Financial Instruments

advertisement

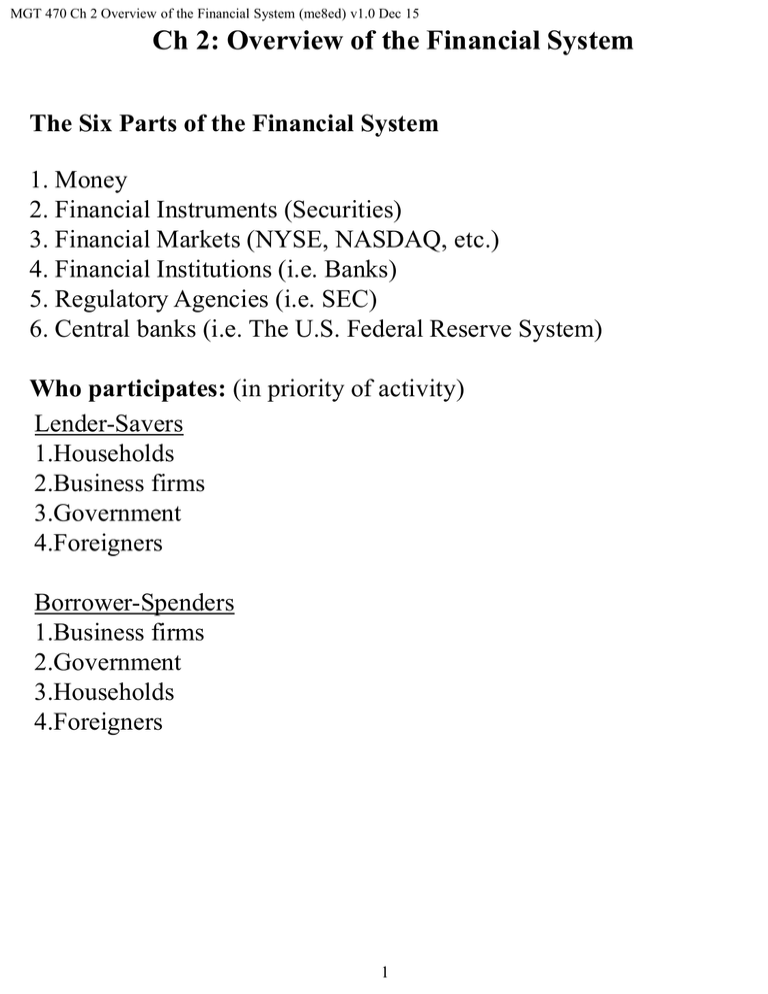

MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Ch 2: Overview of the Financial System The Six Parts of the Financial System 1. Money 2. Financial Instruments (Securities) 3. Financial Markets (NYSE, NASDAQ, etc.) 4. Financial Institutions (i.e. Banks) 5. Regulatory Agencies (i.e. SEC) 6. Central banks (i.e. The U.S. Federal Reserve System) Who participates: (in priority of activity) Lender-Savers 1.Households 2.Business firms 3.Government 4.Foreigners Borrower-Spenders 1.Business firms 2.Government 3.Households 4.Foreigners 1 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 What is Money? Answer: Anything that can be readily used to make economic transactions Specifically, money is: 1. A means of payment; money finalizes payments so that buyers and sellers have no further claim on each other 2. A unit of account: it establishes a standard of value the relative value of goods & service is easily expressed in terms of money 3. Store of value: money retains value from day to day (w.r.t. inflation) money is not the only thing that is a store of value (i.e. securities, real estate, commodities, classic cars, etc.) but it is the most liquid. What does it mean for something to be liquid? these qualities are essential for money to be used as a means of payment. Liquidity: Economic definition: A measure of the ease with which an asset can be turned into a means of payment Business definition: the ability to convert a non-cash asset into cash quickly and without significant loss in value Funding Liquidity: the ability to borrow money to buy securities or make loans Corporate Liquidity: the ability to use cash reserves to deal with an unforeseen liability or exploit an unforeseen opportunity 2 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Inflation: Definition: The decrease of the purchasing power of currency over time Cause: various factors; chief among them: demand for goods & services grows faster than the supply of goods & services; as time goes by, goods & services become more valuable thus more expensive; this reduces the purchasing power of currency An increase in the amount of money in circulation in an economy; as quantity of currency increases, value of currency decreases with respect to the value of goods & services; it takes more money to purchase goods & services, thus the purchasing power of currency is reduced 3 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Financial Instruments (Securities): A written legal obligation/agreement of one party to transfer something of value to another party at some future date A written legal obligation/agreement: subject to government enforcement; i.e. a person can be compelled to take action as specified in the agreement significantly lowers risk and attracts investors Obligates one party to transfer something of value to another party could be an exchange of money for money only could be an exchange of money for a commodity could be an exchange of commodities only Payments will be made at some future date payment schedule is specified specifies conditions under which payments will be made some agreements allow for payments only if certain conditions are met i.e. insurance agreements cash flows are re-arranged/translated/exchanged over time Four Fundamental Factors That Determine Value of Securities: 1. Size of the promised payment 2. When the payment is to be made 3. The likelihood that the payment will be made 4. The circumstance under which the payment will be made (primarily applies to derivative securities and insurance) 4 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Uses of Financial Instruments: A means of payment: money is not the only thing you can use to pay for stuff many business transactions involve an exchange of securities: stock options received as employment compensation corporations purchase other corporations and pay for them in stock Securities can be used as a storage of value: allows you to save up current earnings for future spending (i.e. invest); you store up value allows you to spend/purchase a lot now and pay for it later; the finance company stores up value securities (especially bonds) are thought to be better than money as a storage of value Why? Answer: refer to Introduction p.5 Time Has Value Securities can be used to transfer risk between buyer & seller: insurance futures contracts Characteristics of Financial Instruments: Standardization: homogenous design if all securities were different they would be confusing; people would be reluctant to invest greatly enhances trading/marketability: people have a much better understanding of what they’re buying securities market are much more efficient 5 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Characteristics of Financial Instruments(cont.) Communicate information: summarize essential details about the issuer reduce the amount of time, effort & expense of gathering info about the issuer reduces the uncertainty (risk) of investing thus encourages investment reduces the problem of asymmetric information (i.e. one party knows more than the other). Example: borrowers usually know more about their own risk factors than lender; borrowers may be unwilling to disclose potential financial risk factors the financial system allows lenders to gather information on borrowers to reduce the uncertainty debt securities are designed to elicit and disclose information about borrowers Underlying vs. Derivative Financial Instruments: Underlying instruments: stocks & bonds the value of these securities is based directly on the value of the underlying asset i.e. the value of ownership in a company (stocks) or the value of the loan (bonds) Derivative instruments: futures & options contracts the value of these securities is based indirectly on the value of the underlying asset; the value is “derived” the value of these securities is based on the price behavior of the underlying asset 6 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Basic Types of Financial Instruments: 1. Securities Used Primarily as Stores of Value: Bank Loans: service individual consumers as well as corporations amount of money loaned is specific to each transaction not very tradable Bonds: a type of loan debt is issued in chunks (uniform denominations, usually $1,000) instead of one big lump sum issued by governments and private corporations much more marketable/tradable than loans Home Mortgages: primarily service individual consumers a loan that is primarily used to purchase real estate usually requires collateral (the house, land, etc.) more tradable than loans, less tradable than bonds Stocks (Equity): entitles the holder to a share of ownership in the firm and a share of the profits of the firm usually promises no payments value is based on expected future income of the firm issued by companies to raise funds for large expansions usually issued in large quantities only once Asset-Backed Securities: shares in the returns or payments arising from specific assets such as student loans, credit card debt & even box office receipts the most prominent are mortgage-backed securities large number of mortgages are pooled/bundled together securities are issued which offer a share in the interest profits 7 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Basic Types of Financial Instruments(continued) 2. Securities Used Primarily to Transfer Risk Insurance Contracts Futures Contracts: a derivative security an agreement between two parties to exchange a fixed quantity of a commodity or asset at a fixed price at some specified future date the value of the contract is a mere fraction of the value of the underlying asset the value of the contract changes as the current market value of the underlying asset changes Option Contracts: a derivative security an agreement that gives the owner the right but not the obligation to buy or sell a fixed quantity of a commodity or asset at a fixed price at some specified future date the value of the contract is a mere fraction of the value of the underlying asset the value of the contract changes as the current market value of the underlying asset changes Swaps: a derivative security an agreement to exchange two specific cash flows at certain times in the future (more on this in Ch 9) 8 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Financial Markets: Are places in which funds are transferred from people who have an excess of available funds (lenders/savers) to people who have a shortage of such (borrowers/spenders) are places where financial instruments and assets are bought and sold the trading of financial instruments and assets is the way funds are transferred Markets pool and communicate information Markets relay and react to information quickly Markets allocate resources Markets determine prices of resources Markets enable firms and individuals to finance activities Markets minimize transaction costs Markets foster risk sharing Markets offer investors and investees liquidity: participants buy & sell cheaply through minimized transaction cost and broad choice transactions made as easily as possible through standardization of information exchange 9 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 The Structure of Financial Markets: Primary Financial Market: borrowers obtain funds from lenders by selling newly issued securities big players only; major banks, investment banks, underwriting firms and Uncle Sam Secondary Financial Market previously issued securities (“seasoned securities) are traded NYSE, NASDAQ, AMEX, etc. must participate through licensed brokers and dealers Main Types of Secondary Market Exchanges: centralized exchange: fixed location and trading floor (i.e. NYSE) transactions occur face-to-face with electronic assistance over-the-counter (OTC) no fixed location (i.e. NASDAQ) almost all transactions occur over electronic media (initially phone then computer/internet) electronic communication networks: this is what OTC exchanges are becoming no human interface; everything done electronically Etrade, Scottrade, etc. Debt Markets: money markets: short-term (maturity < 1 year) capital markets: intermediate term (1 < maturity < 10 ) long-term (maturity > 10 year) intermediate term (maturity in-between) represented $38.2 trillion at the end of 2012 Equity (stock) Markets (also considered a capital market) pay dividends, in theory forever represents an ownership claim in the firm total value of all U.S. equity was $18.7 trillion at the end of 2012 10 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Financial Institutions Called “financial intermediaries” because they intermediate between investors and investees Banks, securities firms, insurance companies, pension funds, etc. The Role of Financial Institutions: Reduce transaction cost by issuing standardized securities Reduce information cost of screening and monitoring borrowers to ensure credit worthiness Ensure that proceeds are issued properly Provide investors easy access to their funds 11 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Regulatory Agencies Government Regulation establishes specific rules for financial intermediaries to follow The goal of govt’ regulation is not to eliminate all risks that investors face The goal is to minimize the cost of financial crises to tax payers Banks and other financial intermediaries are regulated by a combination of various federal and state organizations: FDIC, Office of the Comptroller of Currency, National Credit Union Administration, U.S. Office of Thrift Supervision (OTS), Securities Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), etc. 12 MGT 470 Ch 2 Overview of the Financial System (me8ed) v1.0 Dec 15 Central Banks The Functions of Central Banks 1. The Government’s Bank: Creates money Controls the amount of money in circulation Executes financial transactions for the government 2. The Banker’s Bank: Guarantees that sound intermediaries can do business by lending to them, even in time of crisis (“lender of last resort”) Manage the payments system for interbank payments Objectives of Central Banks Central banks work to reduce the volatility of economic and financial systems by: 1. Maintain low and stable inflation (preserve price stability): Volatile inflation degrades the information content of prices, (i.e. price movements caused by inflation mask price movements caused by changing supply or demand. High inflation is detrimental to economic growth; people are reluctant to invest their money for fear of not receiving adequate compensation for inflation 2. Promote high, stable in output and employment: 13