General Ledger Accountant - Reno

advertisement

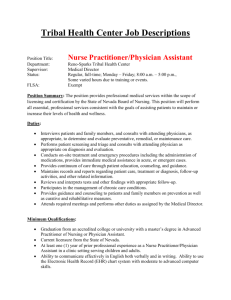

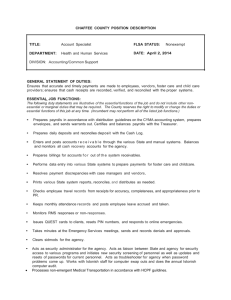

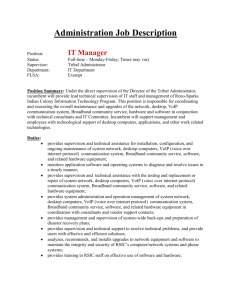

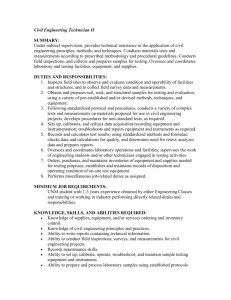

Administration Job Description NOTE: The Reno-Sparks Indian Colony requires a designated candidate to successfully complete a pre employment criminal background check, drug screen, and confirmation of references. Must pass and comply with the HR Policy 164.905- PL101.630. Position: Status: Supervisor: Department: FLSA: Procurement Technician Full-time – Monday-Friday; 8 am to 5 pm Accounting Supervisor Finance Non-Exempt Position Summary: This position is responsible to assist the Procurement Department and Accounts Payable section in processing purchase orders and support the inventory and fix assets of the Reno-Sparks Indian Colony. Duties: Administrative support for the purchasing and inventory management for the RenoSparks Indian Colony. Coordinate and process purchase order requisitions for Procurement Officer Approval. Assign appropriate purchasing account codes to requisitions and confirm vendor selection as established by policy and Procurement Officer. Research and assist in reconciling monthly vendor account statements and accounts payable ledger accounts. Provide technical support to Assistant Finance Director and Procurement Officer for computer accounts payable system. Provide support to ensure procurement records management system is up-to-date including filing and creation/maintenance/disposition of tribal vendor contract files. Performs related work or other duties, as requested. Minimum Qualifications: Associates Degree from an accredited college or university with a major in accounting, business, economics, finance or computer science; or a closely related field and five years of direct experience in purchasing, accounts payable, and accounting or data processing. Must be computer Proficient on various types of computer accounting applications and ability to utilize programs operated by the RSIC. Possess a good knowledge of the principles and methods of bookkeeping; office filing systems; and account maintenance including closing, reconciling, and balancing accounts. Be able to work and deal in a diverse cultural setting. Be bondable, able to pass a security back ground check and have a valid Nevada driver’s license with no moving violations in the past years. Position: Status: Supervisor: Department: FLSA: Accounting Supervisor Full-time – Monday-Friday; Times may vary CFO Finance Exempt Position Summary: Under the direct supervision of the CFO, the position performs professional level accounting services and supervision to the accounting support staff to ensure accuracy and timeliness of RSIC accounting records and reports. Responsible for ensuring compliance with RSIC financial and accounting policies and procedures in all aspects of supervision and responsibilities. Provides support and assistance to RSIC management staff as needed regarding accounting services, procurement requirements, and programmatic financial reporting. Reporting directly to the CFO, performs related work as assigned or delegated by the CFO. Duties and Responsibilities: Supervises, directs and reviews the day to day accounting work and operations of the RSIC, including Accounts Payable, Accounts Receivable including billing and customer services. Personnel management includes hiring, evaluating, training, and disciplining direct subordinates. Responsible for the monthly billings, collections, notices and reconciliations of all G/L accounts. Other financial transactions in accordance with Generally Accepted Accounting Principles and in conjunction with Federal, State and RSIC guidelines and laws; prepares and reconciles the balance sheet, compliance reports and other financial reports as needed. Responsible for day to day payments to make sure vendors and third parties get their payments in a timely fashion. Assists the CFO in implementing and maintaining the electronic fiscal records, financial accounting system software and initiate improvements/training for all users. Oversees and directs accounting staff to assist CFO prepare for annual single audit, other grantor reviews and/or other audits as required. Collaborates with CFO to formulate and implement short term and long term financial policies and procedures; develop departmental goals and objectives and administer the finance budget. Exercises prudent judgment on diverse and specialized accounting projects, prepares accurate financial statements and reports. Maintains chart of accounts, ensures accuracy of account codes by reviewing and approving work of subordinates before data is entered into the financial accounting system. May provide technical assistance to Program Managers in understanding financial reports and other accounting related matters. Minimum Qualifications: Bachelor’s degree in accounting, business administration or finance from an accredited college or University and five years of management or supervisory experience in financial accounting, preferable in governmental or Tribal accounting systems. Knowledge of organizational planning techniques including supervision and staff as well as goals and objectives and work standards; administrative principles and practices, program and budget development and implementation. Ability to work with software formulas, tables, and analytical review for reconciliation purposes.Must possess knowledge of GASBE 34 and thorough understanding of principles and practices of generally accepted accounting principles, including financial statement preparation and methods of financial recording, reporting, and budgeting. Experience and working knowledge of the principles and practices of computer applications and accounting software (AccuFund) as applied to the accounting functions. Must be able to secure a bond, pass a security background check, and possess a valid Nevada driver’s license. Please note: hiring preference is given to qualified members of the Reno-Sparks Indian Colony followed by members of other federally recognized tribes. Reno-Sparks Indian Colony requires a designated candidate to successfully complete a pre employment criminal background check, drug screen, and confirmation of references. Position: Status: Supervisor: Department: FLSA: General Ledger Accountant Full-time – Monday-Friday; Times may vary CFO Finance Exempt Position Summary: This position is responsible for the performance of accounting work related to the operation and maintenance of the computerized financial accounting system, including grants and contracts, tribal funds, and enterprise funds and has responsibility for complex technical accounts and maintenance duties. Duties: Reviews accounting documents to ensure accuracy of information and calculations as well as conformance with agreements, contracts, tribal budgets, grants, and applicable regulations; prepares and monitors control and subsidiary accounting records involving a variety of transactions and accounts; reconcile loan payments, long term debt voids AP checks and invoices – process stop payments, prepares year end 1099s. prepares tribal balance and financial reports, prepares journal entries and monthly reconciliation of general ledger, journal, subsidiary accounts and bank statements; for final review and approval; maintains expenditures and budgetary control accounts; prepares and compiles financial statements, general and subsidiary ledgers and supporting schedules; provides grant accounting and prepares required financial reports; coordinates daily with Contracts & Grants Manager to prepare timely and accurate reports to funding agencies; performs fixed asset and depreciation schedules, as requested; and performs all other job related duties as assigned. Minimum Qualifications: Graduation from an accredited college or university with a four-year degree in accounting, finance, or closely related field of study; at least one (2) years of prior work experience involving budgeting, accounting, use of accounting terminology, and practices regulating public agency accounting and fiscal operations as evidenced by prior work history; and moderate to advanced ability in business data processing including accounting authorizations and reconciliations.