wkst 7 answer key

advertisement

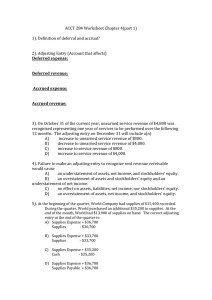

Name:_________________ Course:________________ Date__________________ On Oct 1, Matt paid $75,000 for five months of rent. What is the adjusting entry on Dec 31? Unearned Revenue 45,000 Revenue 45000 During May, consumers paid 6,000 for services. On Dec 31 they still owed 3500 of services. What is the adjusting entry on Dec 31? Unearned Revenue 2500 Revenue 2500 Unbalanced Supplies of 950 at the beginning of the month. 100 of supplies were purchased during the month. The ending balance was equal to 150. What is the adjusting entry? Supplies Expense 900 Supplies 900 On Feb 1. Ben borrows 10,000. Interest is 8% annual. What is the adjusting entry on Dec 31? Interest Expense 733 Interest Payable 733 This year our company earned 200 in interest from a checking account. This has not yet been recorded. What is the adjusting entry? Interest Receivable 200 Interest Revenue 200 We had 4,000 of supplies on hand on Oct 1. Purchased 6300 since Oct 1 and the end of the count showed amounts of 1200. What was supplies expense? Supplies Expense is equal to 9100 Supplies Expense 9100 Supplies 9100 On September 1, the company paid for a three year insurance policy costings 27,000. The unadjusted balance of insurance expense was 8,500. What is insurance expense on Dec 31? Insurance Expense 3000 Prepaid Insurance 3000 Ben rents out an unused building for a year on Oct 1. The lease requires a 24,000 payment. What is the adjusting entry on Dec 31? Unearned Revenue 6000 Rent Revenue 6000 Employees work five days a week and are paid 75,000 bi-weekly. The last payday was Friday, September 23. What is the adjusting entry needed at the end of September? Wage Expense 37500 Wages Payable 37500 Bank Statement Book Cash Account End Balance 25,000 Balance 25,600 NSF 200 Deposit in Transit 900 Service Charge 25 Check Outstanding 200 Interest 250 Electronic Deposit 75 Reconciliation Amount=25700