ACCT 284 Worksheet Chapter 4(part 1)

advertisement

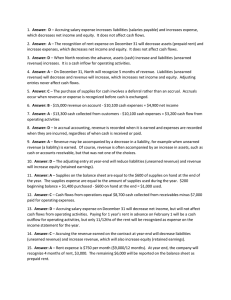

ACCT 284 Worksheet Chapter 4(part 1) 1). Definition of deferral and accrual? 2). Adjusting Entry (Account that affects) Deferred expense: Deferred revenue: Accrued expense: Accrued revenue: 3). On October 31 of the current year, unearned service revenue of $4,800 was recognized representing one year of services to be performed over the following 12 months. The adjusting entry on December 31 will include a(n) A) increase to unearned service revenue of $800. B) decrease to unearned service revenue of $4,000. C) increase to service revenue of $800. D) increase to service revenue of $4,000. 4). Failure to make an adjusting entry to recognize rent revenue receivable would cause A) an understatement of assets, net income, and stockholders' equity. B) an overstatement of assets and stockholders' equity and an understatement of net income. C) no effect on assets, liabilities, net income, nor stockholders' equity. D) an overstatement of assets, net income, and stockholders' equity. 5). At the beginning of the quarter, World Company had supplies of $15,400 recorded. During the quarter, World purchased an additional $35,200 in supplies. At the end of the month, World had $13,900 of supplies on hand. The correct adjusting entry at the end of the quarter is: A) Supplies Expense + $36,700 Supplies - $36,700 B) Supplies Expense + $33,700 Supplies - $33,700 C) Supplies Expense + $35,200 Cash - $35,200 D) Supplies Expense + $36,700 Supplies Payable + $36,700 6). On July 1, 2012, Ryan Company paid the premium in advance on a one-year insurance policy on equipment in the amount of $6,000. At that time, the full amount paid was recorded as prepaid insurance. On December 31, 2012, the end of the accounting year, Ryan Company would be required to record an adjusting entry that would include a A) $2,500 decrease to prepaid insurance. B) $3,000 increase to insurance expense. C) $3,000 increase to prepaid insurance. D) $2,500 increase to insurance expense. 7). On April 1, 2012, Allen Company signed a $100,000, one-year, 6 percent note payable. At due date, March 31, 2013, the principal and interest will be paid. Interest expense and interest receivable should be reported on the income statement (for the year ended December 31, 2012) as A) $6,000. B) $3,000. C) $4,500. D) $1,500.