Question 2 - stust.edu.tw

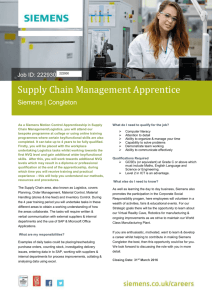

advertisement

BEN Q’S DEAL OF THE CENTURY HEG Hung Duy Elwin Kusumaningtyas Goran Adam Gasparac • BenQ Corporation is a Taiwanese multi-national company that sells and markets consumer electronics, computing and communications devices under the "BenQ" brand name, which stands for the company slogan Bringing Enjoyment and Quality to life • Headquarters Taipei, Taiwan • Revenue US $2.24 Billion (FY 2010) • Employees 1,600 (2011) • • • • Siemens AG is a German multinational engineering and electronics conglomerate company headquartered in Munich, Germany. It is the largest Europe-based electronics and electrical engineering company It has operations in around 190 countries and approximately 285 production and manufacturing facilities Siemens had around 405,000 employees (2012) Revenue € 78.29 billion (2012) • Siemens offers a wide range of electrical engineering- and electronicsrelated products and services. Its products can be broadly divided into the following categories: buildings-related products; drives, automation and industrial plant-related products; energy-related products; lighting; medical products; and transportation and logistics-related products. Marketing and management issue • BenQ’s strategy of focusing on fast-growing product lines (flat-panel screens and cell phones) has brought it into direct competition with some of the world’s largest consumer electronics companies including Samsung and Sony. • BenQ is paying its brand-building bill through original design manufacturing (ODM). • BenQ competes in products with short life cycles and prices that drop rapidly within weeks of product introduction. BenQ-Siemens Siemens was expected to regain investor confidence through the selling of their money-losing mobile phone unit, and shifting its focus to its more profitable industrial operations, including power turbines and automation equipment. BenQ has been seeking ways to boost its economic scale and manufacturing capabilities to become a leading mobile phone player. MERGER Agreement BenQ Siemens • Acquired 100% of Siemens’s mobiledevices unit without directly paying the German company. • Gained the exclusive right to use the Siemens trademark for mobile phones for an 18-month period and co-branding rights to BenQ-Siemens for 5 years. (cost Siemens about 350 million euros. ) • Agreed to fulfill Siemens’s labor contract agreements with the cell phone employees through the end of 2006. • Siemens provided BenQ with 250 million euros to help fund the business, and later paid 50 million euros to buy newly issued shares in BenQ. • Carry the unit’s losses, about 1.5 million euros a day, until the transaction was completed • Continued to work with BenQ on developing handset technologies. BenQ-Siemens • (2005) Germany’s Siemens launched the new brand, BenQ-Siemens. With the merger, BenQ Mobile became the world’s fourth largest mobile phone brand after Nokia, Motorola, Samsung. • The acquisition of Siemens’s mobile phone unit lost over 500 million euros in 2005. • (September, 2006) BenQ decided to stop investing in the money-losing operation and filed for bankruptcy protection in Germany. Question 1 • How do you evaluate BenQ’s acquisition deal of Siemens handset unit ? Is it needed “too good to be true” ? Where are the pros and cons? Question 1 • BenQ’s acquisition deal of Siemens handset unit was a good decision because - They made mobile phones for Nokia and Motorola. Besides phones, BenQ is the manufacturer of Acer laptop computers, flat-panel televisions and other household electronics -Get high technological achievements of BenQ, so they can save time to catch up new technological achievements -Own high technological infrastructures -Own Siemens brand in 5 years, so they can access Siemens’ customers in Europe and Latin American Question 1 • BenQ’s acquisition deal of Siemens handset unit was a good decision because - They made mobile phones for Nokia and Motorola. Besides phones, BenQ is the manufacturer of Acer laptop computers, flatpanel televisions and other household electronics -Get high technological achievements of BenQ, so they can save time to catch up new technological achievements Question 1 • However - Motorola, Samsung, Nokia, and Apple develop fast. Those brand command 60% of the worldwide handset market. - Current technologies of Siemens is good, but it can be suitable with customers’ demands - 3,700 workers in high cost in German - Siemens do not guarantee about profitability Question 1 • “Too good to become true” has several problems - Siemens could not sell handset department if it still can make profit - Siemens get stuck with their technology and customers’ demand, the mobile unit has long been a key weakness for Siemens. Siemens has been criticized for being late to sell phones with crucial innovations like cameras, clamshell design and color screens. - Siemens made its first mobile phone in 1988. In 2002, Siemens was the No. 4 maker of mobile phones, with 9 percent of global market share; its position has slipped this year to No. 6, with a 5.5 percent share, the company said (2005). Question 2 (1) Where is BenQ vulnerable? • The acquisition with siemens proved to be a strategic mistake, as the two companies could not successfully integrate. • Culture and communication issues in what became an unsuccessful acquisition. • Disagreements or miscommunication between BenQ’s German management and Taipei headquarters over the development process of new products and the speed of reorganization highlight some of the difficulties of integration. BenQ’s decision to cut its financial support for the German subsidiary was condemned as rash and irresponsible in Germany, while it was deemed rational to many in Taiwan. Question 2 (2) • In the case of BenQ-Siemens, labor leaders, politicians and media commentators in Germany accused Siemens of knowing that its mobile unit was doomed when BenQ took it over, and that it was trying to avoid the big payoffs typically awarded to German workers when they lose their jobs . • The Siemens employees felt they were deceived and betrayed by the German executives and had no trust in BenQ. • BenQ did not create appropriate internal communication mechanisms at the onset of the deal to reduce rumors and anxiety among the German employees. • Cross-cultural communication was difficult to achieve. Analysis • Two companies’ incompatible cultures made it unlikely that they could add value and create synergy. • An international merger and acquisition has a better chance of success when managers consider the host country’s culture and allocate enough time and resources for assimilation. • Managers need to communicate and clearly define objectives and performance expectations during the integration and implementation process. Question 3. What strategic marketing recommendation would you make to BenQ's going forward? •Question 3. As stated earlier, in order to become a serious global player in this branch of industry with respected market share, all of the company's business has to be functioning on the very demanding level German Company Siemens obviously had problems on different levels of this part of their business already for a long time Question 3. So they estimated that is easier to get rid of that part of their company's business Merger like this one (Siemens-BenQ) is really difficult because both companies are big, doing similar but not the same business and definitely not in the same way Companies are from different part of the world with different management capacity and style, language barrier, and not even to mention different social potential of their employees. Question 3. So in order to do the business globally and even better to be successful while doing it obviously depends on many factors This is something that Siemens as a global player knew as they experienced it on their own. On the other hand there is a BenQ company which is trying to become one by merging with company that has everything what they don't – brand, know how, innovation, tradition..etc. Question 3. It is very hard to say what is there for BenQ to do in order to make this merger with Siemens beneficial for them as it was initially planned especially because I do not believe it will end up as a success story Some things though are certain: 1. In order to penetrate global market with your own brand your marketing approach has to be clear and understandable 2. Marketing budget is playing a serious roll on this level of market overtaking