ch. 4 analyzing investing activities

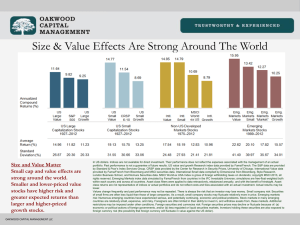

advertisement

CH. 4 ANALYZING INVESTING ACTIVITIES Current Assets Cash and cash equivalents If cash equivalents are invested in equity securities, companies risk a reduction in liability should the market value of this investments decline. Cash and cash equivalents are sometimes required to be maintained as compensating balances => not available to meet normal operating needs Current Assets Receivables Collection risk: rely on knowledge of industry conditions to assess the provision for uncollectibles Authenticity of receivables: credit policy and the right of merchandise return Securitization of receivables Current Assets Prepaid Expenses Inventories Inventory cost flows Inventory costing for manufacturing companies: overhead Lower of costs or market Investment Securities Separating investment from investing assets and performance Analyzing accounting distortions from securities Opportunities for gains trading Liabilities recognized at cost Inconsistent definition of equity securities Classification based on intent Derivative Securities Derivative: a financial instrument whose value is derived from the value of another assets, class of assets, or economic variable. Futures contract, swap contract, option contract, forward contract. Analyzing derivatives: Objectives for using derivatives Risk exposure and effectiveness of hedging strategies Transaction specific versus companywide risk exposure Inclusion in operating or nonoperating income Long-Lived Assets Plant Assets and Natural Resources Historical costs & Impairment Depreciation and depletion: useful lives, allocation method Intangible Assets Goodwill is recorded only when acquired, most goodwill likely exists off the balance sheet. Amortization Valuation