Nature of Business

advertisement

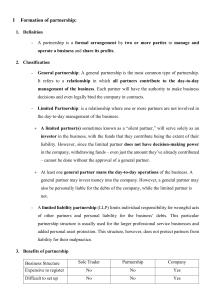

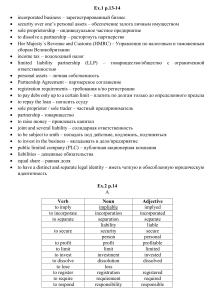

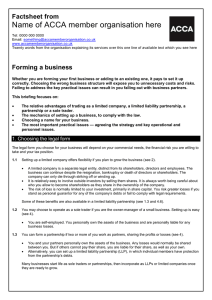

Types of Businesses classification of business size – small to medium enterprises (SMEs), large local, national, global industry – primary, secondary, tertiary, quaternary, quinary legal structure – sole trader, partnership, private company, public company, government enterprise factors influencing choice of legal structure – size, ownership, finance Small to medium enterprises (SMEs) are the most common businesses in Australia. These businesses play a key role in the provision of goods and services for the general public, provide employment, foster innovation and productivity improvements, supply inputs to larger businesses, serve the interests of local communities and facilitate growth in the Australian economy. According to the ABS in 2001, a small business is defined as a business that employed less than 20 people, including categories of: non-employing businesses – sole proprietorship and partnership without employees micro businesses – businesses employing less than 5 people, including non-employing businesses other small businesses – businesses employing 5 or more people, but less than 20 people. A medium business is one that employs more than 20 but less than 200 people. Thus a large business is one that employs 200 or more people. Local, national, global A local business is an organisation that operates within one area. National businesses operate across Australia. An international business is one whose ownership and production is based in one country; it exports the goods and/or services it produces to other countries. A transnational business is a business that operates in many countries. Its goods and services are produced and sold in a number of different countries. Primary industry businesses are involved in the acquisition of raw materials The secondary industry consists of businesses that use raw materials, combined with labour and capital equipment, to create finished products. The tertiary industry is made up of businesses whose prime function is related to providing a service. The quaternary sector consists of those businesses that provide information services to their customers. The quinary sector is concerned with businesses that provide services that are traditionally performed in the home. Sole Trader Trust Partnership Legal Structure Private Company Cooperative Company Limited by Guarantee Public Company Size – as a business grows, it is likely it will move from either a sole trader or partnership to a company structure. Ownership – by altering the legal structure of a business, the original owner is also likely to relinquish his or her full control over the business. Finance – generally, smaller businesses may find it more difficult to access finance than do their larger counterparts. Business growth is often accompanied by a greater demand for financial resources. Advantages Personal (unlimited) liability for business Low cost of entry debts Simplest form End of business when Complete control owner dies Less costly to operate Difficult to operate if No partnership disputes sick Owner’s right to keep Need to carry all losses all profits Burden of management Less government Need to perform a regulation wide variety of tasks No tax on profits, only Difficulty in raising personal income finance for expansion Disadvantages Advantages Disadvantages Low start-up costs Personal unlimited liability Less costly to operate than a company Liability for all debts, including partner’s Shared responsibility debts, even before the and workload partnership has begun Pooled funds and talent Possibility of disputes Minimal government Difficulty in finding a regulation suitable partner No tax on profits, only Divided loyalty and personal income authority On death of one partner, business can keep going Advantages Disadvantages Easier to attract public finance Limited liability – separate legal entity Can transfer ownership easily Enjoys a long life – perpetual succession Experienced management – board of directors Greater spread of risk Company tax rate lower than personal income tax rate Growth potential Recent legislation power allows a company to have only one shareholder and one director Cost of formation Double taxation – company and personal Personal liability for business debts of directors knew at the time that the business was unable to pay loans Must publish a yearly annual report of audited accounts Public disclosure – reporting of certain information Becomes too large resulting in inefficiencies