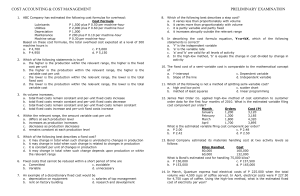

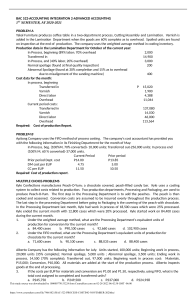

For items 59-60: The Magkaisa Company manufactures special purpose machines to order. On January 1, there were two jobs in process, #705 and #706. The following costs were applied to these jobs in the prior year: Job No. Job No. 705 706 Direct material $ 5,000 $ 8,000 Direct labor 4,000 3,000 Overhead 4,400 3,300 Total $13,400 $14,300 During January, the following transactions took place: Raw material costing $40,000 was purchased on account. Jobs #707, #708, and #709 were started and the following costs were applied to them: Job No. Job No. Job No. 707 708 709 Direct materials $3,000 $10,000 $7,000 Direct labor 5,000 6,000 4,000 Job #705 and Job #706 were completed after incurring additional direct labor costs of $2,000 and $4,000, respectively Wages paid to production employees during January totaled $25,000. Depreciation for the month of January totaled $10,000. Utilities bills in the amount of $10,000 were paid for operations during December. Utilities bills totaling $12,000 were received for January operations. Supplies costing $2,000 were used. Miscellaneous overhead expenses totaled $24,000 for January. Actual overhead is applied to individual jobs at the end of each month using a rate based on actual direct labor costs. 59. January overhead rate: 60. Cost of Job 708: