1 - Holy Family University

advertisement

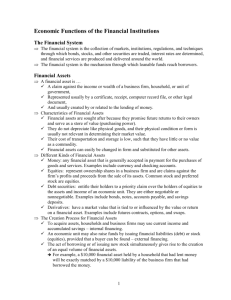

Chapter 1 Investments: Background and Issues 1.1 Real Versus Financial Assets • Real Assets • Used to produce goods and services: Property, plant & equipment, human capital, etc. • the net wealth of an economy is the sum of its real assets. • Financial Assets • Claims on real assets or claims on asset income 1-2 Table 1.1. Balance Sheet – U.S. Households Table 1.2 Domestic Net Worth Most Current http://www.federalreserve.gov/releases/z1/current/ 1-3 Major Classes of Financial Assets or Securities • Debt o Money market instruments • Bank certificates of deposit, T-bills, commercial paper, etc. o Bonds o Preferred stock • Common stock o Ownership stake in the entity, residual cash flow • Derivative securities o A contract whose value is derived from some underlying market condition. 1-4 1.3 Financial Markets and the Economy 1-5 Financial Markets • Informational Role of Financial Markets o Do market prices equal the fair value estimate of a security’s expected future risky cash flows? o Or any thing? – Intrade.com 1-6 Separation of Ownership and Management; Ethics o Agency costs: Owners’ interests may not align with managers’ interests o Mitigating factors: • Performance based compensation • Boards of Directors may fire managers • Threat of takeovers – M&A FINC 350 • Governance and ethics failures have cost our economy trillions of dollars. o Eroding public support and confidence in market based systems 1-7 Example 1.1 • In February 2008, Microsoft offered to buy Yahoo at $31 per share when Yahoo was trading at $19.18. • Yahoo rejected the offer, holding out for $37 a share. • Billionaire Carl Icahn led a proxy fight to seize control of Yahoo’s board and force the firm to accept Microsoft’s offer. • He lost, and Yahoo stock fell from $29 to $21. • Did Yahoo managers act in the best interests of their shareholders? 1-8 Other examples • Accounting Scandals o Enron, WorldCom, Rite-Aid, HealthSouth, Global Crossing, Qwest, • Misleading Research Reports o Citicorp, Merrill Lynch, others • Auditors: Watchdogs or Consultants? o Arthur Andersen and Enron 1-9 Corporate Governance and Corporate Ethics • Sarbanes-Oxley Act (SOX) o Increases the number of independent directors on company boards o Requires the CFO to personally verify the financial statements o Created a new oversight board for the accounting/audit industry o Charged the board with maintaining a culture of high ethical standards 1-10 1.4 The Investment Process o Asset allocation Choosing the percentage of funds in asset classes 60% Stocks 30% Bonds 6% Alternative Assets 4% Money market securities o Security selection & analysis Choosing specific securities w/in an asset class o The asset allocation decision is the primary determinant of a portfolio’s return 1-11 Risk-Return Trade- Off o How do we measure risk? o How does diversification affect risk? o Discussed in Part 2 of the text o Investors can choose a desired risk level Bonds versus stock of a given company Bank CD versus company bond Tradeoff between risk and return? 1-12 Efficient Markets o Market efficiency: o Securities should be neither underpriced nor overpriced on average o Security prices should reflect all information available to investors o Whether we believe markets are efficient affects our choice of appropriate investment management style. o 3 forms – strong, semi-strong, weak 1-13 Active vs. Passive Management Active Management (inefficient markets) Finding undervalued securities Security Selection Timing the market Asset Allocation Passive Management (efficient markets) No attempt to find undervalued securities No attempt to time • Indexing Holding a diversified portfolio: • Constructing an “efficient” portfolio 1-14 The Players • Business Firms – net borrowers • Households – net savers • Governments – can be both borrowers and savers • Financial Intermediaries “Connectors of borrowers and lenders” o Commercial Banks • Traditional line of business: Make loans funded by deposits o o o o Investment companies Insurance companies Pension funds Hedge funds 1-15 The Players Cont. • Investment Bankers aka Wall Street o Firms that specialize in primary market transactions o Primary market vs Secondary o After 2008, no more pure investment bankers, annulling 1933 Act o As a result, they face much stricter banking regulations, e.g. deleveraging 1-16 1.7 Recent Trends • Globalization o Managing foreign exchange o International diversification reduces risk o Instruments and vehicles continue to develop (ADRs and WEBs) • Securitization • Financial Engineering • Information and Computer Networks • Nasdaq as of Feb 2011 has the fastest network: 98ms/trade, Soon Singapore 90ms/trade • Deleveraging 1-17