilometers 6000. 14. The following information is obtained from the books of X Ltd for the year ending 30th June 2008:. Opening stock of raw material Rs.30,000 Opening stock of finished goods Rs.60 Closing stock of raw material Rs.25,000 Closing stock of finished goods Rs.55,000 Transactions during the period: Purchase of raw material Rs.4,50,000 Wages paid Rs.2,30,000 Factory overheads Rs.90,000 Administration overheads Rs.30,000 Selling overheads Rs.20,000 Sales Rs.9,00,000 Prepare a statement of Cost and Profit. 15. From the following data calculate reorder level, minimum level, maximum level and average stock level. Reorder period 4 to 6 weeks Consumption 25 to 75 units per week Reorder quantity 300 units 16. From the following data calculate earnings of a worker for a week under: a. Straight piece rate b. Taylors differential piece rate c. Rowan plan Number of working hours per week 48 Wages per hour Rs.3.75 Rate per piece Rs.1.50 Normal time per piece 20 minutes Normal output per week 120 pieces Actual output for the week 150 pieces Differential piece rate 80% piece rate when output is below standard and 120% when above standard. 17. The following transaction took place in respect of material X. 2nd January 2009 received 200 units at Rs.2 per unit 10th January received 300 units at Rs.2.40 per unit 15th January issued 250 units 18th January received 250 units at Rs.2.60 per unit 20th January issued 200 units Record the above transactions in the Stores Ledger pricing issues under Weighted Average Method. 18. From the following data prepare Reconciliation statement and ascertain the profit as per Financial Accounts: a. Profit as per cost accounts Rs.1,45,500 b. Works overheads under recovered Rs.9,500 c. Administration overhead under recovered Rs.22,750 d. Selling overheads over recovered Rs.19,500 e. Over valuation of opening stock in costing Rs.15,000 f. Under valuation of closing stock in financial Rs.7,500 g. Interest received during the year Rs.3,750 h. Bad debts written off during the year Rs.9,000 2 PART C Answer ANY TWO questions Marks:2x20=40 19. From the following data prepare process A account Units introduced in Process A 4000 Units completed and transferred to Process B 3200 Closing stock of work in progress 800 units (Stage of completion – material 80%; labour and overheads 70%) Normal process loss 5% of input Scrap value of loss Re.1 per unit Value of raw materials Rs.7,480 Wages Rs.10,680 Overheads Rs.7,120 20. A contracting company commenced a contract in 1st April 2006 for a contract price of Rs.6,00,000. The following were the details for the year ending 31st March 2007. Materials issued Rs.2,20,000 Plant issued Rs.50,000 Wages incurred Rs.80000 Other expenses Rs.5000 Cash received on account upto 31st March 2007 amounted to Rs.2,40,000 being 75% of the work certified. Of the plant and materials charged to the contract, plant costing Rs.5,000 and materials costing Rs.4,000 were lost. On 31st March 2007, plant costing Rs.8,000 was returned to stores Work uncertified was Rs.10000 and material on hand at site on 31st March 2007 was Rs.5,000. Depreciation is to be charged at 20% per annum on plant. Prepare Contract account, Contractee’s account and the Balance Sheet. 21. M.Ltd, has 3 production depts.. A, B and C and 2 service dept., X and Y. following particulars are available for the month of March 2005. Rent Rs. 15000, Electricity Rs.2400, Indirect wages Rs. 4000, Power Rs. 6000, Depreciation on machinery Rs. 40000, Welfare expenses Rs. 40000. The following further details are available: Total A B C X Y No of employees 400 120 80 100 50 50 Floor space(Sq mts.) 5000 1000 1250 1500 1000 250 Light points (nos) 240 40 60 80 40 20 Direct wages (Rs.) 40000 12000 8000 12000 6000 2000 HP of machines (nos.) 150 60 30 50 10 Cost of machines (Rs.) 200000 50000 60000 80000 10000 Working hours 2335 1510 1525 The expenses of the service dept. are to be allocated to the production depts.. as follows: A B C X Y X 40% 20% 30% 10% Y 20% 30% 40% 10% Calculate the overhead absorption rate per hour for each of the three production depts. What should be the price to be quoted for a job which would require Rs. 800 material, Rs.300 in wages and the job is handled by the three production depts. as follows: Dept A. 6 hrs., Dept.B 5 hrs and Dept C. 2 hrs. A profit of 25% on total cost is expected. @@@@@ 3