Lesson 12: Adjusting Entries

advertisement

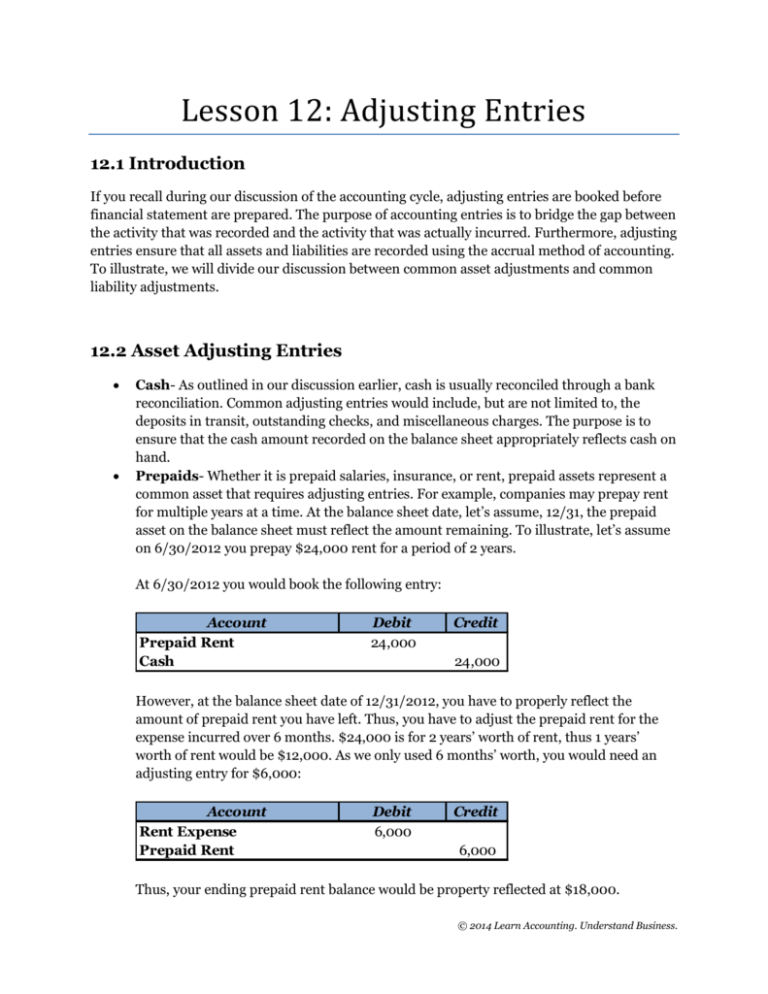

Lesson 12: Adjusting Entries 12.1 Introduction If you recall during our discussion of the accounting cycle, adjusting entries are booked before financial statement are prepared. The purpose of accounting entries is to bridge the gap between the activity that was recorded and the activity that was actually incurred. Furthermore, adjusting entries ensure that all assets and liabilities are recorded using the accrual method of accounting. To illustrate, we will divide our discussion between common asset adjustments and common liability adjustments. 12.2 Asset Adjusting Entries Cash- As outlined in our discussion earlier, cash is usually reconciled through a bank reconciliation. Common adjusting entries would include, but are not limited to, the deposits in transit, outstanding checks, and miscellaneous charges. The purpose is to ensure that the cash amount recorded on the balance sheet appropriately reflects cash on hand. Prepaids- Whether it is prepaid salaries, insurance, or rent, prepaid assets represent a common asset that requires adjusting entries. For example, companies may prepay rent for multiple years at a time. At the balance sheet date, let’s assume, 12/31, the prepaid asset on the balance sheet must reflect the amount remaining. To illustrate, let’s assume on 6/30/2012 you prepay $24,000 rent for a period of 2 years. At 6/30/2012 you would book the following entry: Account Prepaid Rent Cash Debit 24,000 Credit 24,000 However, at the balance sheet date of 12/31/2012, you have to properly reflect the amount of prepaid rent you have left. Thus, you have to adjust the prepaid rent for the expense incurred over 6 months. $24,000 is for 2 years’ worth of rent, thus 1 years’ worth of rent would be $12,000. As we only used 6 months’ worth, you would need an adjusting entry for $6,000: Account Rent Expense Prepaid Rent Debit 6,000 Credit 6,000 Thus, your ending prepaid rent balance would be property reflected at $18,000. © 2014 Learn Accounting. Understand Business. Interest Receivable-When you loan out money, you expect to accrue and earn interest. However, payment terms may vary and you have to properly reflect the amount of interest you have accrued. To illustrate, let’s assume your company gave a loan of $5,000 on 6/30/2012 with an annual interest rate of 10% payable on 6/30/2013. Assuming a 12/31/2012 year end, you would need to reflect the 6 months’ worth of interest you have earned. Thus, $5,000 * 10% = $500 annual interest. Divide by 2, you would have earned $250 of interest over 6 months. To reflect this, you would book the following entry: Account Interest Receivable Interest Income Debit 250 Credit 250 Equipment- As we discussed earlier, equipment would be depreciated over its useful life. As you are familiar with this calculation, we will discuss application only. At the end of an accounting cycle, you would ensure that the accumulated depreciation reflects total depreciation accumulated up to 12/31. 12.3 Liability Adjusting Entries Interest Payable- Often times companies may take out loans and incur interest. It is important to properly reflect the amount of interest that has been incurred through the end of the year. The theory is the same as receiving interest, but will just involve different accounts. For example, let’s assume on 11/1/2012, your company borrows $1,000 from the bank with the first payment of interest on 5/1/2013. The interest rate is 5%. To find the amount of interest you incurred for 2012, the first step is to find the annual interest. At 5%, your annual interest would be $50 (1,000*.05). However, keep in mind, for 2012, interest was only outstanding for 2 months. Thus you must take 2 months worth of $50 and record that as your adjusting entry; (50 * (2/12))= 8.33. Thus the adjusting entry will be as follows: Account Interest Expense Interest Payable Debit 8.33 Credit 8.33 As your first payment is not until 5/1/2013, your books will properly reflect the amount you owe up until 12/31. Accounts Payable- There are situations where a company gets a service done, let’s say cleaning, but doesn’t receive the invoice until the following year. This still requires the company to book a liability to reflect the services received. For example, let’s say on 12/1 © 2014 Learn Accounting. Understand Business. your company solicits cleaning services for $200, however, the invoice doesn’t arrive until 1/7/2014. On your 12/31 books, you must reflect this liability as follows: Account Cleaning/Maintenance Expense Accounts Payable Credit 200 Salaries Payable- Company’s usually will have a payment structure of weekly, biweekly, or monthly to remit salary to employees. Naturally, as employees aren’t physically paid every day, there will be a lag. For purposes of our example, let’s say a company has a policy to pay their employees every Friday. We’ll assume monthly payments total $62,000 for all employees. For the month of December 2013, the last payment falls on Friday 12/27, leaving 4 days of payments that will fall in the next cycle. These 4 days will need to be reflected in the books. The first step is to find the amount of payment per day. As December has 31 days and total payments for the month is $62,000, we can see salary accrued per day is $2,000. Multiply that by 4 days, you will see $8,000 worth of salary have still yet to be paid. Thus, you must book the following entry: Account Salary Expense Salary Payable Debit 200 Debit 8,000 Credit 8,000 Unearned Revenue- Unearned Revenue represents when a company is paid for goods or services, but have yet to deliver goods or perform services. To illustrate, let’s assume a customer approaches you to provide him with accounting services. He pays half the fee upfront of $5,000 at the end of the year; however, you won’t be performing the services until the following January. At the end of the year, you have to record reflect the cash received: Account Cash Unearned Revenue Debit 5,000 Credit 5,000 © 2014 Learn Accounting. Understand Business. Keep in mind that you could have performed a part of the services. However, the concept still holds true and you would reflect the amount that you have not performed. Come January, when you have performed the services, you would reverse the Unearned Revenue: Account Unearned Revenue Service Revenue Debit 5,000 Credit 5,000 © 2014 Learn Accounting. Understand Business.