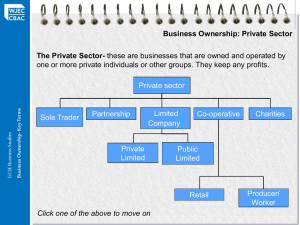

Private Limited Companies

advertisement

Types of Organization Review Content Types of Organizations Profit, non-profit and non-governmental Sole Trader/Proprietors Partnerships Companies/Corporations Classifications of Business Private and Public sectors Profit-based and non-profit based Private Sector First The Private Sector Outline Types of Private Sector Businesses Sole Trader Partnership Private Ltd Limited Companies Cooperatives Public plc The Sole Trader/Proprietor This is the most common form of business organization. One person provides the finances and in return, has full control of the business and is able to keep all the profits. Identify some of the advantages………… The Sole Trader/Proprietor Advantages Easy to set up-no legal formalities. Owner has complete control –not answerable to anybody else. Owner keeps all profits. Able to choose times and patterns of working. Able to establish close personal relationships with staff (if any are employed) and customers. The business can be based on the interest and skills of the owner – rather than working as an employee for a larger business. The Sole Trader/Proprietor Identify some of the disadvantages………… The Sole Trader/Proprietor Disadvantages Unlimited liability – all of the owner’s a assets are potentially at risk. Often faces intense competition from bigger firms, for example, food retailing. Owner is unable to specialize in areas of the business that are most interesting – it is responsible for all aspects of management. Difficult to raise additional capital. Long hours often necessary to make business pay. Lack of continuity- as the business does not have separate legal status, when the owner dies, the business ends too. Partnership Partnerships are agreements between two or more people carry on a business together, usually with a view of making a profit. The Deed of Partnership establishes the rights and privileges of the partners. This document includes issues such as voting rights, distribution of profits, The management role of each partner and who has the authority to sign contracts. Partnership Identify advantages of a partnership Partnership Advantages Partners may specialize in different areas of business management. Shared decision making. Additional capital injected by each partner. Business losses shared between the partners. Greater privacy and fewer legal formalities that corporate Organizations (companies) Partnership . Identify disadvantages of a partnership Partnership Disadvantages Unlimited Liability for all partners. Profits are shared. There is, as with sole traders, no continuity and the partnership will have to be reformed in the event of the death of one partner. Al partners are bound by the decision of any one of them. Not possible to raise capital from selling shares. A sole trader, taking on partners will loose independence of decision making. Limited Company 3 Differences between limited companies and sole traders and partnerships Limited companies have: 1. Limited Liability 2. Legal Personality 3. Continuity What is limited liability? Financial protection in the event that the company fails. The financial liability is limited. Sole Traders and Partnerships are financially responsible for all claims against the company. What is legal personality? A company is its own entity having an identify separate of that of its owners. “It is its own person” so to speak in the eyes of the law. What is continuity? The company will continue to exist in the event of the death of its owners. A sole trader or partnership is automatically dissolved. Who owns a limited company? Shareholders The company issues shares. Each share is a small ownership in the company. Shareholders own shares in a limited company. What is a Private Limited Company? (Ltd.) It is a company – has issued shares. Its shares are not available for sale to the public. Private Limited Companies Tend to be relatively small companies. Their business name ends in Limited or Ltd. IE: JP Solutions Ltd. Shares can only be transferred privately and all shareholders must agree to the transfer. Private Limited Companies are often family businesses owned by members of the family or close friends. The directors of these companies tend to be shareholders and are involved in the running of the business. Many manufacturing firms are Private Limited Companies rather than Sole Traders or Partnerships Private Limited Companies Advantages Shareholders have limited liability. More capital can be raised as there are no limits on the number of shareholders. Control of companies cannot be lost to outsiders. The business will continue even if one of the owners dies. Private Limited Companies Disadvantages Profits have to be shared out amongst a much larger number of members. There is a legal procedure to set up the business. This takes time and costs money. Firms are not allowed to sell shares to the public This restricts the amount of capital that can be raised. Financial information filed with the Registrar can be inspected by any member of the public. Competitors could use this to their advantage. What is a Public Limited Company? (Plc.) It is a company – has issued shares. Its shares are available for sale to the general public. Its share price is quoted on the stock exchange. A board of directors control the management of the company appointed at an annual meeting. Advantages of a Corporations • • • • Can raise money by issuing shares of stock. Offers owners limited liability. Owners are liable only up to the amount of their investments. People can easily enter or leave the business by buying or selling their shares of stock. The business can hire experts to professionally manage each aspect of the business. Disadvantages of a Corporations •Start-up is costly – legal assistance is required as well as business consultants and financial advisors. •Corporations are subject to more government regulations than partnerships or sole proprietorships •Share prices fluctuate; risk of takeover •Income is taxed twice •Short-term profit objectives of major shareholders Public Limited Companies Disadvantages Advantages Huge amounts of money can be raised from the sale of shares to the public. Production costs may be lower as firms gain economies scale. Because of their size, plc can often dominate the market. It becomes easier to raise finance as financial institutions are more willing l to lend to plcs. Questions: What are the limitations of being a limited company in a highly competitive market? Setting up costs can be very expensive. Since anyone can buy shares, its possible for an outside interest to take control of the company. All company accounts can be inspected by member of the public. Because of their size they cannot deal with customers at a personal level. The way they operate is controlled by various company acts which aims to protect shareholders. There is divorce of ownership and control which might lead to the interest of owners being ignored to some extent. Plcs inflexible due to their size. Public Sector Organizations Now the Public Sector Public Sector Organisations The Public Sector is made up or organizations which are owned and controlled by central or local government or public corporations. They are funded by government and in some cases from their own trading ‘surplus’ or profit. Public Sector businesses still have important roles to play in certain areas of business activity. Public Corporations Public corporations are owned and controlled by the government. Profit is not their main goal. They are meant to serve or meet the needs of citizens. Examples: PBS (Public Broadcasting Service) United States Postal Service Public Corporations Advantages Managed with social objectives rather than profit Loss-making services might be kept operating if the social benefit is great Finance raised mainly from the government Disadvantages Tendency towards inefficiency because no profit targets Subsidies from government can encourage inefficiencies Government may interfere in business decisions for political reasons Non-Profits AKA: Non-Governmental Organizations (NGOs) Charities Pressure Groups Social Enterprise Charity Profit is not the objective Money raised is used to support or bring attention to cause Pressure Group Pressure groups are charities Their goal is to change behaviors in: Citizens Business Governments Social Enterprise A company with an objective to reinvest or use profits to benefit society. Triple bottom line: Economic: Make a profit to reinvest Social: Provide job support for community Environmental: Manage business in a sustainable way Higher Level “Stuff” Public-Private Partnerships (PPP) Private sector management and financing in public sector projects that benefit the public Government Funded PPP Government provides all or part of the funding Private management to control costs and be efficient Example: HopeClinicLukuli in Kampala, Uganda. Receives government funding for malaria prevention and HIV testing Private Sector Funded (PPP) Large projects that are financed in the private sector releasing the government from the burden of funding. The gov’t then leases or pays rent Known as PFI – Private Finance Initiative Govt Directed with Private Financing and Management (PPP) Private sector funding and private sector management of public projects. Example: London hospital was built with private financing, then leased to the government which manages and control hospitals health care services. PPP Costs and Benefits Costs If managed by the private sector, can cut wages and benefits and workers no longer have protection of being employed by the public sector Reputation of large business earning large profits paid by taxpayers Private sector may lack experience managing such large scale projects Benefits Schools, roads, prisons, and hospitals have been built with this scheme The goal is for private sector to make a profit causing cost efficiency not seen with government supervision Public service improvement without increasing taxes for capital improvements